Subscribe

Sign up for timely perspectives delivered to your inbox.

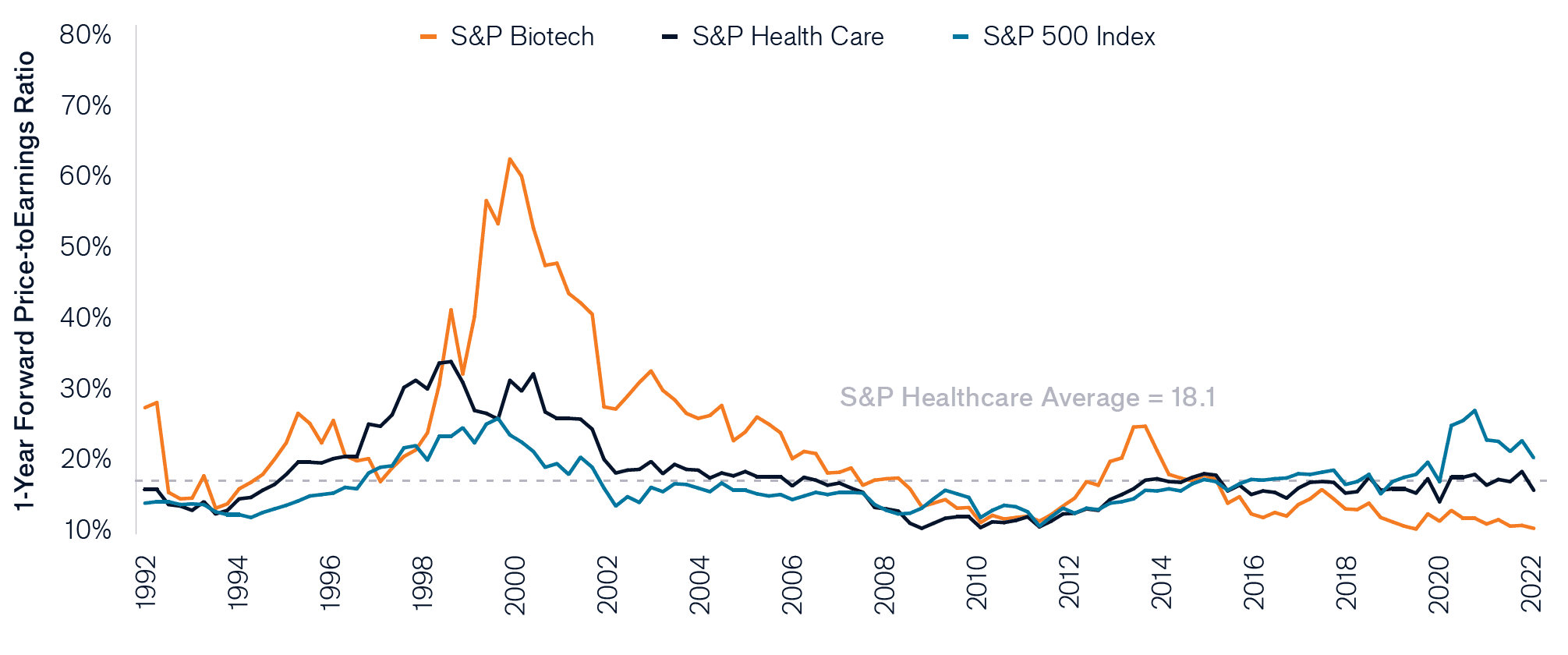

Even while health care companies have been leading the charge against COVID-19, the sector trades below the broad market average. In this interview, Andy Acker, Portfolio Manager of the Janus Henderson Global Life Sciences Fund, explains how health care’s innovation and low valuations make for an attractive combination.

Unfortunately, COVID-19 is still with us and infecting large numbers of people due to Omicron. But this latest variant is proving to be less virulent than previous strains, especially for those vaccinated, giving hope that the disease may become more manageable. In addition, the Food and Drug Administration (FDA) recently authorized a new antiviral pill, Paxlovid, that can be taken at home. In clinical trials, Paxlovid reduced the risk of hospitalization in high-risk patients by 90%, a remarkable result. Supplies of the drug so far have been limited, but manufacturing is ramping up.

In 2020, firms addressing COVID with vaccines, treatments and diagnostic tests all performed well, as did biotech stocks broadly, as investors cheered on the industry’s scientific progress. But starting in 2021, pandemic-related disruptions, worries about drug-pricing reform and a leadership vacuum at the FDA brought an end to the biotech rally. Medtech stocks also suffered when COVID interrupted routine medical care and procedures. On the flipside, insurers’ costs went down as people deferred care, and the companies benefited from expanded government programs and health care access. Health care facilities also fared better than expected given government support and high reimbursement rates for COVID patients.

The sector trades at a significant discount to the S&P 500® Index just as capacity could be returning to the health care system (see chart). As such, we are looking for attractive opportunities across the four major sub-sectors: pharmaceuticals, biotech, health care services and medtech. With interest rates expected to rise this year, pharmaceutical stocks look especially attractive given defensive characteristics, strong free cash flow and low earnings multiples. Similarly, in services, we feel health insurers remain attractive in light of positive free cash flows and the potential for earnings to benefit from rising rates. In medtech, we continue to focus on devices that improve patient outcomes, save labor costs and create efficiencies. Biotech, meanwhile, is in the midst of a historic sell-off, with the industry’s small- and mid-cap companies having fallen more than 50% since their 2021 peak.1 Yet these firms are driving some of the most exciting innovation in health care. As such, we are finding numerous opportunities to invest in innovation, while maintaining a bias toward revenue-generating firms or those with pipelines in the later stages of development.

Source: Bloomberg, from 30 September 1992 to 31 January 2022.

Note: Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio. S&P Health Care comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector. S&P 500 Biotech comprises those companies included in the S&P 500 that are classified as members of the GICS biotechnology sector.

2 U.S. Food and Drug Administration, as of 31 December 2021.

3Janus Henderson Investors, FactSet. Data as of 31 December 1999 to 31 December 2021. Downside Capture is the ratio of a fund’s monthly return during periods of negative benchmark performance divided by the benchmark’s return.