Subscribe

Sign up for timely perspectives delivered to your inbox.

The impact of the conflict in Ukraine continues to mount and the humanitarian situation is saddening. No meaningful progress has been made towards military or political de-escalation. In fact, political hostilities are still intensifying and, as a result, estimates of the potential economic spill-overs from the conflict continue to rise. In just the last few days, US lawmakers have reached a deal to ban Russian oil imports, EU ministers have announced plans to discuss broadening restrictions on energy imports and Russia has threatened to respond, which may have a severe impact on natural gas supplies to Europe.

Unsurprisingly, against this backdrop, the mood in financial markets continues to darken, with investors increasingly unsettled by rising commodity prices and the potential damage they could inflict on the global economy. The near-vertical ascent in European natural gas, nickel and wheat prices in recent days, and the continued surge in other commodities, are continuing to undermine risk appetite across a broadening range of global financial assets.

Concerns remain most intense in Europe, where a substantial reliance on Russian commodities means that growth and inflation expectations are highly sensitive to commodity prices. While modelling the economic consequences of the conflict is a speculative exercise given the fluid military and political backdrop, some forecasters have nevertheless already chopped 2% off eurozone GDP growth forecasts for 2022, reflecting the impact of sanctions and the commodity squeeze. While even these lowered forecasts still project regional GDP growing at 2-3% in real terms this year, a prolonged conflict with a multi-month impact on commodity prices could push forecasts lower, raising the spectre of European recession.

As investors have scrambled to reprice these risks, money has fled from eurozone assets. The EURO STOXX 50 Index has retreated 20% from its early-January high (5 January to 7 March 2022), with even bigger drawdowns evident in more economically sensitive sectors such as autos and banks. Fund flow data suggests signs of investor capitulation, with exchange-traded funds (ETFs) and mutual funds seeing the biggest weekly net outflows ever from European equities in late February.

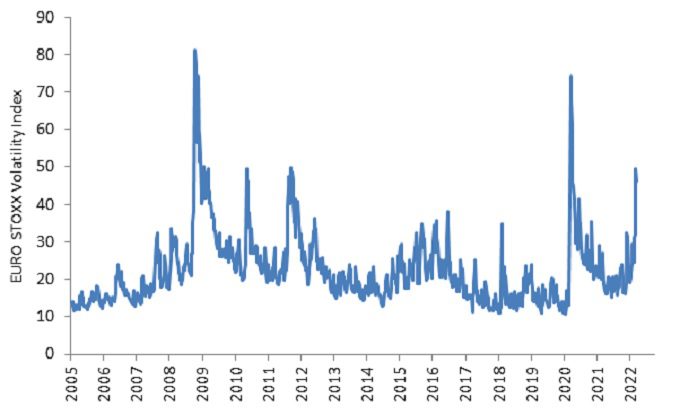

Other market metrics reinforce how far investor sentiment has swung. Equity and currency option prices are now indicating levels of investor pessimism about eurozone assets that have previously only seen in the US sub-prime crisis, the eurozone debt crisis and the early days of the COVID-19 pandemic (Exhibit 1).

The average eurozone stock is now trading at a 30% discount to consensus analyst 12-month share price targets. In recent decades, discounts of this size have only been seen in those same three episodes – periods of recession and significant financial stress. Valuation indicators reinforce this message. Eurozone equities are now trading at 30-year valuation lows versus US stocks, levels last seen in the eurozone financial crisis.

It is not difficult to show that a lot of bad news is now priced into European stocks. Still, while the political outcome remains so uncertain, it is hard to have much confidence in estimates of the economic and financial impact of the conflict. Things could get much worse. Worrying scenarios involve a lengthy war, a spreading of the conflict to other countries, or escalation in the types of weaponry being deployed.

It seems natural to be gloomy about the outlook for European financial markets, against the backdrop of the human tragedy unfolding in Ukraine. It is easy to conclude that a sustained revival in investor risk seems unlikely until a credible path to de-escalation becomes visible. However, financial markets are forward looking and market recoveries from geopolitical events have often taken place even while risks surrounding a key event remain high. Given the pessimism now baked into eurozone assets, any progress towards political outcomes that limit the scope of the conflict could be enough to shift the mood in the markets from fear to hope.