Subscribe

Sign up for timely perspectives delivered to your inbox.

As investors prepare for an era of monetary tightening, the volatility that has roiled financial markets during the first months of 2022 looks set to continue until a clearer picture emerges on inflation, geopolitics and the eventual pace of interest rate hikes.

Financial markets have experienced a turbulent 2022 thus far. Equity volatility, as gauged by the Cboe VIX Index, has averaged 23.7, year to date, which is 38% higher than during the preceding decade. The ICE BofA MOVE Index, which measures Treasury market volatility, is 29% higher than its 10-year average. Furthermore, 41% of the year’s trading days through February 18 saw the S&P 500® Index register moves greater than 1.0%.

While myriad factors influence securities prices, their current path largely emanates from a primary source: unexpectedly high – and persistent – inflation causing the Federal Reserve (Fed) and other central banks to pull forward plans to reduce accommodative monetary policy. And although the manner in which economic developments reverberate through markets is unpredictable, 2022’s moves in asset prices appear to tell the common story of investors recalibrating for an era of tightening monetary policy.

The prevalence of this inflation-recalibration narrative enables us to highlight select data points that help explain the current situation. These data also merit close attention going forward as they may help divine what the economy and markets could have in store for investors in the months ahead.

Source: Bloomberg, data as of 18 February 2022.

Source: Bloomberg, data as of 18 February 2022.

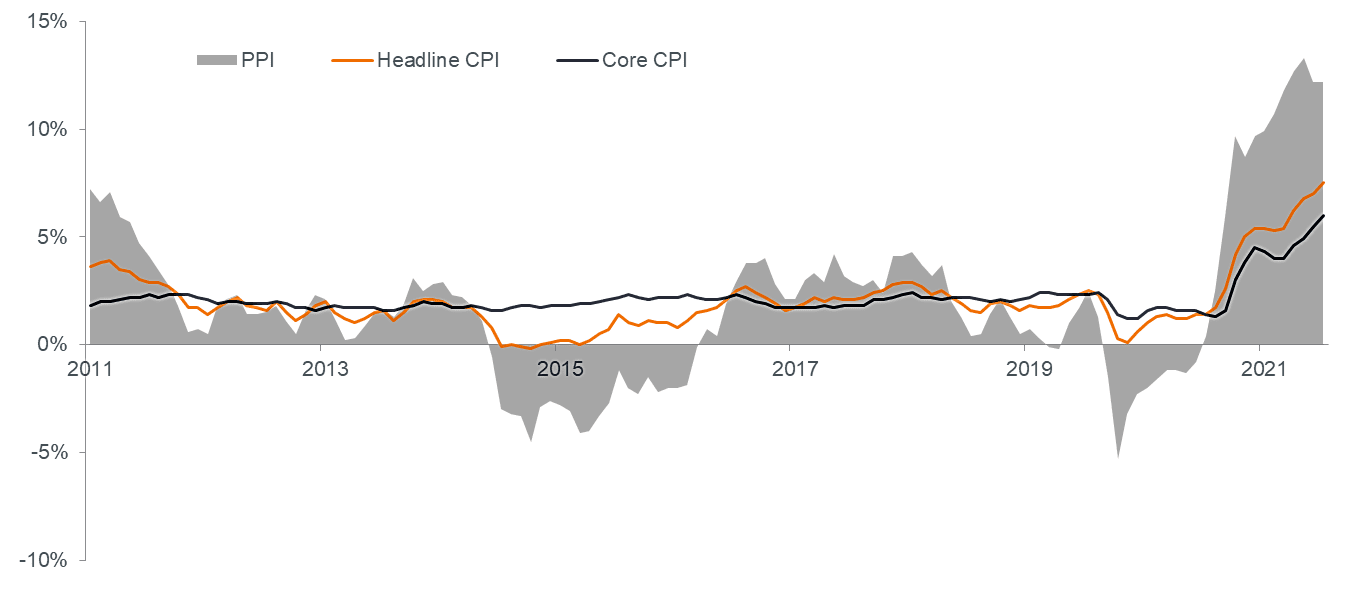

U.S. inflation, as measured by the Consumer Price Index, rose 7.5% in January 2022, its highest rate in 40 years. For perspective, over the 20 years ending December 31, 2021, it averaged 2.2%. Core inflation, which excludes typically volatile food and energy components, rose 6.0% – also a nearly 40-year high. As late as December 2020, consensus estimates were for U.S. inflation to average 2.0% in 2021. The actual rate was 4.7%.

Consensus was for prices to temporarily spike in mid-2021 as the U.S. economy continued reopening. Unaccounted for in these estimates were supply-chain dislocations and a dearth of workers. Year-on-year gains in average hourly earnings were 5.7% in January, well above the 2.2% pace in the decade that preceded the pandemic. Supply disruptions are expected to resolve as capacity is added across industries. Wages present a thornier issue, as higher inflation often begets higher inflation as employees demand wage increases to maintain purchasing power.

Consensus estimates are for U.S. inflation to clock in at 5% in 2022. Market expectations, based on Treasury Inflation-Protected Securities (TIPS), are for inflation to average 3.75% and 3.0% over two-year and five-year horizons, respectively. How inflation ultimately evolves in the coming months will go a long way toward determining whether these projections need to be adjusted.

Source: Bloomberg, data as of 18 February 2022.

Source: Bloomberg, data as of 18 February 2022.

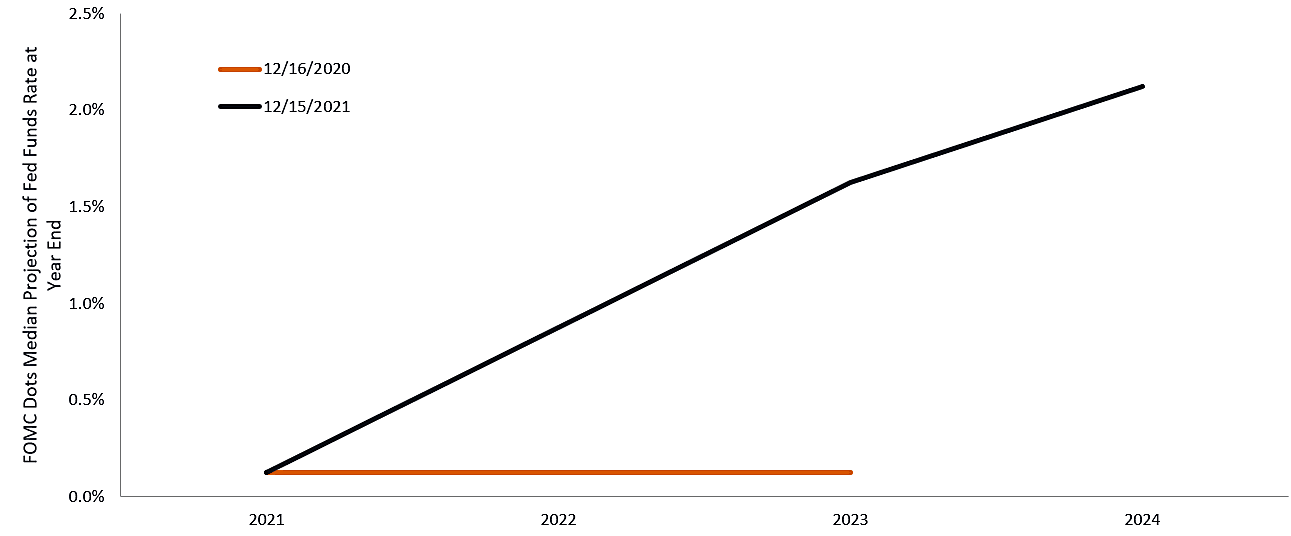

Just over a year ago, the Fed was calling for no rate hikes through 2023. By December, it anticipated three in 2022 and another three in 2023. Futures markets are less sanguine, calling for over six hikes this year. Any time there is such a disparity between market expectations and Fed projections, asset prices have the potential to move as new data prove which view is correct. With the market taking a more bearish view on inflation stabilizing, any signs that the Fed is succeeding in reining in prices – or at least having more success than what’s already priced in – could ease the pressure on the asset classes that are most sensitive to rising rates.

Source: Bloomberg, data as of 18 February 2022.

Source: Bloomberg, data as of 18 February 2022.

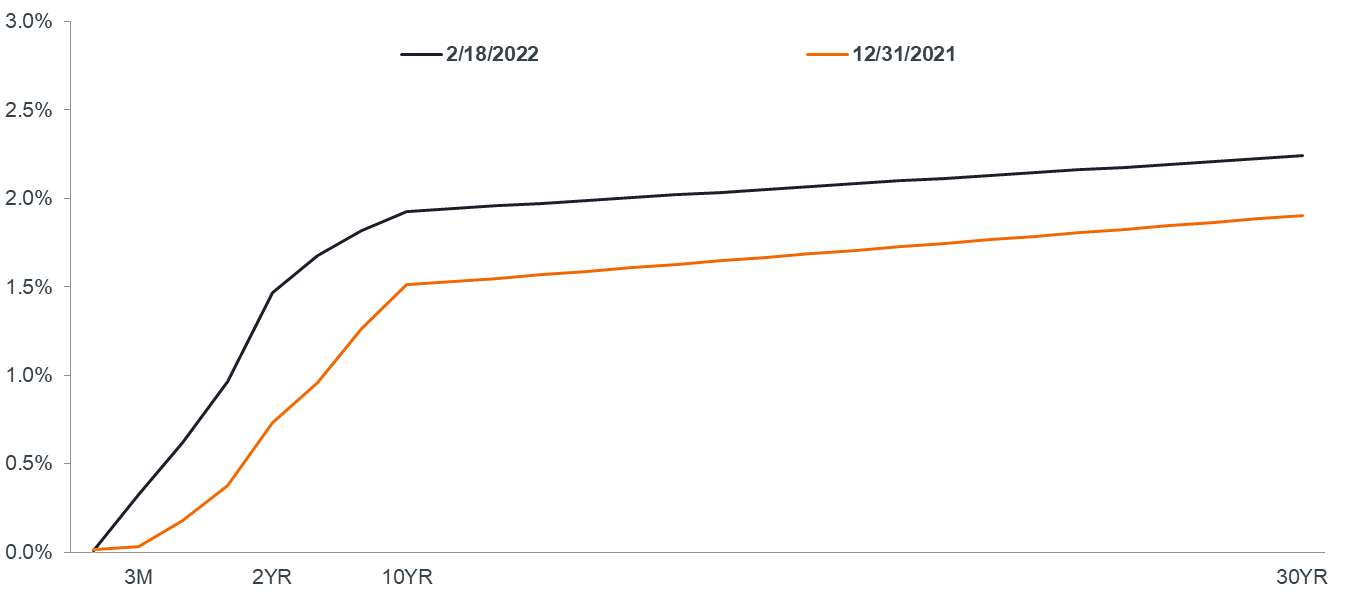

The market segment most acutely impacted by the expectation for higher policy rates is shorter-duration Treasuries. With the first whiff of inflation in early 2021, the Treasuries yield curve steepened as Fed officials demurred from taking a more hawkish stance. Since then, the front end of the curve has risen in advance of the commencement of telegraphed rate hikes. Consequently, the spread between the yield on 10-year and 2-year Treasury notes has slid to 39 basis points (bps), its narrowest since the early days of the pandemic.

Typically, a flatter yield curve is seen as a harbinger for impending recession. While that may not be the case at present – given the role that the Fed continues to play in Treasury markets – this flattening does indicate the potential for higher policy rates to weigh on economic growth further down the line.

Source: Bloomberg, data as of 18 February 2022.

Source: Bloomberg, data as of 18 February 2022.

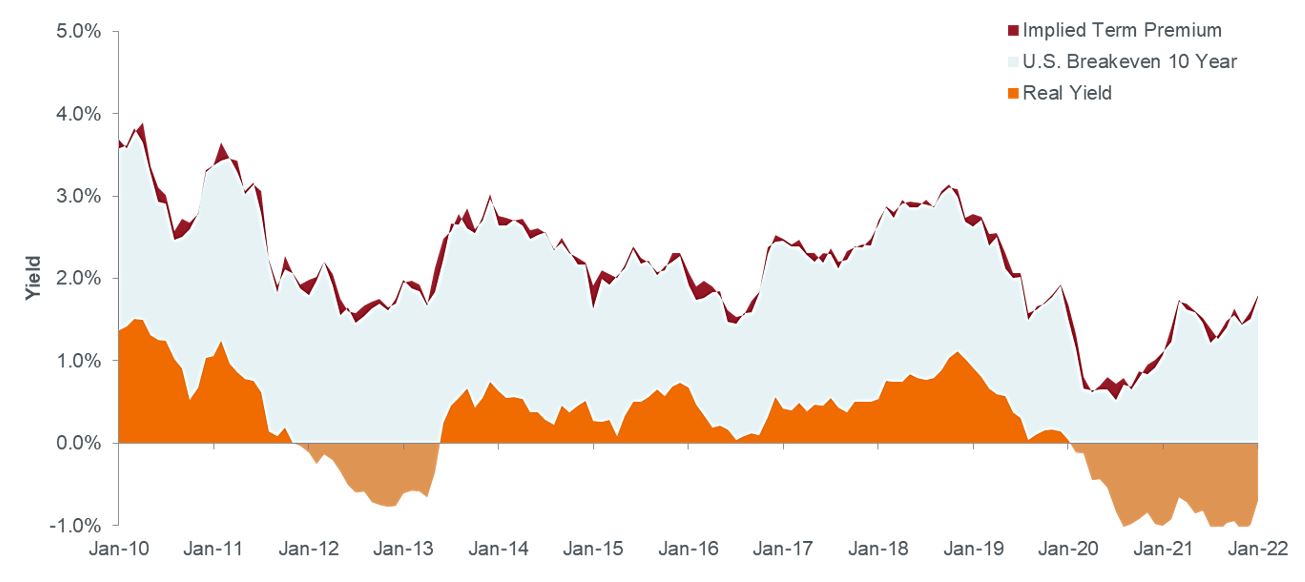

The goal of tighter policy is to tame inflation by raising the cost of capital. In that case, the Fed’s pivot is already proving effective as the real yield (nominal yield minus annual inflation rate) on the 10-year Treasury has risen. It closed out 2021 still below -1.10% but has since climbed to -0.51% – its highest level since mid-2020. Higher real yields have the potential to affect all asset classes and should therefore stay on investors’ radar screens. If investors start earning positive real returns on safer assets, the years-long urge to “reach for yield” could diminish, removing a tailwind for more speculative investments. The path to get to positive territory, however, would not be without headaches for investors who currently have exposure to shorter-duration assets.

Source: Bloomberg, data as of 18 February 2022.

Source: Bloomberg, data as of 18 February 2022.

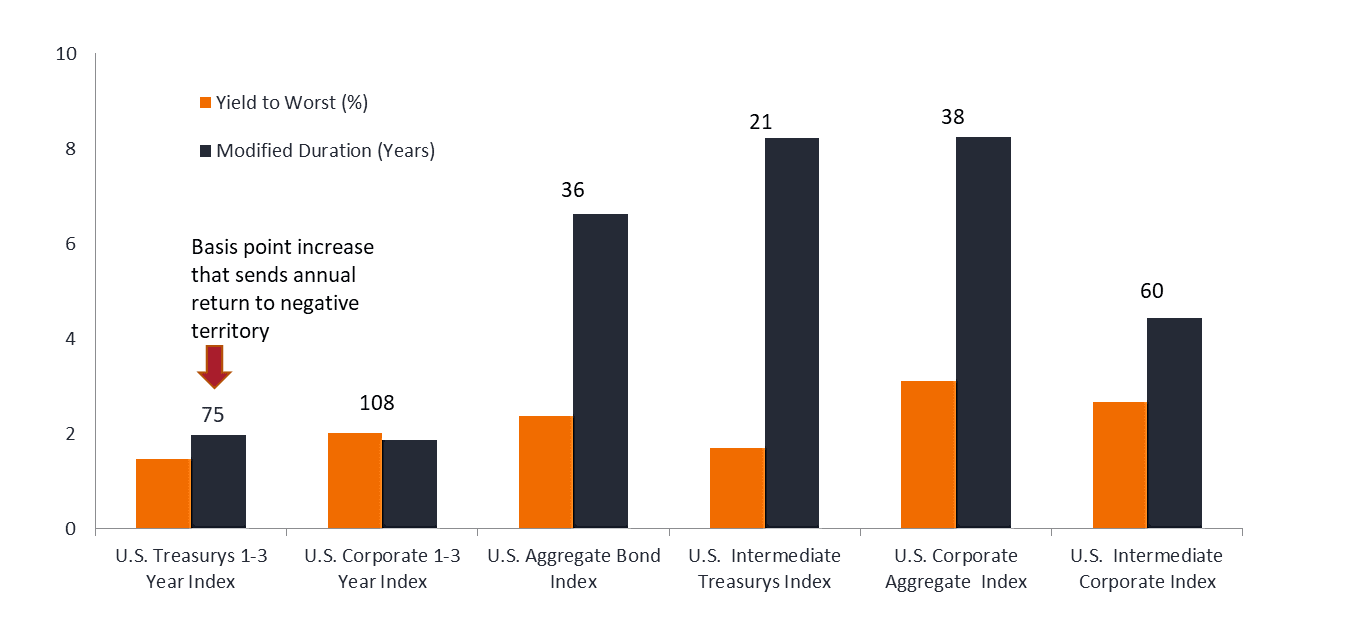

A flattening yield curve changes fixed income securities’ risk/reward profiles. Duration on bond indices remains near historical highs. The mismatch between duration and yields has left investors vulnerable to even small interest rate moves, something that has been borne out in market returns this year. Yet higher yields across a flatter curve means that investors need not expose themselves to excessive rate risk by extending duration to capture modest incremental gains. At present, it would take a 75 bps rise in rates to wipe out a year’s return on the Bloomberg U.S. Treasuries 1-3 Year Index. One year ago, it would have taken only 7 bps. While still trending in the right direction, this breakeven on the Bloomberg U.S. Aggregate Bond Index has only climbed from 21 bps to 36 bps.

Source: Bloomberg, data as of 18 February 2022.

Source: Bloomberg, data as of 18 February 2022.

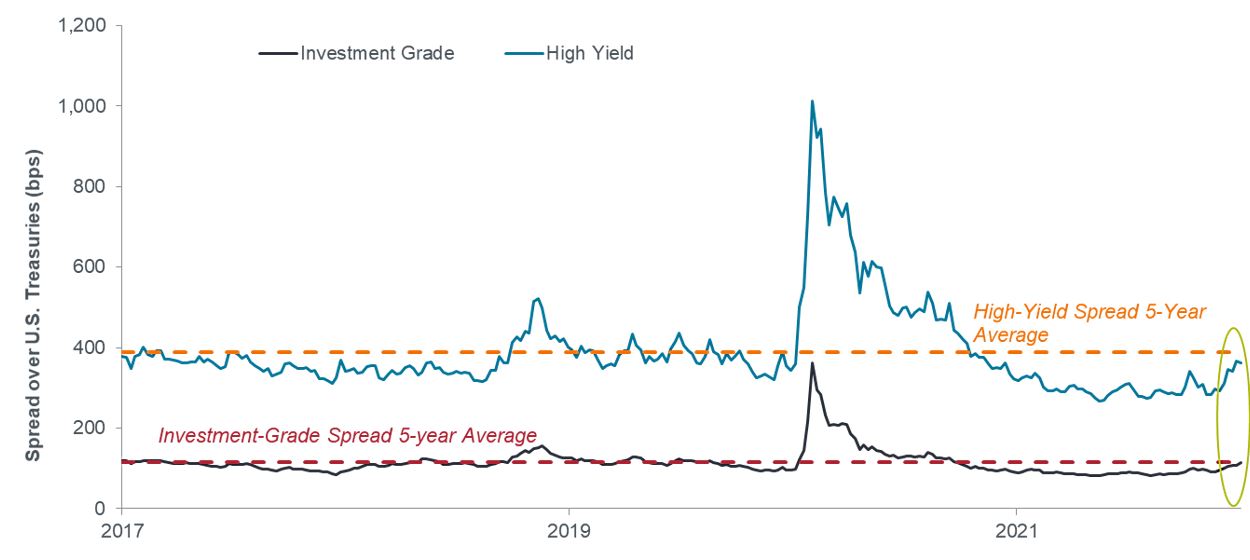

With the Fed set to move, it would seem that investment-grade corporates are vulnerable given their sensitivity to interest rates. Although the spread between these securities and those of their risk-free benchmark has crested its 5-year average, it still is low by historical standards, meaning there is little cushion to absorb additional rate surprises. But this level already reflects the cadence of expected rate hikes. Barring any negative developments, these incrementally higher yields represent the potential for returns that were unavailable only a few months ago. And while many segments of the investment-grade market appear fully valued, corporate fundamentals may lend credence to these levels given low default rates and healthy balance sheets.

It’s a similar story with high-yield corporates. Many of these issuers used the era of low rates to repair balance sheets, and their inherently larger spread cushion means they could better absorb any additional rate or inflationary shocks. Over the longer term, investors should be mindful of the Fed’s notoriety as the killer of economic expansions. While likely some ways off, higher rates could eventually clog the gears of growth enough to stress balance sheets and, in turn, send credit spreads wider.

Source: Bloomberg, data as of 18 February 2022.

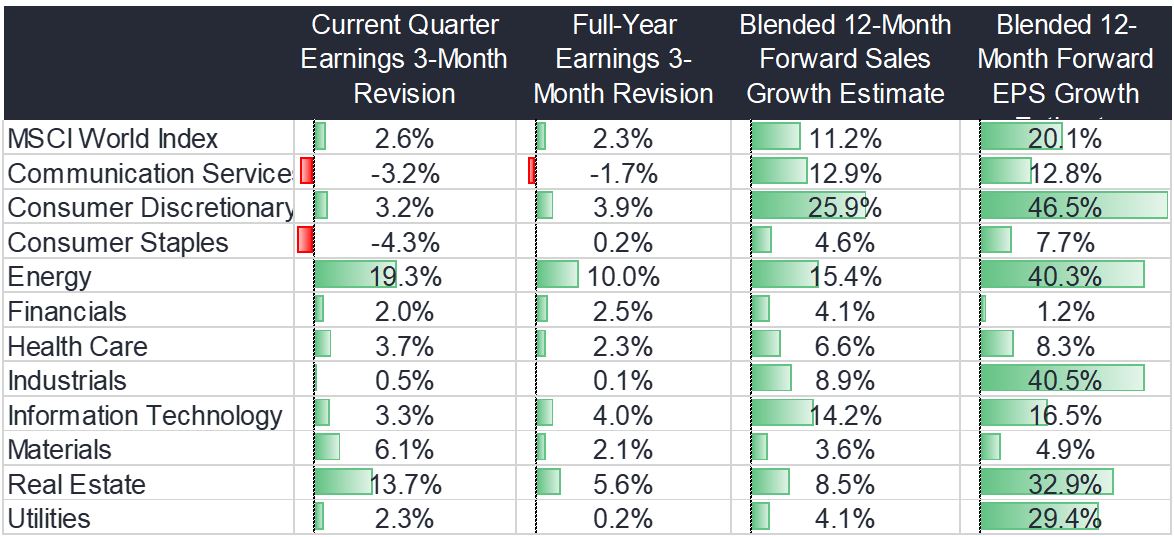

Equity markets have also reacted to the inevitability of higher rates. This has been most evident in the pronounced compression of earnings multiples, which is the leading contributor to the year’s negative returns, with P/E ratios on many indices falling by more than 10%. This stands in contrast to 2021 when positive earnings revisions were the dominant driver behind strong equity returns. Importantly, consensus full-year 2022 earnings revisions remain positive.

Source: Bloomberg, data as of 18 February 2022.

Source: Bloomberg, data as of 18 February 2022.

Moderate levels of inflation can create a favorable backdrop for equities as it accompanies economic growth and allows companies to raise prices to either pass along higher input costs or increase profitability. Too much inflation, however, can lead to demand destruction and weigh especially hard on sectors that must absorb higher costs. Despite the current spike in inflation, full-year 2022 earnings revisions remain positive. If the initial steps of policy tightening prove insufficient to lower inflation, corporate earnings may not be able to evade the negative consequences of higher prices.

Source: Bloomberg, data as of 18 February 2022.

The compression of earnings multiples is most evident in the growth stocks that have dominated markets in recent years. Typically, stocks with lower valuations would be on the ascent due to broadening economic growth. This year’s shift toward value, however, has been less about value’s prospects and more about a re-rating on secular growth stocks. As the cash flows from which these stocks’ valuations are derived occur many years into the future, they are especially sensitive to shifts in interest rates. No doubt that’s been a factor in growth stocks’ 2022 travails. Exacerbating the situation have been subpar – and in some cases, downward – earnings revisions for a few mega-cap Internet and e-commerce names that hold tremendous sway in the growth universe.

Other pockets of technology – among them semiconductors – have seen notable upward earnings revisions over the past three months. So while the broad-based re-rating of growth stocks may be justified in some instances, in others it has created attractive entry points for secular growers whose proposition to deliver on an increasingly digitized global economy remains intact.

In another consideration, should central banks raise rates too aggressively and extinguish the recovery, secular growth stocks may once again become one of the few destinations in equities markets where one have the potential to find attractive earnings stories.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.