Subscribe

Sign up for timely perspectives delivered to your inbox.

Andrew Mulliner, Head of Global Aggregate Investments, considers the implications of a divergence in tone among central banks seemingly on the same path.

The US Federal Reserve (Fed) and Bank of England (BoE) both hiked rates by 25 basis points (bps) in mid-March, as widely expected. The common context for the moves are tight labour markets, rising wages and inflation soaring to levels not seen in decades. Yet, the commonality ends there.

While there was dissent at both meetings – it was in opposing directions. One member of the Fed voted to hike even more aggressively by 50bp, while at the BoE, one member called for restraint and was against hiking at all. The Fed Chair Jerome Powell struck a confident and hawkish tone. Noteworthy were the dismissals of any significant concerns around real incomes being squeezed; this was, he said, a strong economy capable of absorbing a fast hiking cycle. Contrast this with the BoE, which is much more focused on the negative consequences of high inflation and the associated real income squeeze.

So, we have a tale of two hikes, one dovish, one hawkish. Why so different?

There are a few points of note here. First, the war in Ukraine is a significant event, not only in the appalling human cost, but also the economic consequences not just to Russia and Ukraine but to the global economy. Given the strategic importance of both Russia and Ukraine across commodity markets, the destruction and sanctions regimes implemented have resulted in significant cost increases to raw materials as well as aggravating already challenged supply chains. The impact of the price increases is being felt most keenly by countries in closer proximity to Ukraine and which rely heavily on Russia to meet their energy needs.

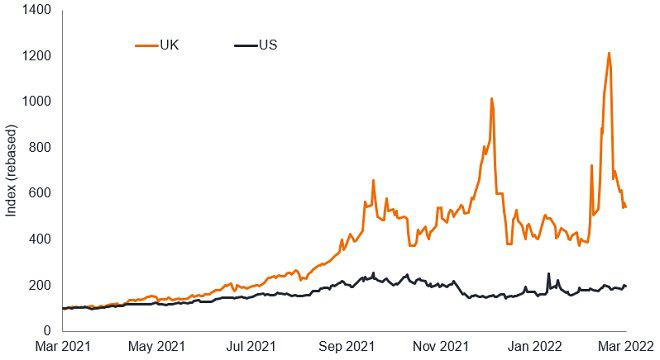

The UK, while less directly reliant on energy from Russia, is geographically situated within a market that is heavily reliant on Russian energy supplies and where volatility has been most extreme. The US is relatively insulated from the direct consequences, being the world’s largest producer of oil and natural gas as well as being a significant agricultural commodity producer. This can be seen most acutely between the difference between US and UK natural gas prices.

)Source: Bloomberg, UK Natural Gas Future (FN1), US Natural Gas Future (NG1), 18 March 2021 to 18 March 2022.

Second, the US embarked on a significant fiscal package in the wake of the 2020 election, which resulted in a significant spike in demand and contributed to a very strong US economy in 2021. This has potentially left the US with a greater imbalance between strong demand and insufficient supply relative to other economies. Elsewhere, the increase in inflation is more keenly attributed to the disruptions to supply in the form of input costs as discussed above as well as the ongoing supply disruptions associated with the pandemic.

Finally, the UK economy has undergone a significant transition in the past few years as the impact of Brexit feeds through. Understanding the full bearing of Brexit will take time, but UK export performance has lagged other markets in the post-pandemic recovery. This is another source of uncertainty to the UK economic outlook which may be weighing on the BoE’s economic outlook and adding to the more cautious tone.

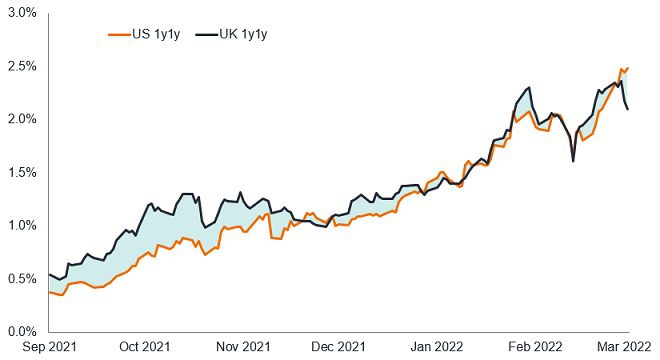

For markets, the implications of this divergence are important. One of the surprising features of the past few months has been how closely aligned interest rate expectations for 2022 in the UK and US have been in spite of the apparent difference in tone. Post the meetings in the past days, we have started to see divergence appear, with the UK curve steepening substantially relative to the US and the front-end rates diverging.

Source: Bloomberg, 17 September 2021 to 18 March 2022.

We believe 2022 will be increasingly marked by divergence across economies and central bank policy. The tale of two hikes from the Bank of England and the US Federal Reserve demonstrate this theme.

Basis point: One basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Inflation: The rate at which the prices of goods and services are rising in an economy.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. When policy is moving in this direction it is referred to as dovish. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money. When a central bank policy moves in this direction it is described as hawkish.

1 year 1 year Forward: A forward interest rate swap is an agreement between two parties to exchange cash flows (fixed versus floating interest rates) in the same currency on a fixed date in the future (in the case of a 1 year 1 year forward this would be one year hence). It gives an indication of where investors expect rates to be a year from now.

Volatility: The rate and extent at which security prices move up and down. Large movements indicate high volatility.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. A yield curve can signal market expectations about a country’s economic direction.

GC-0322-118184 09-30-23 TL