Subscribe

Sign up for timely perspectives delivered to your inbox.

After two years of COVID-dominated news flow, the spotlight has moved, with inflation and interest rate hikes likely to take centre stage in the year ahead. The Bank of England’s decision to increase interest rates late last year, albeit to still lower than pre-COVID levels, underlines our view that it is not just investors who are more concerned about persistent inflation than the adverse impact of new COVID strains on developed, and vaccinated, economies. Central bankers are worried too.

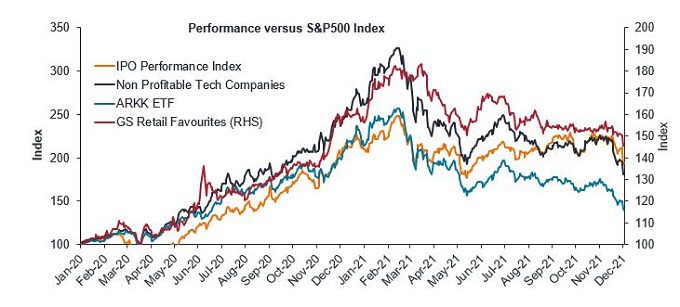

Markets have already started to price in yield curve steepening in line with expectations for higher inflation and economic growth. Figure 1 shows the ‘darlings of the quantitative easing trade’ such as technology stocks have started underperforming. Unlike the unprecedented global pandemic, there is a well-precedented playbook that comes with a rates cycle; sell your tech and consumer staples and buy banks, miners and cheap cyclical stocks. Will interest rate rises prove to be the catalyst for a snap back of that oh-so-stretched elastic between value and growth stocks? Will this force investors to turn away from the tech-heavy indices in the US and return to the UK market? The UK market with its materially higher benchmark weightings to commodities and financials versus other global equity indices, provides investors with a fertile hunting ground for those looking to benefit from potential opportunities arising from higher interest rates.

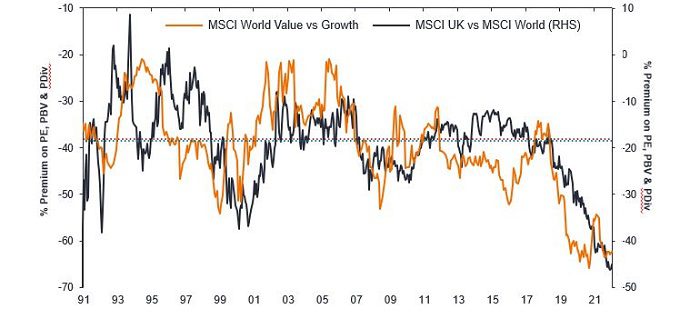

Figure 2 illustrates the very high correlation between the performance of the UK market relative to global equity markets and the performance of value versus growth stocks globally. If value becomes the ‘plat du jour’ in 2022, a painful rotation could be in store for investors as, much like the UK equity market, ‘value’ stocks have never been more out of favour. We have seen some actively managed funds with a value mandate fall dramatically since the Global Financial Crisis (and the start of quantitative easing).

Once investors reach the shores of the UK equity market, they will find not just the behemoths of traditional value investing, but also some multinationals currently trading at significant discounts to international peers (courtesy of Brexit). Beaten-up UK domestic retail, travel and leisure stocks look primed for earnings recovery, trading at a ‘double discount’ (courtesy of Brexit and COVID). Potentially manna from heaven for investors searching for both value and growth.

Negative headlines around Brexit negotiations, the Irish protocol in particular, a government running low on goodwill with the public and impending tax rate rises continue to dampen sentiment towards the UK market. This, coupled with some very muted earnings forecasts for the year ahead, which look incongruous given the above-trend UK GDP growth forecast for 2022, suggest that the ‘spring is coiled’ and that after years of underperformance the UK equity market could well be ready to shine again. If not now, when?

Cyclical stocks: companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by the ups and downs in the overall economy, when compared to non-cyclical companies.