Subscribe

Sign up for timely perspectives delivered to your inbox.

The key attribute for managing a truly all-weather portfolio is to have genuine investment flexibility, with many levers to pull when it comes to positioning for different macro regimes.

Materially above-target inflation is one such backdrop that is novel to many investment professionals, even those with over a decade of experience under their belts. Living professional memory for most has been one of low inflation and low interest rates.

Many of us thought that the first rounds of quantitative easing (QE) in the Global Financial Crisis (GFC) would herald a world of much higher inflation, as it had done during every single historical episode of widespread money printing and currency debasement. Not only were the historical precedents there; it also seemed the only expedient way of reducing the eye-watering amounts of newly minted debt that had been used by governments to tackle the meltdown in the financial system. But higher inflation did not come to pass… until now.

So, if interest rates have been generally decreasing since the late 1980s – against a backdrop of negative yields in recent years – how are investors equipped to deal with the threat of sustained price inflation and central banks’ attempts to control it?

Multi-asset funds’ USP is their potential to adroitly navigate the investment and economic cycle. It is the job of such portfolio managers to position their strategies appropriately for the prevailing conditions, and in preparation for what might be coming. This predominantly entails adjusting interest rate exposure and equity risk. It then involves looking at credit risk and regional/factor risks in equities.

Multi-asset managers flag the broad toolkit that comes with asset allocation strategies, touting healthy diversification as a means to achieve attractive returns with moderate volatility. But looking across the asset classes available to investors in mainstream, liquid asset classes – equities, government bonds, investment grade, high yield, emerging market debt – it is hard to see where genuine protection from higher inflation can come from.

Government bond, investment grade and emerging market debt returns are driven by duration, particularly when yields are so low and spreads so tight. And while the inflation-linked bond market might seem the ideal refuge in these environments, the market is relatively small and hugely distorted by the activity of pension funds and their liability-driven investment strategies. High yield, while less duration sensitive, is a relatively risky asset, which currently promises little by way of real return.

Equities, however, can offer an implicit inflation hedge, in that earnings can keep pace with inflation so long as companies have reasonable pricing power. The problem is that many equities, especially the performance leaders of recent years, are very sensitive to rising interest rate assumptions and this tends to cause price/earnings (PE) multiples to shrink, given that there is less opportunity for higher real earnings growth. In other words, there is (often) an inverse relationship between valuation multiples and interest rates, those financials benefiting from higher rates aside.

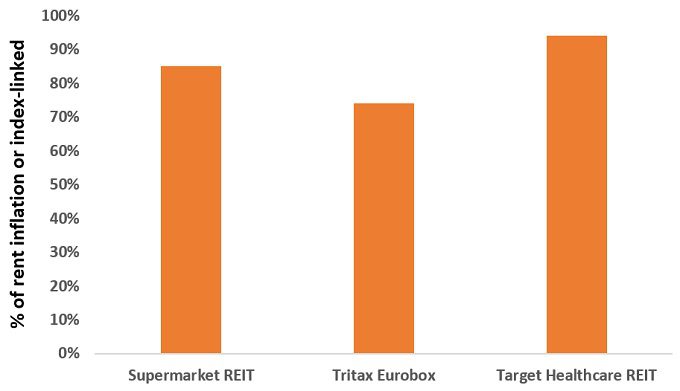

Property also can benefit from higher inflation, primarily through rental growth (Exhibit 1), so long as debt levels are sufficiently conservative that interest rate rises do not become problematic. But the issue remains of how best to access illiquid physical assets, such as office blocks and shopping centres. Investors have various options for this, from direct property funds and real estate investment trusts (REITs) to private equity funds.

We believe that many alternative asset classes could offer a way to protect against and even benefit from higher inflation. Closed-ended funds, such as investment trusts, can provide the best solution for most investors to access these less liquid, real assets in our view.

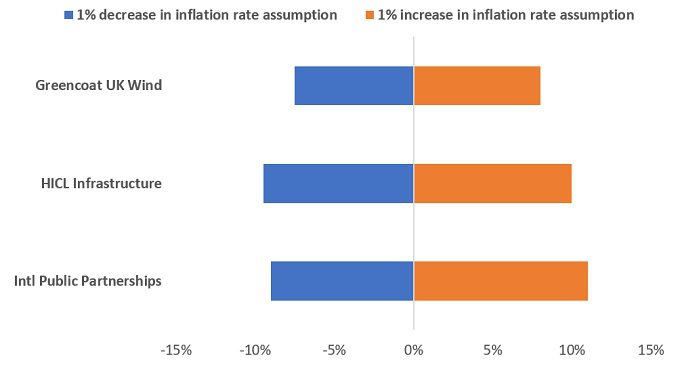

Beyond property, many infrastructure investments – economic and social, including the fast-growing renewable energy and energy efficiency sub-sectors – have explicit revenue linkages to inflation (Exhibit 2). While valuations may be linked to interest rate expectations, revenues are often fairly insensitive, or even entirely unconnected, to the economic cycle, and tend to be contracted for very long periods.

The property universe also includes various sub-sectors such as healthcare, supported living, logistics and the private rented sector, all with rent increases very closely or explicitly linked to inflation. In contrast to renewable energy assets where these rises are unlimited, rent increases tend to be capped, albeit at a relatively high level.

Commodities tend to perform well in times of higher inflation, although this is akin to pointing out that inebriation is correlated to the amount of alcohol consumed. In other words, higher energy prices drive a higher cost of living. Gold, however, plays a slightly different role and we believe it acts as a good hedge against both inflation and deflation shocks, rather than simply higher inflation. This is because if higher inflation is met with higher real interest rates, gold – as an unproductive asset with no yield – looks relatively unattractive. Inflation/deflation shocks, in contrast, lead to concerns about currencies and general market instability, meaning gold’s store-of-value characteristics look very appealing.

Hedge/absolute return strategies can play an interesting role during inflection points in markets, such as we are currently experiencing. Any strategy capable of profiting from bouts of volatility, especially when markets are confronted with changing market regimes, has potential value. At the end of long cycles, when the same dynamics have consistently worked for investors (growth equities, high quality bonds, etc), assets can become materially mispriced.

Most bonds do not cope well with environments of high inflation and rising interest rates. However, the less traditional areas we consider tend to offer floating-rate coupons, which can help to mitigate much of this risk – and can sometimes be a driver of higher-than-normal total returns. These instruments are typically senior-secured loans or asset-backed securities. While much of the universe is below investment grade, they are senior to typical, nominal high yield bonds in the capital structure and therefore recovery rates are higher in the event of default. While the floating-rate coupon mitigates much of the duration risk, there will be a point where interest rates reach a level that causes defaults to rise in these assets, just as in the more traditional parts of credit.

Finally, the inflation linkage within private equity, as with listed equities, is much more implicit rather than explicit. Companies delivering essential services and products are well positioned to pass on any higher costs they incur to do business. However, all things being equal, higher interest rates are likely to lead to P/E multiple contraction across public and private markets. Investors are left relying that any underlying private equity exposure can generate a decent level of earnings growth to offset any valuation fall.

We believe that inflation is the dominant risk currently facing investors across any asset class. If growth remains strong alongside high inflation, then mainstream equities can continue to perform, albeit almost certainly delivering lower returns than in recent history – the same applies to private equity. But not many assets thrive in environments where inflation is materially above central banks’ targets and growth is lagging. It is our view that an allocation to the alternatives universe, and specifically real assets, could prove valuable in this environment, particularly if we enter a stagflationary environment akin to the 1970s. While recession risks are still low as the economy continues to recover from the COVID crisis (and lockdowns), some warning signs are starting to appear, such as yield curve inversion.