Subscribe

Sign up for timely perspectives delivered to your inbox.

Just how important is patience for trend following investors? Portfolio Managers Mathew Kaleel, Andrew Kaleel and Maya Perone consider the implications of the “gradually, then suddenly” phenomenon as markets respond to a sudden change in expectations for bond and commodity markets.

—–

In our last piece on trend following in June 2021, we looked at the implications of inflation and a rising interest rate regime on various asset classes. We highlighted the potentially positive environment for managed futures, and in particular trend following strategies.

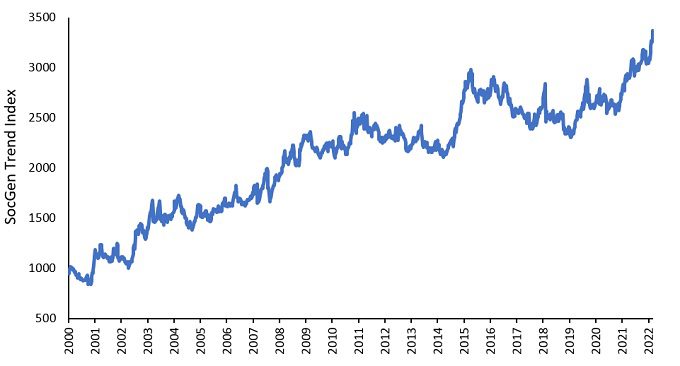

“Gradually, then suddenly” captures a particularly favorable setup for trend following strategies, which have been recent beneficiaries of exactly that shift in bond markets (the normalizing of interest rates and the resetting of inflationary expectations) and the growing awareness of the underlying constraints in commodity markets, and hence high sensitivity to any supply shocks. The ability of trend following to effectively pick up on these themes has seen the SocGen (SG) Trend Index move to all-time highs (Exhibit 1). This gradual then sudden repricing of financial assets is one of the drivers for trend following strategies continuing to offer the “crisis protection” characteristic of absolute returns during dislocated market conditions.

Exhibit 1: The SG Trend Index Has Broken New Ground Source: Bloomberg, 1 January 2000 to 4 March 2022.

Source: Bloomberg, 1 January 2000 to 4 March 2022.The returns for trend following strategies, which constitute the bulk of assets in the managed futures industry, are driven by two primal forces – price and volatility. Price, or more specifically the change in the price of a given asset over specified time intervals (the short-, medium- or longer-term trend) determines directional positioning. Any given market moving higher for a sustained period will result in a long position, and vice versa on the short side.

The strategy is agnostic to market direction but relies upon a continuation of a move higher or lower to generate attractive returns. Volatility is the second driver. A typical trend following strategy will target a particular level of volatility on an ex-post basis, both to control risks between portfolio constituents and to manage overall realized volatility at a portfolio level.

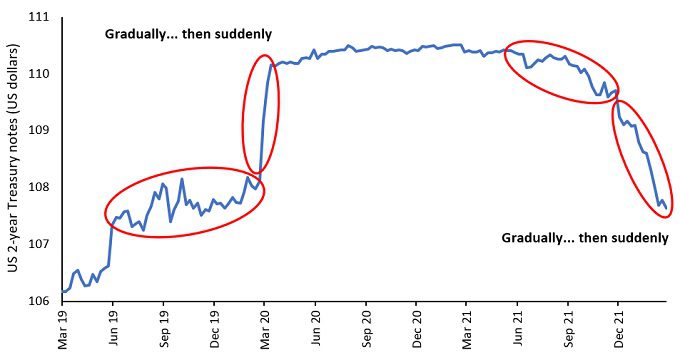

One sector that has reflected the gradual then sudden movement in markets over the last two years is bonds. Bond markets have provided a window into the ability of a trend following strategy to participate in extended market dislocations, specifically when markets gradually move in one direction (allowing the trend strategy an opportunity to be positioned well in both size and direction), then adjust suddenly.

One of the main Treasury Futures markets is in U.S. 2-Year Treasury notes, which has highlighted the round trip that markets have taken over the last two years, moving gradually, then suddenly, on both the upside and downside (Exhibit 2).

Exhibit 2: U.S. 2-Year Treasury Notes Have Gone Both Ways During the COVID Era

The periods preceding both the run-up in U.S. 2-Year Treasury notes in February and March 2020 and sell-off between September 2021 and the end of February 2022 were environments in which we saw markets gradually processing new information:

In both instances, a low level of realized volatility allowed for a relatively large position to be taken, both long and short.

The gradual, benign environments highlighted in the gradual phase were followed by periods of dramatic change as markets suddenly priced in new information:

In both the first quarter of 2020 and the fourth quarter of 2021, markets provided trend following strategies with a window of opportunity to position going into the trend. Sudden and significant moves during these periods resulted in a reduction in position sizing to recalibrate portfolio volatility, which had the effect of locking in profits.

Another such instance of the gradually, then suddenly phenomenon occurred in late 2007/early 2008, prior to the start of the Global Financial Crisis. At that point, markets were gradually processing information that indicated stress in credit and financial markets. This turned into a far more dramatic “suddenly” moment as these underlying influences flowed directly into stress in companies (Exhibit 3).

In much the same way as we have seen trend following benefit from the gradual then sudden move in price and volatility in short-term rates over the past two years, trend followers were able to take short positions in stock indices (among other positions), which made 2008 one of the best years on record for trend following strategies.

In a final example, relevant at the time of writing, the events occurring in Russia and Ukraine have had significant consequences across markets, with an outsized impact upon supply constrained energy, industrial metals and grain markets. The gradual assessment of risks has transformed quite suddenly into something far more acute, as shown by the step change in wheat prices over the last two weeks (to 4 March 2022) – see Exhibit 4.

The gradual then sudden moves in markets exemplified by the above examples represent a potentially favorable setup for a trend following strategy. But it is important to recognize that these trade setups are not the norm. Trend following strategies tend to have payoffs in clusters, either preceded and/or followed by trendless regimes with variable volatility and noncommittal moves. These are periods that may not be conducive to trend strategies, and it is in these environments that more dynamic approaches to both defining trends and managing position sizing come to the fore.

Much like Bill in Hemingway’s classic, markets often process information gradually, then suddenly. While this is not the default state, these occasional environments are highly conducive to positive performance for trend following strategies. The key with trend following is patience: remaining allocated during less conducive periods to ensure you reap the potential rewards when information is absorbed into market pricing, first gradually, then suddenly.

1Bianchi, R., Drew, E., Fan, J. “Commodities Momentum: A behavioral perspective.” Journal of Banking and Finance, 2016.

2The Powell Put: The point where U.S. Federal Reserve (Fed) Chair Jerome Powell indicated he would intervene with stimulus measures/looser monetary policy in the event of a financial crisis (first aired in early 2019). This echoed a similar policy by former Fed Chair Alan Greenspan.

3“Powell’s Pivot is the right move.” Washington Post, December 2, 2021.

4“Goodbye, Mr. Gradual, Hello Mr. Nimble: Fed Chair Powell tears up rate-hike script.” Reuters, January 26, 2022.

Connecting you to the latest thinking from our Alternatives teams.

Explore Now