Subscribe

Sign up for timely perspectives delivered to your inbox.

Andrew Gillan, Head of Asia ex Japan Equities, provides a recap of 2021, discusses the key issues for investors, as well as the sectors with the strongest growth potential.

Looking into 2022, there is a real prospect of more accommodative monetary policy in Asia’s largest market, China, which looks interesting in the context of the region given expectations of tapering and tightening elsewhere in the world. The People’s Bank of China (PBOC) cut the reserve requirement ratio for banks in July this year then again in early December to stimulate growth and it is reasonable to expect more supportive policy given softer economic data in the second half of 2021.

Asia’s recovery from the pandemic has been more prolonged and later than Western economies for a variety of reasons. Firstly, vaccination rates have been much lower, especially for the more emerging markets within the region. Government policies have also generally been more conservative, resulting in more significant shutdowns of normal economic activity and greater border restrictions. As we move into 2022 this is gradually changing. We are seeing market expectations for strong economic recoveries from countries like India, and those in Southeast Asia such as Indonesia, Thailand and Vietnam, although the emergence of new COVID-19 variants could still thwart this.

After a very strong 2020 when China’s internet, e-commerce and other new economy sectors were relative winners from the Covid-19 shock, many of these sectors underperformed in 2021 due to significant changes in regulatory policy. This began with the decision to cancel the much-anticipated listing of Ant Financial in late 2020, but then escalated to impact sectors including education, e-commerce and internet gaming. The decision to ban private sector companies from profiting from after-school education began a period of underperformance for Chinese equities relative to the rest of the region. Government policy more recently has focused on reducing debt in the property sector and there has been an increase in bond defaults, which so far has been relatively contained but there remain concerns over Evergrande, one of China’s largest property developers, with a significant amount of outstanding debt due.

Our expectations are for regulatory policy to ease in China as the government’s focus turns back to the health of the economy. But the investment environment has changed with the government’s common prosperity programme, which is likely to have an impact on stock valuations going forward. Within the China universe, domestic A shares [those listed in mainland China] continue to provide investors with access to sectors that have been typically less impacted by regulatory policy action and offer the potential for strong structural growth.

Inflationary pressures in Asia have been relatively less pronounced this year. This is mainly due to reduced economic stimulus in 2020; hence demand has recovered slower while Asian economies have also reopened more cautiously. Also noteworthy is that the region has a lower reliance on the global supply chain attributed to localised and regional production. Rising energy and commodity prices have impacted inflation but so far, Asian central banks have not been pressured to increase interest rates significantly. Despite relative US dollar strength during the pandemic, Asian currencies have not weakened significantly and fiscal positions [government revenue versus spending] are generally stronger than a decade ago.

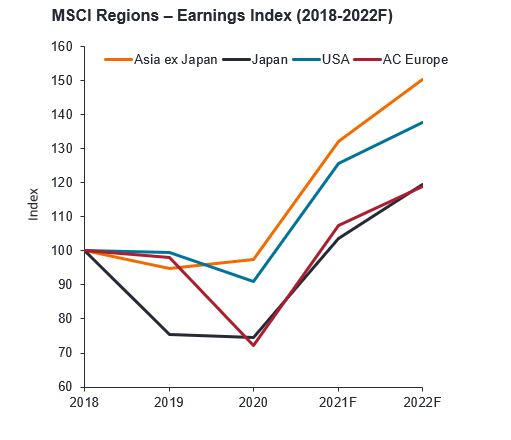

Following a period of depressed earnings in 2020, Asia experienced a very strong earnings recovery this year but expectations for 2022 are currently more muted, with only a single-digit percentage increase. For Asia and emerging markets more broadly to reverse their decade of relative underperformance compared with developed markets, and in particular US equities, there will need to be a return to consistent double-digit earnings growth. This could still be achievable in 2022 if some inflationary pressures subside. It is interesting to note that current market consensus earnings expectations are at least fairly cautious. Cyclical sectors, those that are more sensitive to business conditions such as financials, energy and materials, have enjoyed better earnings growth in 2021.

The region continues to provide crucial technology and manufacturing to the rest of the world in areas such as semiconductors and memory production. Many Asian companies continue to benefit from increasing global e-commerce penetration and digitalisation, hence the likelihood of significant opportunities for businesses that are both suppliers and enablers of these secular trends, but also those that have direct access to consumers within Asia in e-commerce, gaming and other high-growth sectors. Meanwhile, in markets such as India and Indonesia, structural growth opportunities appear more plentiful in the more traditional sectors such as financials, where banking products and services penetration remains low but there is large growth potential.

Valuations in Asian stocks currently look low compared to developed markets. While earnings growth seems likely be more subdued in 2022, we remain optimistic about the prospects for a reversal in the decade-long structural relative underperformance of Asia and emerging market equities. Overall, we think economic growth rates will normalise but remain attractive in Asia, while the overarching supportive demographics and strong consumption story will remain as key reasons to continue investing in Asian equities for many years to come.