Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio managers Nick Childs and John Kerschner explain why they believe key risks are now largely priced in to fixed income markets, with selective areas – particularly mortgage-backed securities (MBS) – presenting an opportunity to provide favourable risk-adjusted returns.

Fixed income investors have endured a tough start to the year. As inflation has soared, bond prices have been hit simultaneously with rising interest rates and widening credit spreads. The trifecta of upward inflationary pressure, less accommodative central banks and the negative impact of the Russia/Ukraine conflict resulted in the Bloomberg U.S. Aggregate Bond Index registering its worst quarterly return in more than 30 years in Q1 of 2022 (see Exhibit 1).

As painful as this sharp drawdown has been for investors’ portfolios, in our view, a lot of bad news is now priced in. While there is potential for more bad news, we believe there are opportunities in selective areas of fixed income, particularly in mortgage‑backed securities (MBS). Notably, credit spreads on MBS are presently the widest they have been since the first quarter of 2014, excluding the COVID‑19 sell-off in March 2020 (see Exhibit 2).

Exhibit 2: MBS Credit Spreads Have Widened Dramatically

Fannie Mae 30-year Current Coupon Spread to the 5/10-Year Blend

Source: Bloomberg, Janus Henderson Investors, as of 27 May 2022.

With so much uncertainty surrounding inflation, expected interest rate hikes, quantitative tightening (QT) and the war in Ukraine, interest rate volatility as measured by the BofA MOVE Index has been elevated above 100 for much of 2022 (see Exhibit 3).

Source: Bloomberg, Janus Henderson Investors, as of 29 May 2022.

Note: The ICE BofA MOVE Index is a measure of bond market volatility.

The MOVE Index has crossed over the 100-point mark only three times in the last 10 years, and only for brief periods. During such times of high volatility, the prices of bonds with theoretical put options (like MBS) are more adversely affected than comparable non-option bonds, because the prepayment option (the ability to refinance the mortgage) held by the borrower increases in value with higher interest rate volatility.

We think that as the market gains more clarity around the trajectory of these various risks, it is likely that rate volatility will recede to more normalised levels. To the extent MBS are penalised for their theoretical put options in a higher volatility environment, all else being equal, their optionality should provide a tailwind for price returns if we begin to move back to lower levels of volatility.

As a result of the U.S. Federal Reserve’s (Fed) recent hawkishness, the market is pricing in a year-end federal funds rate of 2.75% (lower band). After starting the year at zero, the Fed has already raised its benchmark rate by 75 basis points, with an additional 200 basis point increase expected to follow. If the Fed does end up raising rates by a full 2.75% in 2022, it would register as the fastest 275 basis point start to a rate hiking cycle since 1994.

There is much debate as to whether the Fed will get to this level. Many believe that growth and inflation will slow enough in 2022 that the Fed, which in recent history has shown a propensity to err on the side of dovishness, could make a dovish pivot. Therefore, in our view, it seems possible that the federal funds rate could close out 2022 below the 2.75% currently priced in. If that proves to be the case, MBS may benefit from the lower-than-anticipated rise in rates.

In the minutes of its May meeting, the Fed provided clarity on how and when it would begin reducing the size of its balance sheet. After a three-month phase-in period following its June start date, the Fed plans to allow $60 billion in Treasuries and $35 billion in MBS to roll off its balance sheet each month.

On the MBS side, to hit the monthly cap of $35 billion on prepayments alone, the Fed’s $2.7 trillion portfolio would require a prepayment rate of roughly 15%. There is some concern that prepayment rates may be lower than 15% following record prepayments in 2021, which raises the question: Would the Fed start selling MBS in an effort to hit its monthly cap if prepayments alone do not get them there?

In our opinion, we think it is unlikely that the Fed will sell MBS anytime soon, and if they do not, the pricing of this risk into asset prices is likely to unwind.

A piece of the valuation puzzle that is particularly strong for MBS is record low post-Global Financial Crisis delinquency rates on single-family residential mortgages, thanks in part to unprecedented stimulus in the preceding two years, high retail savings rates and a strong labour market (see Exhibit 4).

Source: Bloomberg, Janus Henderson Investors, quarterly data, as of 31 March 2022.

While this bodes well for the asset class, if delinquency rates do start to move higher, prices of MBS could come under pressure. But for now, consumer balance sheets remain strong and, in our view, it is unlikely that delinquencies would rise considerably without a deterioration in the labour market. We continue to monitor the situation closely.

One of the variables that is most difficult to model in the valuation of MBS is prepayments risk – the risk that borrowers will refinance their existing mortgages. For bondholders, an early return of principal makes duration management challenging, while the reinvestment of prepayments poses its own set of challenges. However, the prepayments risk landscape has changed dramatically since mortgage rates have risen above 5.0% in 2022.

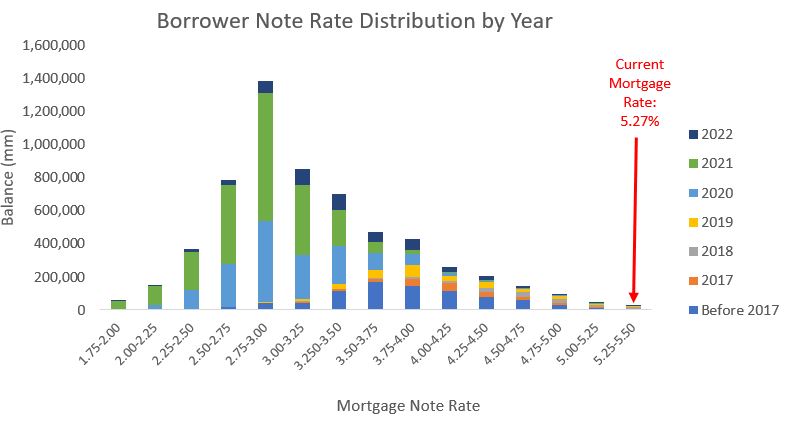

When mortgage rates plummeted in 2020 and 2021, record numbers of borrowers refinanced their existing loans at historically low rates. As a result, less than 1% of outstanding government-sponsored entity (GSE) mortgages have a rate incentive to refinance because their existing rate is below the current mortgage rate (see Exhibit 5). This means the prepayments risk is low, the duration profile of existing mortgages is more stable and investors can consider using mortgages when seeking to add duration to their portfolios.

Source: RiskSpan, Janus Henderson Investors research, as of 24 May 2022.

Source: RiskSpan, Janus Henderson Investors research, as of 24 May 2022.

Note: Current mortgage rate is as of 27 May 2022.

While risks remain, we think the recent sell-off in MBS has been overdone. We believe there are opportunities for mortgage‑backed securities to provide favourable risk‑adjusted returns as part of a core fixed income holding in the current environment. In our opinion, the additional income offered by MBS relative to U.S. Treasuries, combined with the potential for normalisation of valuations, makes the asset class attractive from a valuation perspective.