Subscribe

Sign up for timely perspectives delivered to your inbox.

The financial impacts of rising prices can cause investors to make irrational decisions. Retirement Director Ben Rizzuto explains how to manage emotional reactions to inflation and stay focused on long-term goals.

Inflation affects us in many ways. The main way we feel it is on a day-to-day basis when we go to the supermarket or gas station. Gas prices here in the United States have increased 32% since February 23 – the day before Russia invaded Ukraine1 – and the price of food and groceries is up nearly 9% year over year as of March.2 This is painful for consumers and investors, who are in effect losing money due to inflation.

What’s important for us to understand is that these losses can cause us to make emotional (and often bad) decisions. For example, it could lead investors to sell their “risky” assets and put those proceeds into cash. This defies logic, as the rational thing to do when prices are rising is to seek investments that have the potential to grow at rate that can outpace inflation. While that may be the case, we also know that humans don’t always behave rationally.

We have seen this irrationality play out around the world as investors have increased the amount of money they have in cash, money market funds or liquidity stocks.

So how can we make sure we make the right decisions to continue building our assets toward our future goals?

First, we might consider how taking the irrational approach described above can lead to the erosion of assets. The Rule of 72 is something we use in finance to show how long it will take assets to double. In this case, however, we can use it to show how long it would take assets to be cut in half using an inflation percentage.

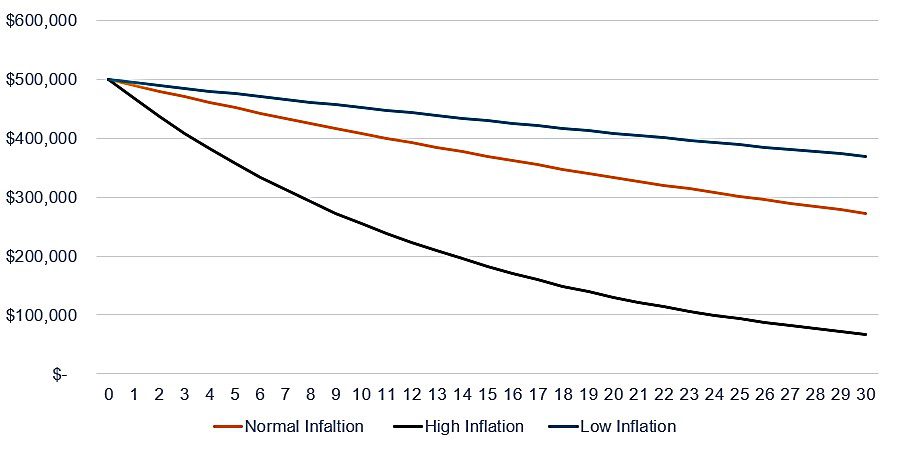

In the chart below, you can see how $500,000 can erode – in some cases significantly – based on the rate of inflation. Plus, if we were to add ongoing expenses to the chart, the trajectories become much steeper and could turn negative sooner than many would hope.

Source: Janus Henderson. Normal Inflation = 2.0%, High Inflation = 6.5%, Low Inflation = 0.5%

Source: Janus Henderson. Normal Inflation = 2.0%, High Inflation = 6.5%, Low Inflation = 0.5%

That’s why I would encourage investors to try to think of these issues in different, more concrete ways. For example, think of yourself as a business. If you want to run a profitable business, that means saving and growing your overall net worth at a pace that exceeds your input costs. Over time, if you have to pay more for the materials used to make your products, you will eventually need to increase the price of your product. We can apply this same basic thinking to your personal finances, but in this case, the product is your investments and savings, and the input cost is inflation. The higher inflation goes, the more you need to save and the more those savings need to grow.

Another interesting way to think about this problem is to ask yourself the following question: “What advice would I give to my best friend if they were faced with a similar issue?” Putting yourself in someone else’s shoes can widen your perspective and help you realize what other – potentially better – options you should consider.

Finally, remember that it is OK to feel the way you do. A study conducted by Janus Henderson in 2019 showed that 67% of investors reported high levels of negative stress due to being somewhat or very concerned about a market downturn.4 Those feelings can lead people to be overly conservative, risk averse and hold assets in cash.

While that may be the case, remember that you are already in the financial “boxing ring.” And within this arena, you only have two choices: freeze or fight. It may feel uncomfortable to open yourself up to getting punched by investing in the market. After all, stocks can be volatile (as they certainly have been this year), but the other option, freezing, is arguably the worse option. For long-term investors, putting your cash to work and staying the course with investments that can outpace inflation is key.

I hope I’ve provided you with some strategies to help manage your emotions so you can stay the course during challenges like these. Below, I’ve included four additional financial planning steps that can be useful in any market or economic environment.

The financial impact of inflation provides us with a view of how the loss of money can affect us emotionally. It also serves as an important reminder that long-term financial goals are best pursued through long-term planning – not short-term emotions.

1 “US gas prices jump to record high $4.67 a gallon.” CNN, June 1, 2022.

2 “Rising inflation has made it more expensive to eat at home-here’s how much grocery prices have increased.” CNBC, April 12, 2022.

3“Inflation and Individual Investors’ Behavior: Evidence from the German Hyperinflation.” Fabio Braggion, Tilburg School of Economics and Management, February 2022.

4 “Study: The War on Stress.” Financial Planning Association, Investopedia, and Janus Henderson, 2019.

5 Ibid.

6 “How your bank balance buys happiness: The importance of ‘cash on hand’ to life satisfaction.” Ruberton, P. M., Gladstone, J., & Lyubomirsky, S. Emotion, 2016.

Volatility measures risk using the dispersion of returns for a given investment.