Subscribe

Sign up for timely perspectives delivered to your inbox.

Financial markets are currently trading through a period of heightened volatility, grappling with multiple sources of uncertainty and angst, including military conflict in Ukraine, inflation shifting from transitory to sticky, and a supply shock across a series of commodity markets. The latter is based on the same geopolitical issues in the short term, but also longer-term constraints imposed by ESG (environmental, social and governance) demands, given the impact this is having on the operations and business decisions of resource companies.

In such a noisy and uncertain environment, in what ways can investors allocate capital to commodity markets, relying less on emotion and noise, and more on a rules-based methodology supported by fundamental information?

Commodity carry[1] is one of a suite of strategies that can help investors to screen out a degree of noise and provide a reasonably good indication as to whether or not specific commodities represent an attractive investment prospect, based upon a fundamental view of commodity markets. Carry has been well documented on both a cross-asset basis and at a commodity level. In a 2017 paper published in the Journal of Financial Economics by Koijen et al[2], the concept of carry was researched at a cross asset level. Among the conclusions, it suggested that:

The study found that being long assets with relatively high carry and short those with relatively low carry generated ‘significant excess returns’ in each asset class.

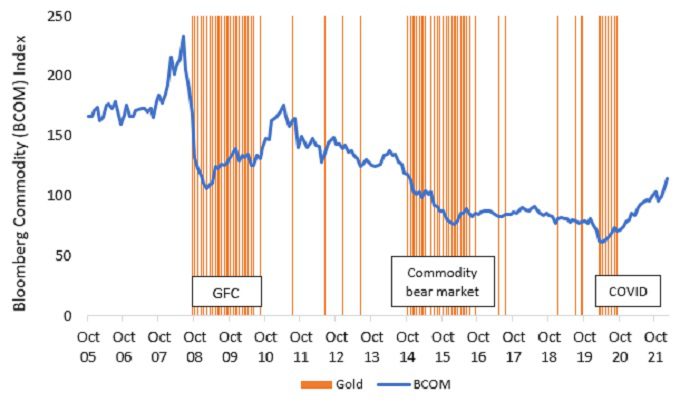

Commodity carry has generated relatively stable excess returns over time, relative to underlying price movements, although this should not be taken as an assurance that this will be the case in future. We can observe this through the construction of a relatively simple model utilising carry as a buy signal.

For this model, we used one-year commodity curve data provided by Bloomberg for 26 commodities (or the longest series available) since 31 October 2005 when this data started, to 28 February 2022. Allocating an equal amount of capital into the 10 commodities with the highest roll yield provided indications of a higher monthly average return when compared to price movements in the Bloomberg Commodity (BCOM) Index over this period (Exhibit 1).

| Top 10 by carry signal | BCOM Index | Difference | |

|---|---|---|---|

| Average monthly return | 0.72% | -0.04% | +0.76% |

While the above returns are hypothetical, they demonstrate the potential of utilising carry as a signal for generating excess returns both on a long-only basis as well as a long/short strategy – being long the commodities with the highest carry, and short those commodities with the lowest carry.

As at the end of February 2022, the top 10 commodity markets, based upon commodity carry, featured energy markets and several grain and softs markets – all markets directly or indirectly impacted by supply shocks and the current conflict in Ukraine. Exhibit 2 shows the one-year roll yield for these commodities.

| Market | One-year roll yield |

|---|---|

| WTI crude | 17.42% |

| Natural gas | 23.08% |

| Brent crude oil | 15.14% |

| Gas oil | 15.75% |

| Heating oil | 13.23% |

| Unleaded gas | 15.42% |

| Corn | 12.22% |

| Soybeans | 14.25% |

| Soymeal | 14.95% |

| Cotton | 20.79% |

Interestingly, there was no allocation to precious or industrial metals, including nickel, the price of which melted up prior to trading being suspended for over a week in March.

As a financial commodity with an abundant supply in storage, gold has a relatively stable forward curve in a state of contango, effectively representing the storage cost of the precious metal. As a commodity with a persistent, yet slightly negative yield, it will not typically screen as a market to hold from a carry perspective. There are, however, environments during which even gold’s minor negative yield may be a relatively better proposition than other commodities.

When using the model described above – holding the 10 commodities with the best carry – gold is typically held in clusters around periods of financial distress for either broader commodities or a deeper market dislocation (Exhibit 3).

While prior studies and basic carry models suggest that commodity carry provides a potentially useful indicator for which commodities might generate excess returns, carry should be considered as only one of several strategies that should be utilised where the objective is achieving a return over and above the performance of a commodity index. Other strategies including value, momentum, commodity skew, to name but a few, can all provide potential sources of alpha to an investor seeking either an enhancement to the beta from commodities, or as a standalone alpha strategy.

Commodity carry is one tool that can be used to construct a portfolio of commodities that has the potential to generate excess returns through time. While it is not recommended to be used as a standalone strategy, as one of several sources of commodity alpha, carry nonetheless provides a potentially valuable insight into which commodities present attractive opportunities based upon fundamental information.

—–

[1] Carry is broadly defined as future returns based upon holding an asset and not factoring in price movements. Commodity carry applies this to the positive or negative returns in holding a commodity separate to underlying price movements. The carry is determined by calculating the return in holding a futures contract and rolling forward. A ‘backwardated’ commodity – one in which the price of a commodity in the future is trading lower than the spot price of the underlying commodity – yields a positive carry. In the opposite instance, a market state of ‘contango’ is one in which the spot price is trading below the price of futures contracts.

[2] Koijen, R., Moskowitz, T., Pederson, L., Vrugt, E. 2018. Carry. Journal of Financial Economics 127 (2018) 197-225. https://econpapers.repec.org/article/eeejfinec/v_3a127_3ay_3a2018_3ai_3a2_3ap_3a197-225.htm

Connecting you to the latest thinking from our Alternatives teams.

Explore Now