Subscribe

Sign up for timely perspectives delivered to your inbox.

Is the risk of a policy misstep the biggest problem for markets? Portfolio Manager, Luke Newman, considers the prospects for absolute return, as governments and central banks signal an end to the monetary and fiscal generosity that has characterised the pandemic era.

The nature of absolute return, objectively aiming to deliver a consistent, stable positive return over time, relies on the ability to be flexible. None of us know what is coming round the corner. None of us know where the next pandemic or political crisis is going to come from, or when it might appear. Having the flexibility to position for market uncertainty, helping to mitigate some of the downside risk, while also having the capacity to take advantage of any perceived upside potential, is absolutely crucial.

Investors’ experience in 2021 is a case in point. Markets were plagued by uncertainties in the last quarter of 2020. Who would be the next president of the United States? How effective were the vaccines? Would there be a no-deal Brexit? The answers boosted sentiment, helping to fuel record stock market valuations. However, coupled with the monetary and fiscal generosity that has characterised the pandemic – and which may have potentially overstimulated economies – we may have seen the foundations being laid for higher market volatility in 2022.

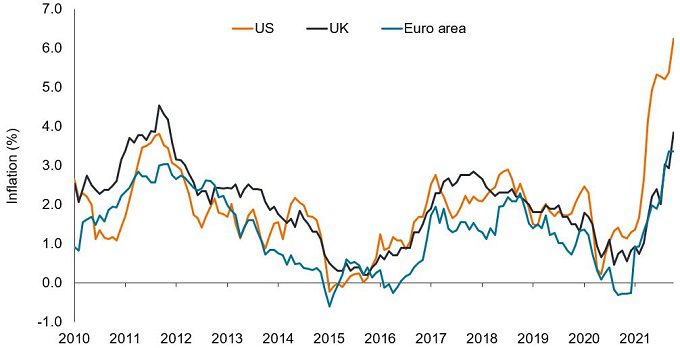

The inflation debate has characterised 2021, both in terms of its severity and how central banks might respond. Markets have already priced in higher rates, but there is a risk of policy error from central banks, as they strive to find a route back to normality. With inflation reported on a delayed basis, any rise in interest rates to combat evidence of inflation could do more harm than good, should lagged data coincide with a real-time fall in inflation.

Source: Refinitiv Datastream, Janus Henderson Investors, 1 January 2010 to 15 October 2021. Inflation measured by the Consumer Price Index (CPI) for the US, UK and Euro Area.

The possibility of higher borrowing costs casts a shadow over one of the most powerful drivers of recent US equity market performance: technology. Without the lockdowns that fueled a digital transformation and saw earnings potential skyrocket, smaller Nasdaq names might no longer be as enticing as the likes of Amazon and Microsoft, which continue to prove their value.

We have also seen markets occasionally switch to risk-off mode in response to specific news flow, be that central banks signaling their determination to taper asset purchases, supply issues within the energy sector, transport and logistics problems, or fears of contagion from Chinese property company Evergrande. More recently, market confidence has been rattled by the latest mutated strain of COVID, ‘Omicron’, which has renewed concerns about prospects for the global economy, as well as more personal fears over the effectiveness of existing vaccines.

These factors have added a hint of caution to our take on markets. Overall, those companies that have proven to take market share and/or offset higher costs could continue to be rewarded, in share price terms. But equity markets are demonstrating little patience for any disappointment, which could continue to provide a fertile hunting ground on the short side.

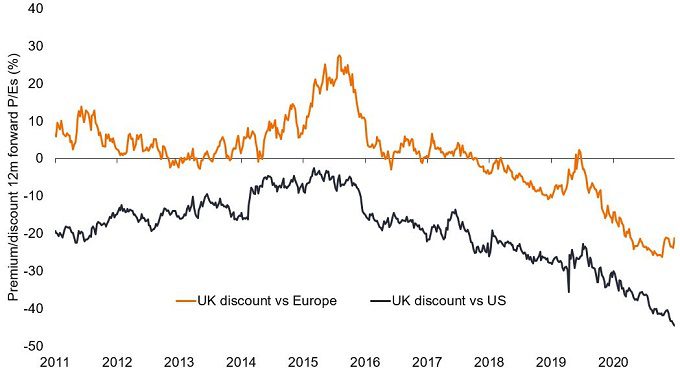

One area we would highlight is the UK market, where a combination of low valuations, pandemic uncertainty and the hangover of Brexit has seen the relative discount on UK equities stretch to multi-decade highs. However, while a fully fledged services agreement between the UK and European Union (EU) seems some time away, the last-minute Brexit agreement in late 2020 dramatically shifted market perception. With the risks of a ‘worse-than-feared outcome’ seemingly averted, it awakened a flood of merger and acquisition (M&A) activity, primarily from the US. But public markets often lag, and this combination of low valuations and broader uncertainties (global supply chain issues, inflationary fears, etc.), has left us with the view that many UK equities remain fundamentally mispriced – exhibit 2.

Source: Janus Henderson Investors, Bloomberg, 2 December 2011 to 26 November 2012. This compares the FTSE 100 Index with the S&P500 Index and the Euro Stoxx 50 Index, showing the relative discount for 12-month forward blended price/earnings (P/E) ratios as a percentage. This is a commonly used indicator of relative value between two different markets. Forward P/E is based on a prediction of future earnings over the relevant time period (in this case, 12 months). Past performance is not a guide to future performance.

It is our view that the flexibility of absolute return could be a useful tool to help investors navigate central bank policy movements and the changing tide of market sentiment. We remain cautious to central bank missteps and the market’s anticipation of less accommodative monetary policy. Lagged inflation reporting means that the path ahead remains obscured, especially since Omicron has reminded us that the pandemic still rages, raising questions about a recovery which hinges on vaccine effectiveness. We believe the UK market remains under-priced, relative to other markets, such as the US and Europe, and observe the current hype of acquisition activity. But an environment of uncertainty persists, one with plenty of opportunities to be active on both the long and short side.

Absolute return: The total return of a portfolio, as opposed to its relative return against a benchmark. It is measured as a gain or loss, in absolute terms, and is commonly stated as a percentage of a portfolio’s total value.

Downside risk: An estimation of how much a security or portfolio may lose if the market moves against it.

Monetary / fiscal generosity: Monetary policy is that which relates to policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Fiscal policy relates to governments, and the setting of tax rates and spending levels.

Inflation: The rate at which the prices of goods and services are rising in an economy. The consumer price index (CPI) and retail price index (RPI) are two common measures.

Bond yield: The level of income on a security, typically expressed as a percentage rate. Higher bond yields mean lower bond prices and vice versa.

Taper asset purchases: Central banks have helped to stimulate the economy via a significant and sustained programme of asset purchases, including bond purchases (quantitative easing).

Short side (short selling): ‘Shorting’ is a strategy where investment managers borrow and then sell an asset they believe is overvalued, with the intention of buying it back from less when the price falls.

Market discount: The ‘premium/discount’ is a term used to describe the relative value of two or more comparable factors, such as stock markets. Here, we use the P/E ratio, which calculates the price of stocks divided by their predicted earnings over the following 12 months. At the time of writing, the P/E ratio for UK stocks is much lower than for the US and Europe, suggesting that the UK is relatively inexpensive compared to these markets.