Subscribe

Sign up for timely perspectives delivered to your inbox.

Not all healthcare stocks participated equally in the sector’s gains in 2021. Portfolio Manager Andy Acker explains why the trade could shift in the new year and where he sees value.

At the outset of 2021, the health care sector was riding high on the success of COVID-19 vaccines and the potential for rebounding demand. But the high did not last long. In January, the commissioner of the U.S. Food and Drug Administration (FDA) stepped down, leaving the agency leaderless at a time when COVID-19 drug applications were ramping up. Then, lawmakers floated comprehensive drug-pricing reform as a way to fund stimulus bills. The Federal Trade Commission began scrutinizing mergers and acquisitions (M&A), and the Delta variant emerged, casting doubt on economic re-openings.

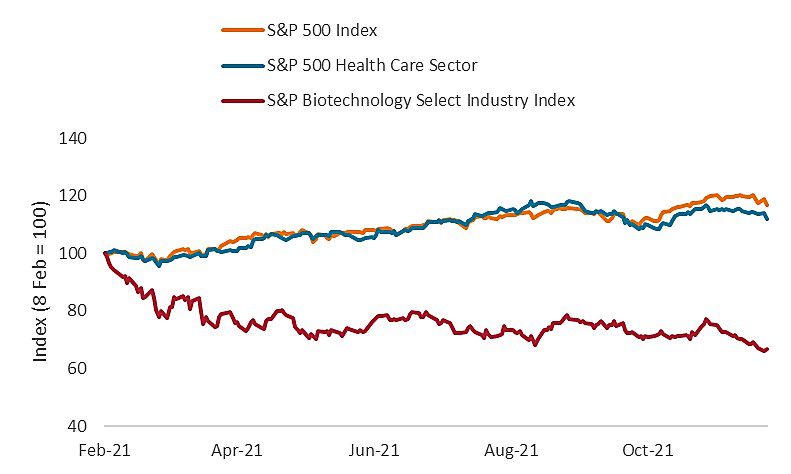

Even so, the health care sector delivered double-digit gains in 2021, following the strong performance of equity markets (as of 30 November).1 But the returns have not been broadly distributed. Small- and mid-cap biotech stocks endured their worst period of underperformance relative to the S&P 500® Index on record. Shares of some med-tech companies lagged as COVID cases climbed. Meanwhile, firms that developed COVID vaccines or benefited in other ways from the pandemic saw their stock prices soar – despite uncertainty about the sustainability of COVID-based revenues.

We take the view that this dynamic is unlikely to persist in 2022. As vaccination rates continue to increase and some regulatory/political overhangs work themselves out, we think areas of the sector that were overlooked in 2021 could be primed for a recovery in the year ahead, creating opportunities for investors.

Medical device companies develop and manufacture the tools and products used in medical procedures and routine care, such as robotics, transcatheter valves and insulin pumps. Despite turning a corner in the first half of 2021, the industry’s recovery hit a speed bump as the Delta variant led patients and providers to once again delay procedures. But we believe most of this demand is deferred, not lost. We also think a sizable backlog for med-tech products exists, as evidenced by a jump in sales during the second quarter of 2021 (pre-Delta).2 Furthermore, after nearly two years of the pandemic, hospitals are financially incentivized to bring back profitable procedures. Providers, for example, are increasingly shifting services to outpatient settings where COVID cases do not dominate resources (or scare off patients).

At the same time, some medical devices that could revolutionize the standard of care for large patient populations are coming to market in 2022. Among the most exciting is the first tubeless, wearable insulin delivery system that continuously adjusts insulin levels for diabetics based on glucose levels and trends. This follows other notable launches, such as a contact lens that slows the progression of myopia (nearsightedness) in children and surgical robots that expand the scope of minimally invasive surgeries, all of which are creating new sources of growth.

Without a doubt, small- and mid-cap biotechnology stocks experienced the largest divergence in performance in 2021 and were probably the most affected by regulatory/political and COVID overhangs. From early February through nearly the end of November, the S&P Biotechnology Select Industry Index declined by 33.8% and underperformed both the S&P 500 and the S&P 500 Health Care Sector by the widest margins ever (Figures 1 and 2).

Source: Bloomberg, data from 8 February 2021 to 29 November 2021.

Indices rebased to 100 as of 8 February 2021. The S&P 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 Health Care Sector comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector. The S&P Biotechnology Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS biotechnology sub-industry.

A number of trends combined to prompt the sell-off, including rapid advances in drug development, which raised questions about clinical trial designs during a period when regulators were ill-equipped to provide clear guidance. As a result, abrupt changes to regulatory policy occurred regularly in 2021, leading some companies’ development programs to fall short of revised standards – punishing stocks.

We expect more clarity soon: In November, the Biden administration nominated Robert Califf for FDA commissioner. Dr. Califf was commissioner during the final year of the Obama administration and is an expert on clinical trials. If confirmed, we believe he will establish more consistent policy for biopharma companies now seeking drug approvals.

Worries about drug pricing reform in the U.S. could also subside. The latest proposal put forth by the House of Representatives limits direct drug price negotiation by the government to 10 to 20 drugs late in their patent cycles, with price changes not taking effect until between 2025 and 2028.3 Pharmaceutical companies would be expected to share other costs, but a cap on out-of-pocket spending by seniors could improve access and affordability and, therefore, compliance with medications. Details have yet to be decided, but for now, the worst-case scenario of more comprehensive reform appears to be off the table.

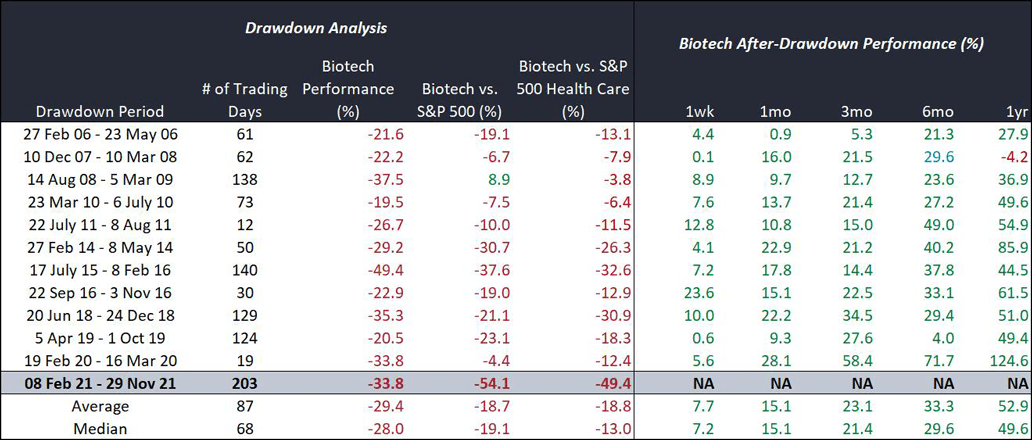

We believe this backdrop could eventually help small- and mid-cap biotech stocks begin to recover. Already, compressed valuations have rekindled M&A activity, with several multibillion-dollar deals announced in the second half of 2021. In addition, historically, the S&P Biotech Select Index has staged sizable rebounds following a pullback of 20% or more. In fact, since the benchmark’s inception in 2006, the average one-year gain from the trough of a drawdown was more than 50%.

![]()

Source: Bloomberg. Past performance cannot guarantee future results. Biotech performance is for S&P Biotechnology Select Industry Index. Index launch date was 27 January 2006. NA = Not applicable.

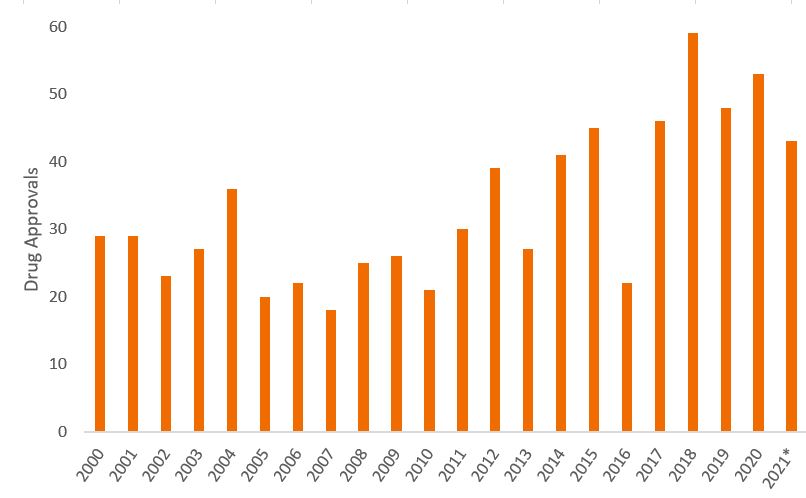

Remarkably, despite the year’s challenges, the FDA is on track to approve a near record number of novel drugs in 2021 (Figure 3), indicating that innovation within the sector remains robust. Indeed, over the past year, we saw the first positive clinical trial data for in vivo gene editing therapies, which aim to cure a genetic defect with a single injection. In addition, improved technologies for drug design are creating the ability to address gene mutations that are common drivers of cancer, while progress continues to be made in small molecule protein degraders that go after traditionally “undruggable” targets. We believe many of these therapies, which focus on unmet medical needs and could have multiple applications, could have long runways of growth.

Even without a permanent commissioner, the FDA has approved 46 novel drugs so far in 2021, with more applications pending before year-end.

Source: US Food and Drug Administration. *data as of 29 November 2021.

To be sure, the health care sector will face new sources of volatility in 2022, including the threat of higher inflation, which could diminish profit margins; ongoing worries about COVID-19 and the potential for rising interest rates, which could make long-duration assets such as biotech stocks less appealing. But we’d argue that as the calendar changes over, the era of pandemic-driven returns could start to come to an end, and investors would be wise to remember what tends to be the biggest driver of long-term performance for health care: innovation.

1 Bloomberg, data for the S&P 500 Health Care Sector.

2 Q2 company earnings reports.

3 Whitehouse.gov, as of 2 November 2021.

4 Centers for Medicare & Medicaid Services, as of 30 September 2021.