Subscribe

Sign up for timely perspectives delivered to your inbox.

Technology plays a pivotal role in the transition towards a more sustainable world and is a deflationary force. In this Q&A portfolio manager Richard Clode explores these themes and the investment opportunities.

We very much see technology as the science of solving problems, and as a result, a key enabler towards a more sustainable world. We think there’s a natural synergy for technology to provide solutions to these major environmental and social challenges, and as a consequence, this allows access to some of the largest growth markets out there. The technology sector is on the right side of that by providing the innovation, those exponential leaps that only technology can provide. No one thought that EVs (electric vehicles) would ever take off in a broad sense, and again, technology’s enabled EVs to be a real credible alternative to internal combustion engine cars and we’re now finally seeing that inflection.

We look at the investment landscape and we very much feel that there’s much more breadth to those opportunities, to those growth areas in technology than is currently being addressed in most sustainable investing today. Because it’s not just renewables, it’s not just electric vehicles. We  think about a wider sustainable transport revolution. So we think about ride hailing, about autonomous driving because it’s not just about the pollution and the carbon emissions, it’s also about reducing the number of accidents and fatalities on the road. Improved efficiency and productivity are also being made possible by technology. We need to reduce the use of scarce natural resources and we need low carbon infrastructure, we need smart cities to do that as well. So we think there are many technologies that provide solutions to those environmental challenges, and more uniquely to social problems too.

think about a wider sustainable transport revolution. So we think about ride hailing, about autonomous driving because it’s not just about the pollution and the carbon emissions, it’s also about reducing the number of accidents and fatalities on the road. Improved efficiency and productivity are also being made possible by technology. We need to reduce the use of scarce natural resources and we need low carbon infrastructure, we need smart cities to do that as well. So we think there are many technologies that provide solutions to those environmental challenges, and more uniquely to social problems too.

The social side is a somewhat neglected area of the power of ‘technology doing good’. Access to quality healthcare, financial inclusion, digital democratisation (making tech accessible to more people), tech health and data security are exciting themes. There’s often a huge focus on the mega-caps when we talk about technology, and there seems to be a lack of realisation of the good that many technology companies do around the world, across both developed and emerging markets. Thinking of financial inclusion, that used to be very much reliant on the expansion of a physical bank branch into a second-tier town, then a third-tier town and then in some of the rural areas, which may well take 50 or 100 years. Now, it can be done with the swipe of a card or a download of an app. People that have never had any credit history, could never access credit to start a business or to get that initial loan or some risk capital to actually be able to start up a business or invest, we’ve seen this progress in China, India, and Latin America.

The critical mass and adoption acceleration that some tech platforms now have around the world, often in places that don’t have very established healthcare or education systems, has meant that more people are able to access quality education and healthcare by leveraging the internet, the cloud and AI (artificial intelligence). The pandemic has forever changed the way we work and learn, making online learning, home schooling and telemedicine possible. We’ve seen a huge acceleration of these trends from the pandemic and while near term the digital divide has only exacerbated the rising inequality we have witnessed globally. We believe longer term, the critical mass lockdowns provided to these more nascent technology platforms and the widespread government support to level up economies, will ultimately help reduce poverty and inequality.

The United Nations has updated the interpretation of human rights to embrace the digital world. What’s very positive for us is the maturing of the technology sector in terms of responsibility, as we’ve seen in their interaction with regulators and governments. What’s happened in the last ten years, particularly the scrutiny in the last five years, has meant that tech companies aren’t just disrupting an industry and then worrying about the aftermath and the implications of scaling to billions of users. Maybe the infrastructure or data security and privacy policies weren’t 100% right or they hadn’t thought more thoroughly about every potential outcome or indirect consequence of the new technology, product or service. I think now there’s much more of a realisation and impetus to think about these implications in advance because if not, the company is likely to be hauled in front of US Congress or the European Commission fairly quickly.

Moore’s Law is widely acknowledged to have provided the building blocks for better, faster, cheaper technology. It relates to the ability to increase the number of transistors every year that can fit onto a microchip per square inch. But this has slowed down. On the other hand, there’s many other improvements, for example architectural, packaging or software improvements that can continue to keep a version of Moore’s Law going.

What this means is that technology is one of the few sectors where prices actually go down. Globally we’re now seeing labour shortages coupled with rising cost inflation. Technology companies are gathering real-world data, the analysis of that data to increase efficiency and productivity, reduce wastage and the need for transportation, among others. These improvements come in multiple forms. It could be software, industrial automation, smart cities, smarter factories or asset tracking.

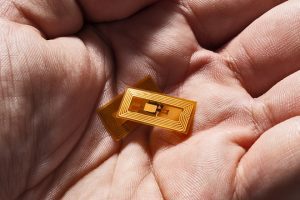

There are many technologies that can be deployed to make the world a more efficient, more productive place. One example would be adoption of RFID (radio-frequency identification), an asset-tracking technology. It’s a very, very small little tag and antenna that can for example be sewn into a  garment. And that reader can sit in a warehouse that can then ping out to all RFID tags on every item within that warehouse or in the back of a truck or going along a conveyor belt in an Amazon warehouse. The information embedded in that tag tells you what it is, where it’s originated or sourced from, where it’s going. The pandemic and its lockdowns have made retailers realise they need to sell online to survive and that visibility of inventory was a must have. That led to a huge inflection in RFID adoption in the retail sector, which is a positive from a sustainability view because it stops overstocking, it reduces wasted stock and unnecessary transportation. And then that technology is now being evolved to enable self-checkout, reducing labour at checkout tills, automated returns, and loss prevention. It will also enable traceability, ultimately end of life and recycling down the line, which supports the circular economy. Aside from retail, we’re also seeing an inflection on the logistics side, with both FedEx and UPS having adopted RFID technology.

garment. And that reader can sit in a warehouse that can then ping out to all RFID tags on every item within that warehouse or in the back of a truck or going along a conveyor belt in an Amazon warehouse. The information embedded in that tag tells you what it is, where it’s originated or sourced from, where it’s going. The pandemic and its lockdowns have made retailers realise they need to sell online to survive and that visibility of inventory was a must have. That led to a huge inflection in RFID adoption in the retail sector, which is a positive from a sustainability view because it stops overstocking, it reduces wasted stock and unnecessary transportation. And then that technology is now being evolved to enable self-checkout, reducing labour at checkout tills, automated returns, and loss prevention. It will also enable traceability, ultimately end of life and recycling down the line, which supports the circular economy. Aside from retail, we’re also seeing an inflection on the logistics side, with both FedEx and UPS having adopted RFID technology.

There are particular areas of tech that have developed beyond Silicon Valley, such as precision engineering, electric vehicles, renewable industrials that Germany has been renowned for but also elsewhere in Europe, as well as the UK. Now there are more entrepreneurs who are leaving the US and returning home to build their businesses. In part this could be a reaction to some of the immigration policies in the US that are less welcoming to foreign entrepreneurs.

Additionally, there’s also been a huge evolution of private equity in venture capital (VC), which means Silicon Valley isn’t the only destination to raise funds. You can get funded in China or in Latin America now. As a result, today there are many more opportunities globally.

Clients’ perception of what is a technology company is key. When we think about tech we don’t rely on GICS (Global Industry Classification Standard) and MSCI (index provider) classifications. For example there’s a company that is a key player in connecting the physical and digital worlds. They have developed a geospatial technology that digitally maps and tracks everything from forests to coral reefs to agriculture and construction. Some investors would view it as an industrial company, but we very much consider it to be a tech company. Among others they provide high resolution mapping of coral reefs enabling the protection of biodiversity there, but also protecting the livelihoods of local people, as well as improving efficiencies in yields and water efficiency in agriculture.

We look beyond the standard definition of a technology company; does the company have proprietary technology which has significant potential to be monetised? You can also find tech businesses within other non-tech businesses. There is a telecom company that owns one of the largest tech health platforms in Canada. But perhaps more uniquely, they also have one of the largest agri-tech platforms with a mission to create better food outcomes by digitising agriculture and improving yields and efficiency and traceability. This is another opportunity that can be found outside the classic definitions of technology, which further reinforces our view that there are many areas of technology that provide great growth opportunities with some really interesting franchises.