Subscribe

Sign up for timely perspectives delivered to your inbox.

James Briggs, Corporate Credit Portfolio Manager, considers the winds of change affecting the balance of risk and opportunity in investment grade in 2022.

As we look to the green shoots of policy normalisation emerging in 2022, it is worth considering the various seeds sown to form the credit cycle, namely economic growth, credit fundamentals and valuations. Given the gradual reduction of asset purchases, we believe there are no near-term cyclical shocks to suggest going short the market. Ongoing financial repression should continue to place downward pressure on yields, and prevent yields rising beyond an acceptable level. Meanwhile real yields – either low or negative – are a strong medium-term predictor of defaults and indicate easy credit conditions. Credit fundamentals continue to be positive with default rates expected to be low and interest coverage ratios forecasted to improve further as we reach year end, potentially to the best levels seen in recent history. This benign credit environment has been priced into markets, which means that despite being mid-cycle on a fundamental basis, valuations are late cycle. While adding beta – or sensitivity to the market direction – to portfolios worked in the early emergence from the crisis, such a strategy is likely to have less relevance in 2022 as central bank policy becomes less of a tailwind.

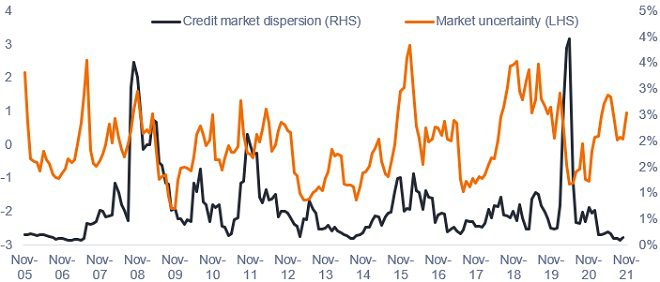

Central banks largely remain accommodative and while it isn’t in their interest to brew a storm, the taps of central bank buying have undoubtedly buoyed the technical environment for credit. When the flow slows, even if it ebbs, this spells the potential for volatility spikes. This risk is epitomised in the two extremes of high market uncertainty against low dispersion in credit markets. The susceptibility of markets amid heightened concern is highlighted in the rapid growth of the size of the market while duration (or interest rate sensitivity) has also jumped as yields have fallen and maturities have been extended. This means that there is much more interest rate risk than there was 15 years ago. Despite this uncertainty, some measures of credit market dispersion have reached lows, as the chart below shows one metric falling to a new record low not seen in 15 years. This means going into 2022, the progression of the economic cycle risks taking the wind out of the broader market’s sails.

![]()

![]()

![]()

Source: BofA Global Research, ICE, 1 November 2021. Market uncertainty tracks the average of the 250-day z-scores (which measure financial variability) of euro rates volatility, oil volatility, and BTP (Italian govt bonds) versus Bunds (German govt bonds) 10-year yield spread. Credit market dispersion is measured by the standard deviation of monthly excess returns across 16 sectors of the IG credit market based on a rolling three-month window.

With credit spreads already near lows in investment grade, we believe pockets of volatility are likely to emerge and returns dispersion is likely to increase. Spread widening in areas of the market is therefore likely to create buying opportunities. Performing careful due diligence on credit will be key in 2022 given the turn towards tightening in financial conditions and as the market is likely to re-focus on the quality of individual names. We believe that upgrading the quality of an investment grade portfolio relies less on a laser-focus on credit ratings, and more on identifying the improving trajectory of individual issuers. One example is bonds in the rising star BB space, which, although forming part of high yield, many are migrating the quality of their business up to investment grade status. Markets have reacted positively to such rating upgrades, suggesting perhaps that not all the good news is baked in. Investors are better placed, in our view, on looking to the catalyst for this transition to be tied to a transformation of fundamentals rather than the cycle. Deep cyclical credit has recovered to narrower spreads than seen prior to the pandemic and such compressed levels create risks if there is a change in the outlook.

One of the risks with the monetary taps being turned off in 2022 and beyond is the potential for the erosion of liquidity. The depth of the investment grade market – and the ability therefore to select credits with features that enable them to be more liquid – will be helpful to maintaining liquidity in portfolios. In certain areas of the market, such as some corporate hybrids and subordinated bonds, investors are not being paid for the optionality – or the potential for different investment outcomes – inherent in these structures. This is not to say that a sector can be labelled as homogenous, but the individual features of credit become ever more important given the waves of uncertainty that could buffet market sentiment in 2022. While sector rotation will play its part in the quest for alpha, issue rotation through careful credit selection will be warranted in an uncertain and diverse world.

Credit spread/spread: The difference in yield between securities with similar maturity but different credit quality: e.g., the difference in yield between a high yield corporate bond and a government bond of the same maturity. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers and narrowing indicates improving creditworthiness.

Cyclical: This refers to the economic cycle. Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

Investment grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high yield bonds.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility.

Financial repression: in simple terms, using regulations and policies to force down interest rates below the rate of inflation; also known as a stealth tax that rewards debtors but punishes savers.

High yield bond: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Short position: Fund managers use this technique to borrow then sell what they believe are overvalued assets, with the intention of buying them back for less when the price falls. The position profits if the security falls in value. Within UCITS funds, derivatives can be used to simulate a short position.