Introduction

The global commitment to net zero emissions by 2050 is gaining momentum, and investment in innovation will be vital to achieving it. This transition represents a multi-decade investment opportunity as the world targets a net zero future.

Commitment to the transition is real

More than 120 countries have pledged to reach net zero carbon emissions by around 2050, along with numerous regional governments, cities and companies. Some countries have even brought their deadlines forward amid greater urgency to address climate change.

Investment is vital to success

Trillions of dollars will be needed to support and enable the transition to a lower carbon future, creating a once-in-a-lifetime investment cycle across a wide range of sectors. At the forefront will be companies in the energy, mining and agricultural sectors – those focused on natural resources – operating at the heart of sustainable development and decarbonisation.

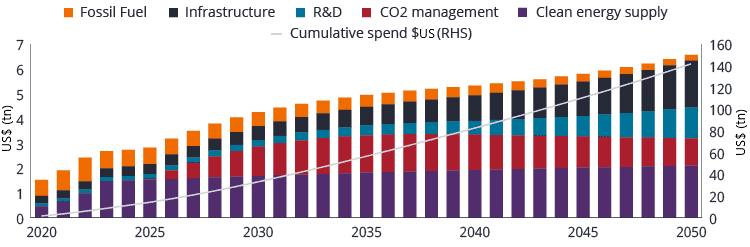

Looking at the energy sector alone brings the magnitude of this investment into sharp focus. Investment bank UBS estimates around US$140 trillion is needed by 2050 to decarbonise the world’s energy supply.

Chart 1: Annual investment needed to decarbonise energy supply

Source: UBS Equity Research Q-Series: Energy Transition: How will $140tn of investment be allocated across the energy supply chain? 25 March 2021. © UBS 2021. All rights reserved. Reproduced with permission. May not be forwarded or otherwise distributed.

Adding to the enormity of the opportunity is that, in 2050, the world’s population will be 20% bigger than it is today. That means an additional two billion people to house, feed, clothe and transport – all of which contribute to emissions that will need to be mitigated.

Natural resources are vital to the transition

Parts of the natural resources sector are far from carbon neutral. But we believe many companies can drive a level of carbon reduction across the global economy that eclipses their emissions footprint.

For example, operating a lithium mine generates emissions, yet as a battery mineral, lithium supports significant decarbonisation by providing the raw materials used to power electric vehicles and store renewable energy.

We see five broad decarbonisation investment themes, each with strong tail winds as we move to 2050:

A multi-decade runway lies ahead

The outlook for the natural resources sector and its potential to change the world for the better is incredibly exciting. This is a transition that will require investment and innovation at an immense scale.

Invest in the transition to net zero

Our new active ETF, the Janus Henderson Net Zero Transition Resources Active ETF (Managed Fund) (ASX:JZRO) offers access to this multi-trillion dollar investment thematic. It invests in companies all over the world that are enabling the transition to a net-zero carbon emission future.

For important product information and disclosures such as PDS and TMD, please visit: https://www.janushenderson.com/en-au/investor/product/net-zero-transition-resources-fund/