Subscribe

Sign up for timely perspectives delivered to your inbox.

We could not put it more succinctly than Satya Nadella, the CEO of Microsoft who said “the case for digital transformation has never been more urgent or clearer. Digital technology is a deflationary force in an inflationary economy”. While the rapid acceleration in technology adoption in 2020 was forced through by the pandemic, the ongoing digital shift is now being driven by an intensified need for enhanced productivity, affordability, and sustainability, an increasing focus for both investors and companies globally.

The technology sector faced unprecedented supply chain headwinds in 2021. Disruption and component shortages began with US-China trade tensions and were subsequently exacerbated by fire and other natural disasters, and supplemented by pandemic-related shutdowns in manufacturing-focused regions such as Southeast Asia. In 2022, we expect to see a sporadic restarting of real-world experiences leading to a period of normalisation for both supply and demand. However, the technology sector is now so diverse that generalisations are inappropriate. The supply chain dynamics for electric vehicles are very different to that of networking infrastructure. The timing and pace at which companies have been impacted by the pandemic, both positively and negatively, vary widely and hence growth comparisons through 2022 are difficult to estimate and are a source of heightened market volatility [market movements], which can often create opportunities for long-term investors in the tech sector.

There were sharp regional divergences in market volatility in 2021. In China we saw regulators take decisive action to curb the powers of large Chinese internet companies, following Europe’s footsteps in areas such as data privacy. We believe the most significant of these steps is largely behind us and have a more constructive view of the regulatory backdrop in China from here on. We expect that ongoing regulatory oversight and intervention will be a constant across all regions; a reflection of the need to control the effects of disruption caused by the exponential rate of innovation and rapid formation of network effects in the tech sector. Additionally, we believe that responsible disruption can also be influenced through pro-active engagement by investors, by urging companies to improve the transparency and disclosure of their environmental and social impact.

We have noted previously that technology adoption is being driven at an increasingly rapid pace by the convergence of many long-term secular growth themes. Strong growth in ecommerce and digital democratisation is driving higher payment digitisation levels, requiring better infrastructure and improved productivity, for example. The ultimate manifestation of this convergence is Internet 3.0 or the ‘metaverse’ – a virtualised digital world parallel, but also interacting with, the physical world, with secure living and working experiences. While we are wary of the short-term hype around this, longer term we view it as a shift towards the digitisation of everything, creating an even broader set of opportunities for tech investors. Millennials and Generation Z are the early adopters, and while the initial focus may be on tools to enhance the experience of the metaverse – the proliferation of new wearable technologies and the internet of things will increase the use cases – the ability to create a quicker and more transparent transfer of assets and their ownership, which will be very disruptive. The emerging use of blockchains, digital twins and digital identities will drive broader disruption in socialising, entertainment, education, construction and real estate as well as finance. We are already seeing accelerating demand for technologies such as mapping and asset tracking, which manage the interaction of the digital and the real world, enabling omni-channel shopping, and lifecycle management of goods.

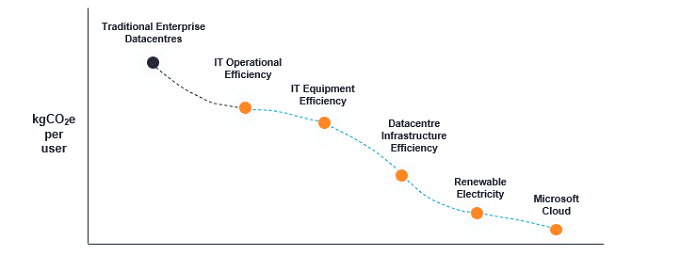

Closely associated with this shift, next generation infrastructure [that enable networks, internet connectivity, management, business operations and communications] remains a key theme within technology, as the accelerated and broadening adoption of technology will require rapidly rising levels of investment to ensure scalable, seamless, fast, and reliable connectivity. Next generation infrastructure should also equate to low-carbon infrastructure, with hyperscale cloud environments having inherently lower power consumption, and increasingly powered by renewable energy. Alphabet looks on course to become the first 24/7 carbon-free company by 2030. Microsoft is on a similar trajectory and both companies are providing their cloud customers with more effective means to measure their own carbon emissions. Achieving targets for carbon reduction will serve as another reason for migration to the public cloud where we expect spending may accelerate significantly in 2022.

Electrification is another key theme for 2022, with transportation at an inflection point. Ride hailing and electric vehicles (EVs) are addressing the issue of combustion engine cars typically spending 95% of their time idle, and creating emissions in the remainder of that time. EV adoption is also ramping up. While the auto manufacturing space for EVs is rapidly becoming more crowded with new entrants and incumbents transitioning, at the same time we are also seeing consolidation and market share gains for the supply chain. Companies that are enabling EV affordability, through innovation and are driving down the costs of connectors, processors, power management, safety systems, wiring and software are likely to offer attractive investment opportunities.

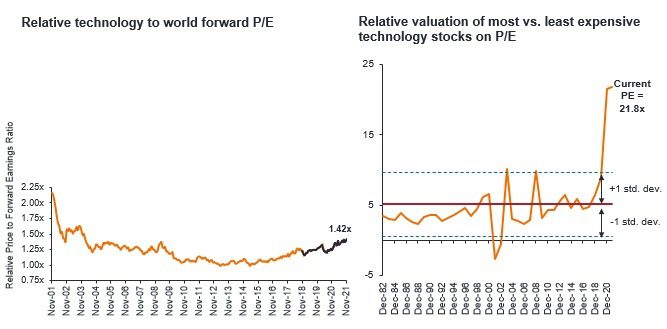

While our positivity on the long-term outlook for the tech sector is evident, we recognise that a combination of low interest rates, retail enthusiasm, and pandemic conditions has resulted in a rapid acceleration in valuations in certain segments of the sector. In line with the Microsoft CEO’s comments, and our investment experience over the last two decades, technology adoption is a deflationary force. Therefore, we believe the risks of rising interest rates warrant less focus than the potential for irrational enthusiasm, as embodied in the technology hype cycle. The chart on the left below shows that the valuation of the tech sector is within its historical range, albeit at the higher end. The chart on the right, however, shows the divergence between the most and least expensive stocks in the sector. This bifurcation in valuations within the sector is extreme by historical standards and reflects in part the increasing diversity in terms of companies, sectors and the associated returns within the sector, but also warrants caution and highlights the need for experience in stock selection.

Our team remains focused on aiming to identify the global technology leaders of the future. In our opinion, taking a long-term investment view, focusing on high quality technology companies with strong cash flows and financial strength, the potential for sustainable growth and adopting a strong valuation discipline are requisites for successful investment in the tech sector.

Technology is the science of solving problems and digital transformation remains in the early stages with multiple challenges to address. Overall, we maintain high conviction and enthusiasm for the growth prospects of the tech sector but our experience also tells us that following the gains of recent years, valuation discipline while unfashionable, remains as important as ever.