Subscribe

Sign up for timely perspectives delivered to your inbox.

The Signal and Noise series from Janus Henderson’s Portfolio Construction and Strategy Team seeks to identify historical patterns and precedents through which we can view current market challenges, escape analysis paralysis and drive toward an actionable set of portfolio solutions.

The first and second notes from our Signal and Noise series were aimed at demystifying yield curve inversions and breaking down U.S. recession risk. While both articles addressed the relationship among economic recessions, market returns and the associated investment implications, the question of whether we’re headed for a recession isn’t necessarily the biggest concern for investors right now: after dramatic sell-offs across both equities and fixed income this year, many investors are wondering if high stock/bond correlations mean the traditional 60/40 portfolio has lost its allure – i.e., the diversification potential that has historically defined stock-bond relationships.

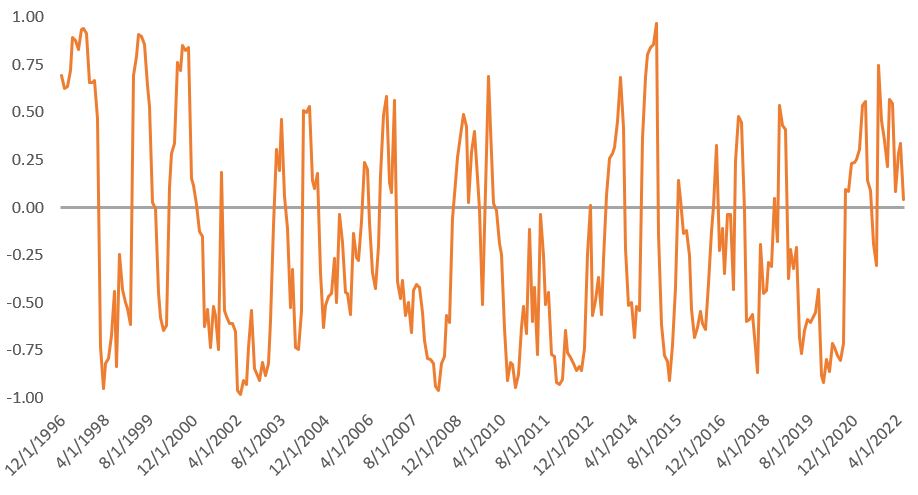

Current Short-Term Stock Bond Correlations Are High … So What? Source: Morningstar as of 30 June 2022. Trailing 6-month correlations between the S&P 500 TR USD and Bloomberg U.S. Aggregate TR USD Indices.

Source: Morningstar as of 30 June 2022. Trailing 6-month correlations between the S&P 500 TR USD and Bloomberg U.S. Aggregate TR USD Indices.

We would argue that this year’s parallel decline in both equity and fixed income is a result of the markets being drastically repriced amid the highest inflation we have seen in 40 years and central banks’ attempts to tame that inflation through quantitative tightening, putting an end to record-low interest rates. While painful, we believe this repricing should be viewed as a correction, not a crisis. While many may worry that recent high correlations signal the end of bonds’ diversification potential, past market sell-offs demonstrate that the bond market has consistently been able to provide a ballast during times of crisis.

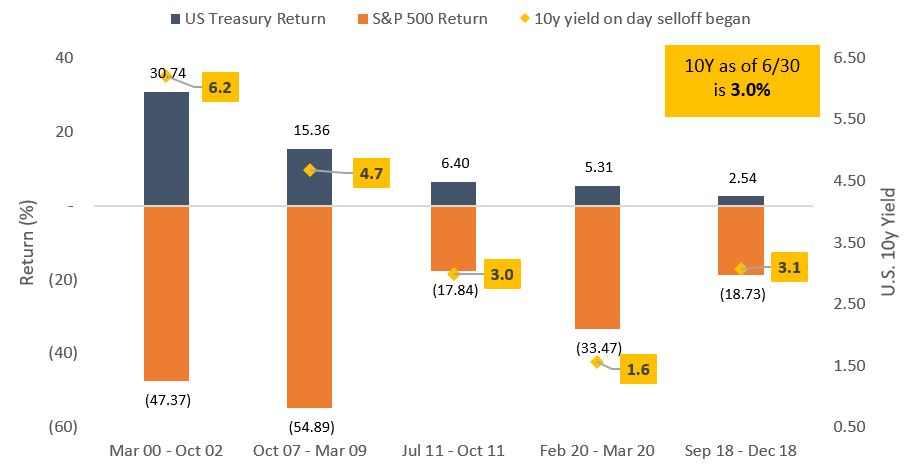

Bonds Have Provided Needed Diversification in Past Market Corrections

Source: Morningstar, as of 6/30/2022.

Source: Morningstar, as of 6/30/2022.

Over the past 20 years, Treasuries have been able to provide the diversification investors seek in an equity market sell-off. Notably, this diversification potential comes regardless of where interest rates stand:

It’s impossible to predict whether the U.S. will enter into a recession, so we believe it’s more important to recognize that we are indeed entering into a slower growth environment. With the 10-year now at 3.0%1, the yield cushion on core fixed income is relatively high. Instead of worrying about correlation noise, we think investors should instead focus on the signal of core bonds as a strategic risk manager.

The year-to-date sell-off across all fixed income provides many opportunities for investors to increase their exposure to historically defensive sectors with yields that have been more recently reserved for higher-risk areas of the market. Among these defensive sectors, we see opportunities to add to several areas of the securitized markets – particularly agency mortgage-backed securities, where yields are materially higher than in many other defensive sectors. Adding to relatively high yields, we are mindful that these defensive sectors also offer additional return potential if growth meaningfully slows, equity markets do in fact sell off, and rates go down from this point forward.

For additional insights, be sure to watch for the mid-year update to our 2022 Trends and Opportunities Report, where we will dive deeper into this topic and others, and synthesize these risks and opportunities within an asset allocation context. Meanwhile, please reach out to a PCS consultant for a customized analysis of your portfolio via your Janus Henderson relationship manager.

1 As of June 30, 2022.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Quantitative tightening is a contractionary monetary policy tool applied by central banks to decrease the amount of liquidity or money supply in the economy.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

U.S. Treasury securities are direct debt obligations issued by the U.S. Government. With government bonds, the investor is a creditor of the government. Treasury Bills and U.S. Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.