Introduction

The global push to reduce carbon emissions is disrupting entire industries, and the transportation sector is no exception. As the push to electrify vehicles steps up, demand for the minerals required to build them is set to intensify.

The decarbonisation imperative

The transportation sector accounts for approximately 16% of all global emissions, of which road transport is responsible for about three quarters1. It’s clear that the decarbonisation of cars, trucks and other road transportation is a global imperative. The days of the internal combustion engine in vehicles are numbered – and savvy investors are paying attention.

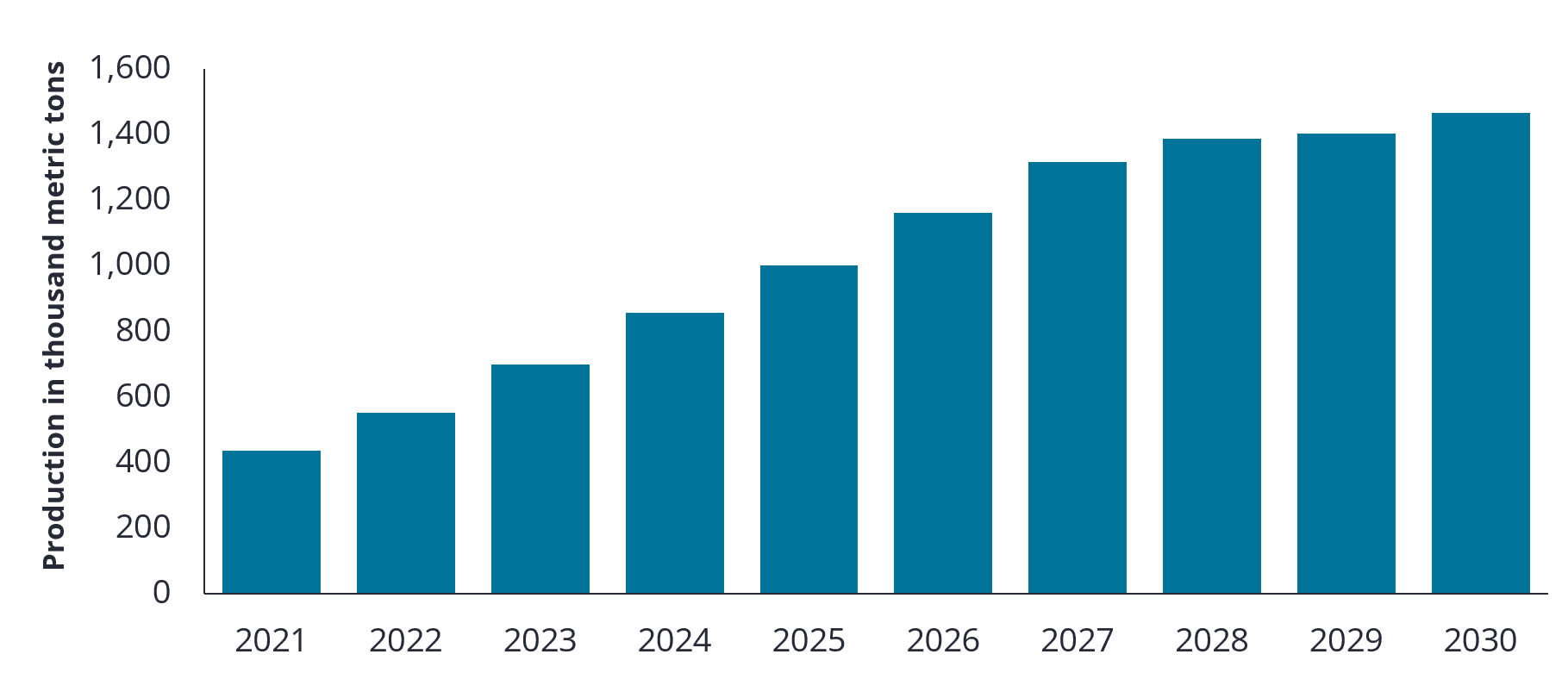

Chart 1: Electric vehicle sales projections

Source: Visual Capitalist, 2021. There is no guarantee that past trends will continue, or projections will be realised.

Insatiable demand for ‘green’ metals and minerals

As the popularity of electric vehicles (EVs) continues to grow, so will demand for various minerals, metals and rare earth elements, including lithium, cobalt, nickel and graphite. These are all raw materials used in the production of batteries, motors and other EV components.

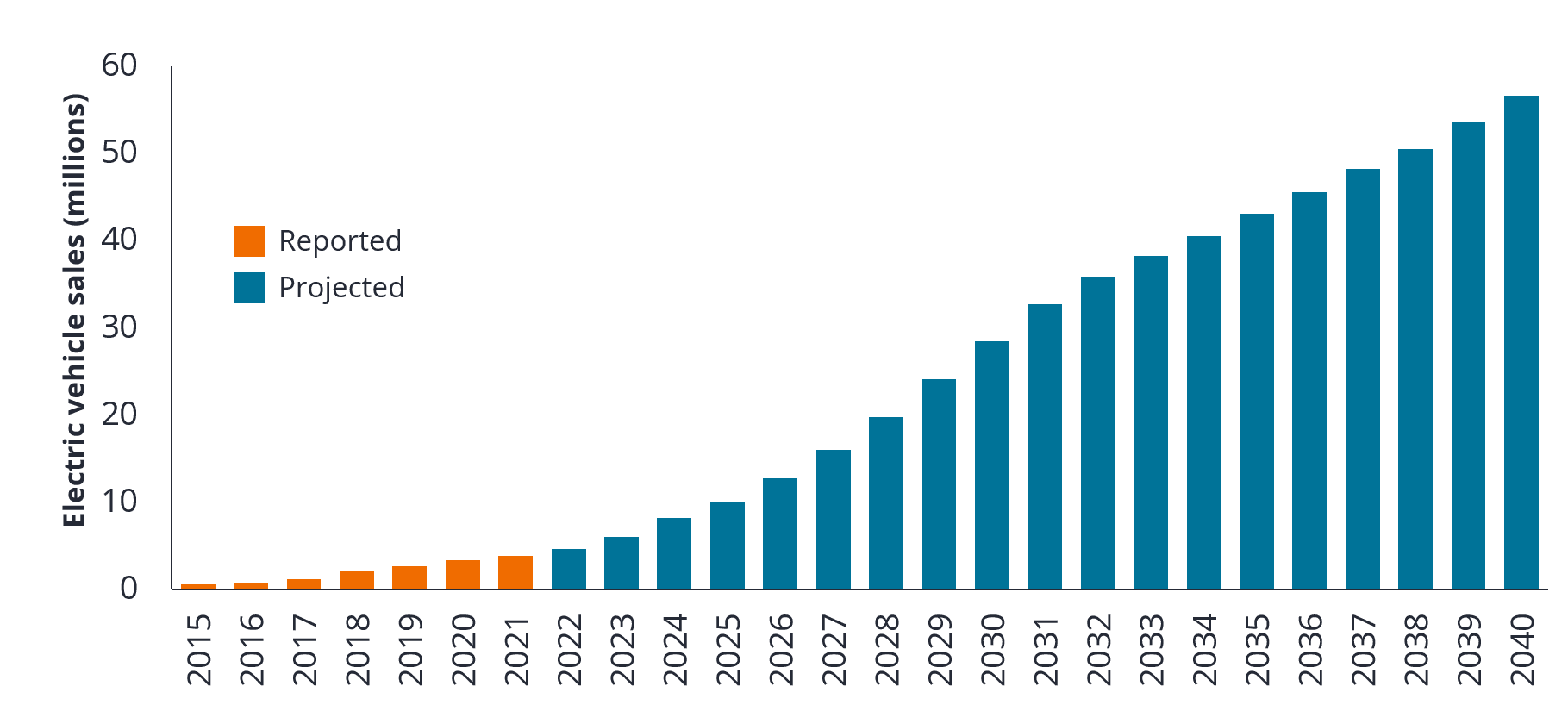

In the case of lithium, a key component in EV batteries, production is forecast to expand by 20% a year2 – and this still might not be able to keep up with growing demand. It is expected that the lithium industry will need a minimum US$42 billion of investment between now and 2030 to avoid a supply crunch.3

Chart 2: Forecast lithium carbonate production

Source: Comisión Chilena del Cobre; Servicio Nacional de Geología y Minería (Chile); Benchmark Minerals, 2020. No forecasts can be guaranteed.

Supercharging the fundamentals

Despite the COVID-19 pandemic, interest and demand for EVs has only strengthened. In 2020, the overall car market contracted, but the EV segment bucked this trend, with global sales increasing to 3 million, or 4.1% of total car sales. In 2021, EVs doubled to 6.6 million sales globally, representing almost 9% of the global car market.

- The global EV market is set to grow at a compounding annual growth rate of 33.6%, to reach US$2,495.4 billion by 2027.4

- In 2012, approximately 130,000 EVs were sold. Today, that many are sold within one week.5

- It’s estimated that the supply of critical minerals for EVs will need to rise 3000% by 2040 to meet climate goals.6

Unlimited investment potential spanning multiple industries

The outlook for the electrification of passenger and commercial transport vehicles is exceptionally strong, with individuals, businesses, and governments worldwide moving to support the transition. That’s fuelling unprecedented demand for the raw materials needed to keep pace. The investment required to drive this step-change in technology can’t be understated.

Invest in the transition to net zero

Our new active ETF, the Janus Henderson Net Zero Transition Resources Active ETF (Managed Fund) (ASX:JZRO) offers access to this multi-trillion dollar investment thematic. It can invest in companies worldwide that enable the transition to a net-zero carbon emission future, including EVs, low carbon transport and resource enablers.

Learn more 1. Global Fuel Economy Initiative – International Energy Agency2. Lithium Mining: How new production technologies could duel global EV revolution, McKinsey

3. Lithium industry needs $42 billion to meet 2030 demand – Benchmark Mineral Intelligence

4. EV market to Grow at CAGR 33.6% – Bloomberg

5. Global Fuel Economy Initiative – International Energy Agency

6. The role of critical minerals in clean energy transitions – International Energy Agency

For important product information and disclosures such as PDS and TMD, please visit: https://www.janushenderson.com/en-au/investor/product/net-zero-transition-resources-fund/