Subscribe

Sign up for timely perspectives delivered to your inbox.

To provide forward-looking perspective on inflation, Director of Equity Research Matt Peron and analysts from our Equity and Fixed Income Research Teams assessed comments made by listed corporations addressing the topic. In a series of articles – also available as a whitepaper – they discuss how select sectors are being impacted by rising prices and what it means for both company profitability and the health of the economy.

Given that consumption comprises roughly 70% of the U.S. economy, insights on how consumer-focused companies are managing the inflationary environment bear special relevance. Based on industry and company data, there has thus far been no noticeable drop-off in consumer demand. That said, all the recent nominal retail sales growth has been a function of inflation whereas volumes remain flat to slightly down on a year-over-year basis.

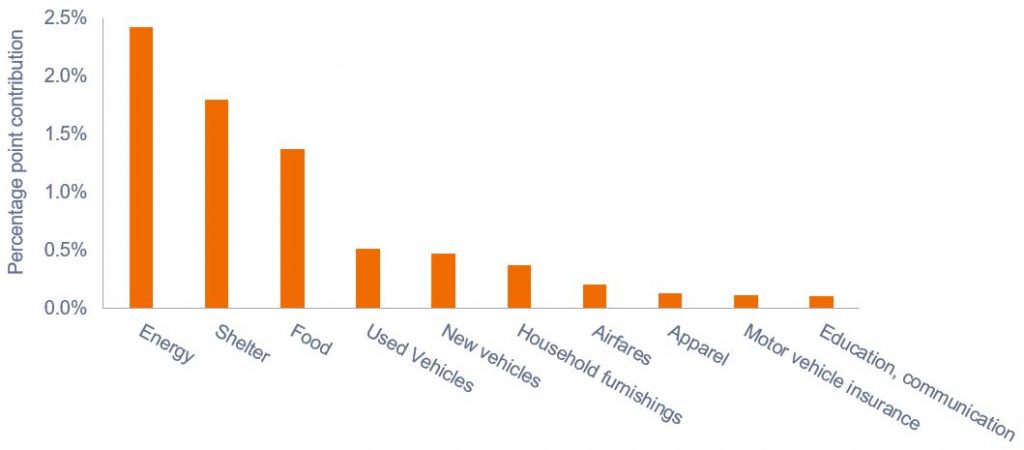

Over the past 18 months, every major category in the consumption basket has been inflationary. Yet during this period there has been a shift in which categories are contributing most to aggregate price pressure. The scramble for “stay-at-home” goods popular during lockdowns has subsided and consumers are now allocating a greater amount of their wallet toward experiences such as leisure travel and entertainment. More recently, energy costs have risen in importance, but even here consumers have perhaps surprisingly been willing to absorb $5.00 per gallon gasoline.

Contributors to U.S. Consumer Price Inflation Index, by Category

The transition to experiences exposes consumers to some of the categories most acutely impacted by supply constraints, namely energy and food. Wages also play a considerable role in the service-based, “experiences” economy. Both supply dislocations and wages are exerting upward pressure on consumer companies’ input costs. Of the two, inflation emanating from supply-chain issues has been worse, but it is a smaller component of the total cost structure, and furthermore, there are signs of easing pressure. Wages, on the other hand, are not only an ingredient of the feared wage-price spiral, but also are proving stickier than supply factors. No company will be able to walk back recent wage increases. So even should wage acceleration subside, these expenses will likely reset at a permanently higher level.

From a profitability standpoint, we have noticed scaled and established national brands have enjoyed pricing power, and consumer behavior has proven fairly insensitive to rising prices. There are signs that this may be changing. In addition to the (expected) slowdown in “stay-at-home winner” categories, some national retailers have noted emerging signs of consumers opting for lower-priced, private-label brands, and others have commented that foot traffic has begun to slow. We expect the coming months will reveal that purchases within rate-sensitive categories – namely autos and housing – will slip given the rise in interest rates.

Looking forward, two factors are likely to have considerable influence on how much longer consumers can withstand inflationary pressure. First, real – inflation-adjusted – wages have turned negative, meaning heretofore impressive nominal wage gains are being canceled out. At some point, workers may realize they are worse off in real terms and react by cutting back on consumption. That reckoning may not have happened yet due to the second factor: flush consumer balance sheets. Since the end of 2019, U.S. household savings have risen by $3.3 trillion.1 Those reserves have likely contributed to both buoyant consumption and inflation. As they are drawn down and the brunt of negative wages is more fully felt, consumption could cease being the marginal driver of economic growth.

1Source: Federal Reserve Flow of Funds Report

Consumer Price Index (CPI) is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

Download Whitepaper