Subscribe

Sign up for timely perspectives delivered to your inbox.

As China enters the Year of the Tiger, a recap of 2021 provides some insight into what to expect in the year ahead. 2021 served as a reminder to investors in Chinese markets that companies are subject to the overarching reach of the state, and along with this, the power to decide the fortunes of corporate China. We also witnessed once again how investor sentiment can swing the pendulum from euphoria to extreme pessimism as reflected in the high valuations that investors are willing to attach to company earnings, in particular to those companies that are seen as beneficiaries of government support or in industries that the government wants to bolster. Conversely, those that are perceived to be out of favour can suffer significant valuation downgrades once these companies’ growth potential is deemed to be weak.

With this background in mind, we discuss the key topics that are top of mind for investors in China.

COVID continues to be a known unknown due to the local authorities’ tighter mobility restrictions. Consumer demand, especially in service sectors such as catering and travel, continue to be constrained. While China’s domestic supply chains were largely left intact and resilient, it is unclear if Omicron will have a more disruptive impact this year given it is more contagious and exhibits milder symptoms. China’s attempt to contain and extinguish localised outbreaks means factory and port shutdowns could happen more frequently this year. With the politically sensitive National Party Congress in October, and President Xi looking toward a third term at the helm, it is likely that China will extend its COVID containment policy until the Congress begins, with a possible opening of borders with Hong Kong and Macau taking place earlier.

2021 was a reminder of the state’s influence and ability to regulate industries that they do not support. The revisions to company valuations and earnings forecasts in ‘big tech’ ultimately led to disappointing share price performance. We now know what the state wants less of. The businesses that manage, comply, and survive these regulations are likely to surface with downward earnings revisions but importantly with their businesses still intact. The innovation in China’s big tech (software, internet) is likely to continue, and continue to feed the growth of China’s hard tech (such as semiconductors and microprocessors).

While we are likely past the peak of regulations in big tech, real estate and even extreme decarbonisation efforts, these polices are nonetheless here to stay with higher compliance costs for big tech. The initial shock and impact on share prices within the internet and real estate sectors are likely to have been mostly reflected in 2021.

Continued rivalry between China and the US, and other developed economies is likely to remain. US-China relations have continued to be bumpy, with a growing number of companies on the ‘Entity List’ that are affected by the US government’s restrictions on investing and trading with certain Chinese companies deemed to be associated with the Chinese military-industrial complex. These companies are effectively cut off from global capital, while their supply chains, as well as customer demand remain at risk.

In our view, China’s desire and will for technology independence will continue to strengthen. We expect industries viewed as providing ‘core’ technologies will continue to be nurtured by the government and incentivised. China’s semiconductor industry, and the wider industrial tech sector, should continue to be a focus of the current 14th Five-Year economic and social development plan, along with environmentally clean technologies, where China is now exhibiting independence in its supply chain.

We think 2022 is likely to be a better year for key internet s tocks where business models have largely stayed intact. Chinese internet companies continue to innovate, providing access to products and services and ease of transaction to the consumer. Having achieved market-leading positions in multiple areas that have made their apps and platforms ubiquitous in China’s daily life, their dominance and success inevitably resulted in the regulatory onslaught seen in 2021. While investors may choose not to view China ‘big tech’ as true internet companies due to the permanently higher regulatory costs and constraints they now face, we prefer to think of them as large China consumer companies and brands. Several internet companies remain attractive to us given some of the issues affecting the sector are temporary, such as the weak macroeconomic environment, and with investor sentiment weak current valuations appear more reasonable.

While demand for consumer services has underwhelmed over the past two years, a change in the COVID containment strategy is expected to lead to a rebound in domestic consumption, although this is likely to come later rather than early in the year.

The property market remains an area of risk. While government policy has shifted to a focus on stabilisation and growth, it is uncertain if further falls in property prices will trigger a buyers’ strike when investors no longer view property gains as a ‘given.’ This has ramifications for construction activity and related industrial activities, which would ultimately feed into lower economic growth.

Additionally, monetary policy in China has been on a divergent path, with China easing and the US tightening. Given the high correlation between US equities and Chinese stocks listed on US exchanges and in Hong Kong (offshore listings), Chinese equities as a whole are likely to also be impacted by the contraction in global liquidity due to policy tightening moves.

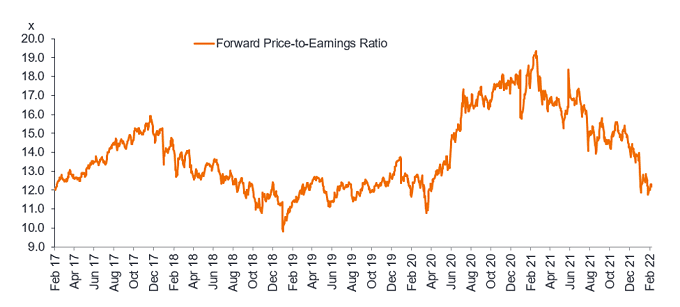

China’s monetary policy direction is set for easing to achieve the goals of economic stabilisation and ensuring growth, with 2022 being a politically sensitive year. We are also currently seeing more reasonable stock valuations relative to recent history, with the MSCI China Index trading at around a five-year average. We believe the combination of these factors could stand Chinese equities in good stead for improved performance in 2022.