Subscribe

Sign up for timely perspectives delivered to your inbox.

It has been a tumultuous start to 2022 for many risk assets, but investors focused on the secured loans market have experienced much calmer conditions.

The loan markets, in both the US and Europe, were very resilient through 2021 with returns of 5.40% and 4.63% respectively*. This reflects primarily a coupon return augmented by some price appreciation from the most COVID impacted sectors, despite further outbreaks of additional variants namely, Delta and Omicron. This was against a backdrop of significant new issuance, with European secured loan supply hitting a post crisis record of €112bn. This strong level of supply (boosted by high levels of private equity backed leveraged buyouts) boosted the size of the European secured loan market to €387bn – an over 20% increase from 2020 (see exhibits 1a and 1b).

*US dollar and euro hedged returns respectively, Credit Suisse, as at 31 December 2021

Source: Credit Suisse, S&P LCD, Janus Henderson Investors, at 31 December 2021

Source: Credit Suisse, Janus Henderson Investors, at 31 December 2021

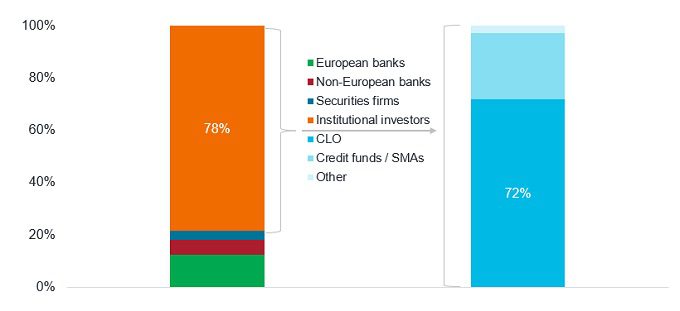

Despite record levels of supply coming into the market, the supply/demand dynamic remained in balance with strong investor demand for loans. 2021 saw record levels of European collateralised loan obligation (CLO) issuance, totalling €36.5bn. CLOs provide a significant level of stability to the loan markets given their structure delivers locked‑up capital (to invest in loans), while as an investor class they constitute more than 50% of the loan market in Europe.

Exhibit 2: CLOs are the biggest investors in leveraged loans

Source: Morgan Stanley Research, S&P LCD, Janus Henderson Investors, at 31 December 2021

Secured loan returns have been very stable so far in January, despite concerns around rate rises and reducing liquidity from central banks which has impacted other fixed income and equity markets. Through to 14 January, the US loan market has already returned 0.49% and European loans delivered 0.40% (both hedged to euro – source Credit Suisse).

First, we are entering a period where short‑term rates are rising (in the US and UK), something which will be beneficial for floating rate assets like loans as it will drive higher overall returns.

Second, we are in a period where default rates sit at close to historical lows reflecting the cheap liquidity provided by central banks since the start of the pandemic, which should mean that market losses from defaults will be minimal.

Source: Credit Suisse, Janus Henderson Investors, at 30 November 2021

Third, loan spreads remain attractive relative to other asset classes and historically so, with spreads on new single B rated issuers typically sitting in the +375 – 400 basis point range.

And finally, CLO issuance is forecast to remain exceptionally strong through 2022 providing a buoyant technical backdrop for the loan market in both the US and euro.

For all of the above reasons, we view secured loans as one of the more attractive credit asset classes, which while not completely immune to wider credit market weakness, their floating rate nature should reduce the impact of likely increasing rates volatility.