Subscribe

Sign up for timely perspectives delivered to your inbox.

Ainslie McLennan, Co-Manager of the Janus Henderson UK Property PAIF, outlines key themes, opportunities and risks expected within the asset class in 2022 and beyond.

Embedded structural changes in the market, such as long-term trends influenced by demographics and technology, as well as environmental, social and governance (ESG) considerations, are increasingly shaping thinking within the asset class. Economic factors tied to inflation, ongoing Brexit and Covid related legacies, as well as navigating evolving business and consumer habits are also likely to be major factors in 2022.

Asset management activity will remain a key opportunity to add value. This can include refurbishment work to improve valuations and attract a better quality of tenant, changing the planning use of assets to increase rental revenue, or renegotiating existing leases to extend tenancies.

Looking at the market more broadly, the definitions of core – retail, industrial and offices – and alternative real estate sectors have been rewritten in recent years given the evolution of the asset class. The longevity of once deemed ’emergency’ record low interest rates has led to growing deployment of capital and resources in the more defensive, income-resilient property sectors, and those that are benefiting from favourable long-term social and economic trends, such as the rise of online shopping. The expansion of relatively new and emerging sub-sectors, such as residential, healthcare, data storage and logistics continues to reshape diversified property portfolios. Within this evolution is a desire for key stakeholders to embrace net zero carbon emission commitments and benefit from environmental and social initiatives over time.

A broader pick-up in property investment activity is unlikely until the economy is on a firmer footing. This is unlikely to lead to a uniform upturn in real estate performance given expectations for more of a divergent K-shaped recovery, with some sectors growing as others lag. As such, selectivity remains key.

How the UK’s financial services navigate post-Brexit regulations will be particularly important for the office sector. Combined with the legacy of the pandemic, the outlook for the office sector does appear challenging near term. With the exception of a potential rebound in retail warehouses, helped by the size and the spacing of the stores, retail remains out of favour. This is in stark contrast to industrials, notably logistics, where capital investment is abundant, availability is limited, and land prices are soaring. Supermarkets and selective assets within the alternatives sector are also expected to outperform.

Arguably, the single most under-appreciated market risk is that the legacy impact of the pandemic on consumer and business behaviour is still largely unknown and remains hotly debated. For instance, the impact of an established working-from-home culture has material impacts on the location, design, and business model across all real estate asset classes. Understanding your tenant base and the effectiveness of property asset management have never been more important. More broadly, businesses will need to continue to review production and supply chains to minimise future disruption risk.

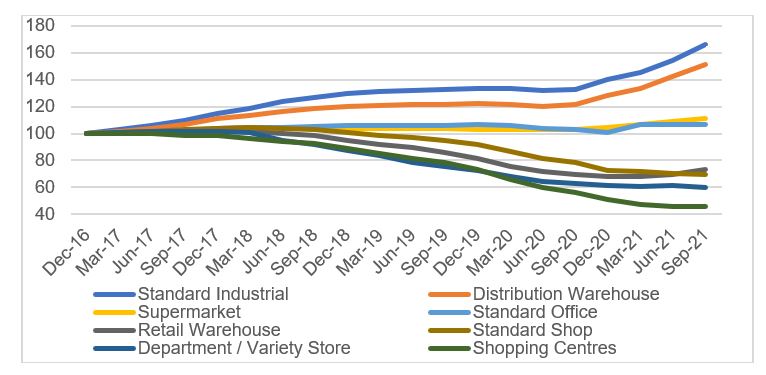

The contrast in performance seen across different forms of UK commercial property has never been so stark. Since 2016, capital values across the industrial sector have risen by approximately 50% on average, while shopping centres have seen a 50% decline. Near-term divergence is likely to remain, which highlights the importance of understanding the trends and risks within the market.

The UK commercial property asset class contains a huge variety of property types across many sectors providing selective opportunities for income investors. Having a tenant base which is strong enough to withstand further economic difficulties and provides a regular income stream – often with rent uplifts that are fixed or linked to inflation – will be what keeps UK commercial property in the frame as a diversifier for multi-asset portfolios.

We await further feedback/consultation from the FCA on the subject of managing the liquidity mismatch arising in authorised open-ended property funds.