Subscribe

Sign up for timely perspectives delivered to your inbox.

Labor shortages, supply bottlenecks, elevated freight and shipping rates – the factors helping to drive up inflation are leading to a reckoning, not just among central banks but also companies. More and more, we see evidence of businesses preparing for a new economic order, one in which securing supply, production and distribution takes precedence over lowering costs. To adapt, some firms are considering reshoring operations. This shift, a long and capital-intensive endeavor, would add to already elevated pricing and potentially weigh on earnings growth. But it could also drive demand for the technology and services that would make it possible.

Reshoring – the process of bringing manufacturing closer to the region of origin and consumption – is not a new phenomenon. Our colleague Daniel Graña has written about deglobalization in the context of emerging markets since before the pandemic started. What is new, in our view, is the frequency with which the topic is now being discussed in corporate boardrooms across the globe. Recently, we spent a week in Europe meeting with management teams of industrial firms. During those discussions, the term “local for local” was used repeatedly to describe future manufacturing production. In short, scarred by trade barriers, pandemic-driven supply shortages and geopolitical tensions, more companies and customers now seem willing to accept lower efficiencies and higher costs in exchange for securing production and distribution. The sentiment was the same no matter which area of the industrials sector we visited, whether defense and aerospace or logistics and heavy manufacturing.

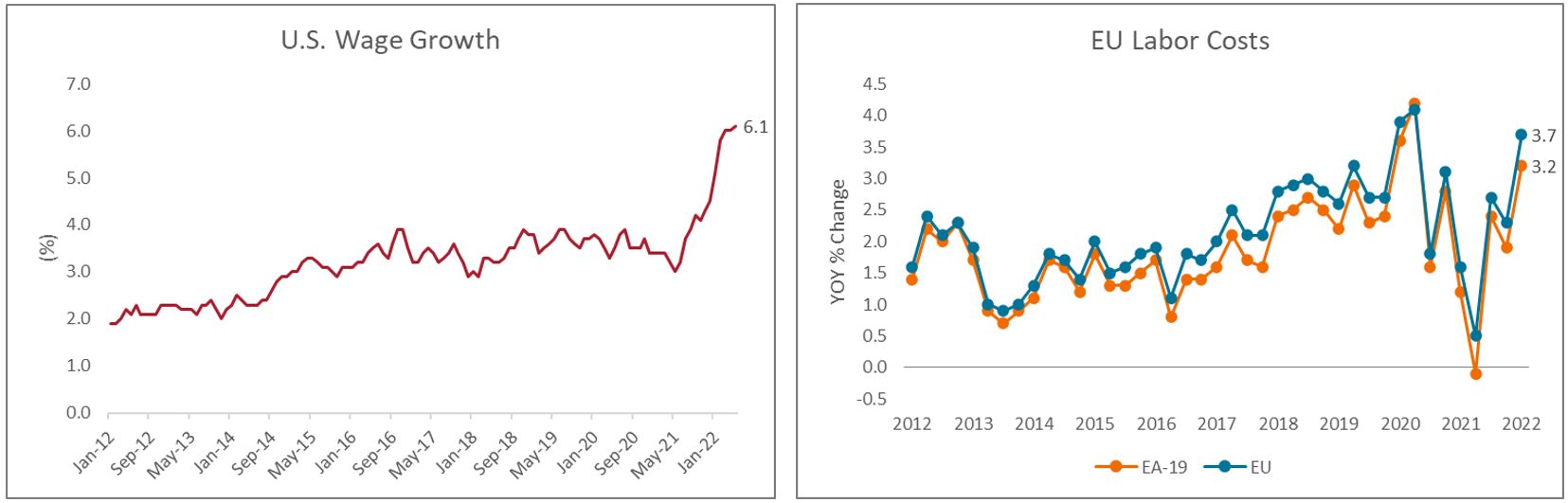

The implications of local for local, should it gain momentum, will be significant. A 2020 study estimated that it would take a five-year, U.S. $1 trillion capital-expenditure cycle to relocate foreign manufacturing out of China (excluding production intended for consumption in China).1 Those figures omit the incremental increase in operating costs that many companies would also encounter, including higher wages, now on the rise in most developed economies. In the U.S., for example, hourly pay increased by a median of 6.1% annualized in May, the largest jump in nominal terms (not adjusted for inflation) in recent memory. In Europe, salaries have been rising more slowly, but among companies we met, there existed a general acceptance that wage negotiations loom and pay pressures are mounting.

Source: Federal Reserve Bank of Atlanta, as of 31 May 2022. eurostat, as of 16 March 2022. Note: U.S. data are monthly and reflect the three-month moving average of median, hourly wage growth, unweighted. EU labor cost data are quarterly. EU = European Union. EA-19 = (euro area) Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Greece, Slovenia, Cyprus, Malta, Slovakia, Estonia, Latvia and Lithuania.

Source: Federal Reserve Bank of Atlanta, as of 31 May 2022. eurostat, as of 16 March 2022. Note: U.S. data are monthly and reflect the three-month moving average of median, hourly wage growth, unweighted. EU labor cost data are quarterly. EU = European Union. EA-19 = (euro area) Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Greece, Slovenia, Cyprus, Malta, Slovakia, Estonia, Latvia and Lithuania.

The impact that local for local could have on bottom lines – and investor returns – will depend on how easily firms can offset the additional expense or share the burden with customers. Against this backdrop, we believe technology that yields productivity gains will grow in importance. Tools such as data analytics, machine vision/learning and robotics can help reduce machine downtime, increase throughput and lower labor needs. Demand is already picking up. Worldwide, installation of industrial robotics hit a record in 2021, with both auto manufacturers (early robotics adopters) and non-automotive industries driving orders.

Source: International Federation of Robotics, as of 7 June 2022.

Companies that provide these solutions or other advanced manufacturing equipment could be able to charge premium pricing and still enjoy revenue growth. During our meetings in Europe, one developer of energy management and industrial automation told us it advised its sales force to “take the summer off” because of the strength of its backlog. And more than one manufacturer, also citing robust demand, intimated they are exploring the possibility of renegotiating prices for existing orders or writing contracts that allow for price increases should “hyperinflation” persist.

In the current environment, we believe it is important to recognize what may be an enduring shift in corporate and customer priorities. Local for local may be a buzzword for now, but it shows signs of having legs, especially amid ongoing geopolitical tensions, the lingering pandemic, commodity shortfalls, and environmental, social and governance concerns. The transition would be costly, but would also drive demand for new solutions. Firms that can meet the need could be uniquely positioned to grow their bottom line, no matter the economic backdrop.

1BofA Global Research, “The US$1 trillion cost of remaking supply chains: Significant but not prohibitive,” July 22, 2020.

Connecting you to the latest thinking from our equity teams.

Explore Now