Subscribe

Sign up for timely perspectives delivered to your inbox.

Guy Barnard, Co-Head of Property Equities, provides context to news of Amazon's warehouse slowdown and explores the opportunities in the REITs sector.

Investors in industrial real estate have been spooked in recent weeks. In April, Amazon announced on its Q1 earnings call that it had excess warehouse capacity and was temporarily halting growth plans as it seeks to ”improve productivity and cost efficiencies”. Now, media outlets are reporting that Amazon is planning to ‘cancel’ warehouse leases, aiming to sub-lease at least 10 million square foot (sq/ft) of space amid cooling sales growth. Headlines can of course shift investor perception, and although an Amazon scale-back is certainty not good news, some context helps provide greater perspective.

Amazon has unquestionably been a meaningful driver of US warehouse demand for many years, but it’s direct influence on the market peaked in 2020 following a historic boom in online shopping due to COVID-related lockdown measures. Prior to the pandemic, there was always a linear relationship between Amazon’s online retail sales growth and its industrial leasing activity, typically averaging 15-20% growth annually.1 The pandemic then fueled an extraordinary rise in e-commerce as consumer shopping habits pivoted. Amazon duly responded with a rampant expansion of its warehouse footprint.

In an attempt to control its own delivery network and amass an empire to rival the most dominant logistics companies, Amazon leased an eye-watering 127 million sq/ft in 2020. This was followed by a further 106 million sq/ft in 2021. The company effectively doubled its entire 25-year footprint in the space of two years.2 If Amazon’s first two decades in business sparked a revival of the modern warehouse sector, that 24-month period gave a glimpse into a golden age. While this growth was stratospheric, it was perhaps also rational given the company’s ambition to build an unrivalled logistics system capable of delivering same-day packages to consumers across the US. Time will tell whether Amazon’s record-breaking expansion in the face of broader labor and supply chain headwinds can ultimately be a winning strategy. What is clear however, is that such a rate of change in warehouse leasing in such a short space of time was never going to be repeated.

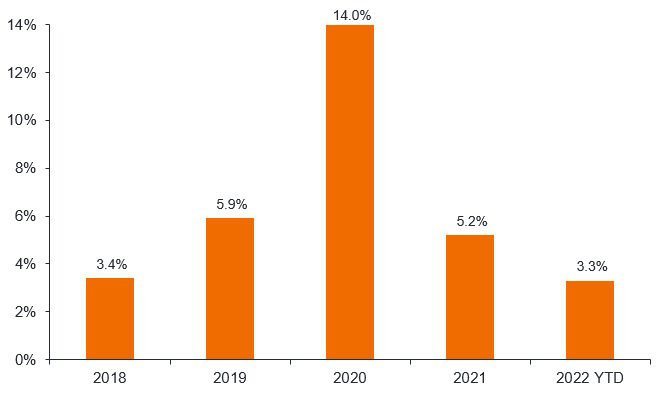

Source: Janus Henderson Investors, BofA Global Research. Industrial REITS: AMZN news is not new information; Industrial is a buying opportunity, 2 May 2022.

In 2020, Amazon comprised 14% of overall US industrial leasing, falling sharply to 5.2% in 2021 – chart 1. Year to date, the company’s share of leasing has fallen to just 3.3%, back to levels seen in 2018. Industrial real estate investment trust (REIT) CEOs and leasing brokers have long considered waning leasing demand from Amazon to be old news claiming that it had been anticipated and penciled into future forecasts. Indeed, REITs gave some indication of their expectations for earnings in 2022 after Amazon’s announcement, providing visibility for their outlooks that was inclusive of a slowdown. It will be important to watch the increasingly uncertain macroeconomic environment closely, and to monitor whether other users are also looking to sub-lease space or cease expansion. Could Amazon be the canary in the coalmine for a broader slowdown in industrial demand? It’s possible, though so far there are no signs of it.

As for Amazon’s immediate intentions, sensationalist headlines that Amazon are ‘cancelling’ leases requires some clarification. Leases are contractual and therefore ‘cancelling’ is not straightforward. If Amazon was to decide that it does not need the amount of space being leased, it could opt to sub-lease the warehouse to another user, while still maintaining the obligation to pay rent as agreed to the landlord (unless they file for bankruptcy). This is common practice in the real estate industry.

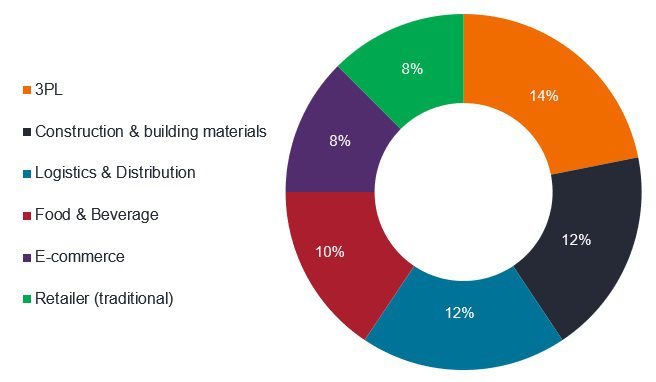

Source: Janus Henderson Investors, JLL Research. Quarterly leasing figures are preliminary and subject to change. The distribution of leased sq/ft by industry does not include leases for which a tenant or industry is unknown or undisclosed. Republished with permission.

It is also worth noting that Amazon is not starting this activity in conjunction with any earnings update or recent media outlet speculation. In fact, the company’s actions are already underway, against a backdrop where industrial market fundamentals are stronger than they have ever been. The first quarter of 2022 saw new leases on approximately 140 million sq/ft of space in the US, the second-best quarter in history.1 Demand is broad-based, covering multiple sectors of the economy, with e-commerce only directly representing 8% – chart 2. In addition, a shifting global landscape and supply chain issues are creating new drivers of demand. As one REIT CEO recently commented:

Previously we have talked about globalisation and just in time. Today it’s increasingly about localisation and just in case”

So while it will take time for investors to properly digest the implications of Amazon’s more subdued activity, we believe that industrial fundamentals are starting from a position of great strength.