Subscribe

Sign up for timely perspectives delivered to your inbox.

Given the uneven nature of the global economic reopening, central banks will likely deploy a range of policy prescriptions over the next year. Portfolio Managers Dan Siluk and Jason England argue that some of these policies may miss the mark, which could have a negative impact on bond markets.

Monetary policy should be the driving force in bond markets in 2022 as officials seek to balance economic growth and inflation concerns. Unlike earlier recoveries – or even the onset of the pandemic -very little about what countries are presently experiencing can be described as synchronous. These dislocations may result in a range of policy responses as central bankers prioritise domestic concerns. With global trade still hampered by supply constraints and labour markets tight – especially in countries reliant upon foreign workers – many central banks have begun reining in extraordinary measures faster than anticipated. While we believe the Federal Reserve (Fed) has been prudent in its approach, others think it’s already fallen behind the curve. There is no playbook that accounts for all these factors and, consequently, we believe that the world is now at peak monetary policy uncertainty.

Policy error is not only a possibility but, given the breadth of scenarios unfolding, it’s likely just a matter of time before a central bank misjudges what conditions merit. Policy makers must thread the needle between the duelling priorities of economic growth and managing inflation. Supply bottlenecks, tight labour markets and high demand have already resulted in estimates about the level and duration of inflation being off the mark. Layer on the risk posed by virus variants weighing on economic growth and experts have plenty to get wrong. If a central bank tightens too quickly, it has injected yet another impediment to growth during a still delicate time for the global economy. Once rate hikes have commenced, reversing course would be difficult and would dent central bank credibility. On the other hand, if central banks stand pat too long, the dangerous psychology of accelerating inflation may take root, thus leading to a self-fulfilling prophecy. This scenario would likely lead to the type of aggressive hikes that would certainly have a negative impact on growth.

The upcoming year is shaping up to be one where relative value trades are likely to be attractive sources of excess returns. By relative value, we mean geographically, along the yield curve and among credit profiles. The disparate nature of the economic recovery and divergent policy responses mean that, at any given time, countries are likely to be in different places on the policy spectrum. Nations that were quick to react to inflation could offer attractive yields on shorter-dated bonds compared to those that have yet to raise rates. Within countries, an unsettled inflationary picture means that some yield curves are apt to steepen while others could flatten either via higher policy rates pushing up the front end or lower growth and cooling inflation sending longer-dated rates lower. With respect to corporate issuers, an uneven global reopening would probably lead to variances in the economic cycle, resulting in relative value opportunities among issuers of different ratings in a particular country or those of similar ratings across jurisdictions.

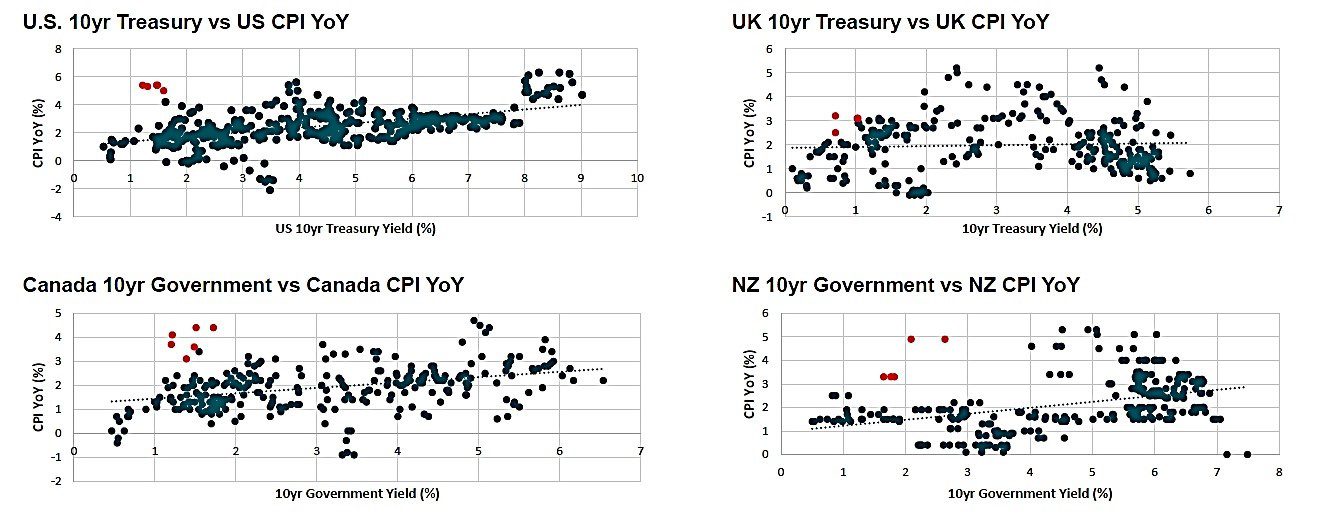

The degree to which monetary policy appears mismatched to economic conditions is best illustrated by the breakdown in the relationship between inflation and interest rates. Granted, an extraordinary policy response to the pandemic was merited, but the return of inflation has seemingly caught central banks out of position. With the path of the global economy still unsettled in the wake of an ongoing health crisis, officials cannot simply right this distorted relationship with the wave of a hand. Still, it bears watching over the next year how central banks can put policy on a path that is better suited to the current state of the global economy.

Source: Bloomberg, as of 30 November 2021.

We hope we are much closer to the end of this public health saga than the beginning. Aside from the diminishing health risk, we think the global economy can start moving toward a more synchronous, self-reinforcing recovery. With that likely comes higher rates. Despite the conventional wisdom, we believe this would not necessarily be an unwelcome development for bond investors. The key is the pace at which rates increase. If gradual, higher rates could offer more attractive yields relative to the recent past and, for investors in shorter- to mid-dated bonds, a more favourable risk/return profile than that of longer dated maturities – a consideration that should not be overlooked with inflation still rumbling. Furthermore, higher rates could result in the return of a bond allocation’s ability to provide diversification to riskier assets, something that has been lacking for much of the past several quarters.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.