Subscribe

Sign up for timely perspectives delivered to your inbox.

Jenna Barnard and John Pattullo believe developed market government bonds have a surprise in store in 2022.

2021 has clearly been a challenging environment for government bonds, as one would expect in the early stages of an economic recovery. There has been much debate on inflation, with strong views on both sides of ‘transitory’ or ‘non‑transitory’. More recently, higher-than-expected inflation has caused many developed world central banks to transform their ‘transitory’ language into more hawkish terms (unusually, the US Federal Reserve is lagging behind the others for now). For us, however, this year’s bond market developments were not a surprise – in our view, it was best to avoid the dogmatic structural views so prevalent on inflation, and instead focus on a regimented cyclical process.

The current narrative of ‘higher rates’ and ‘higher bond yields’, we would argue, is centred around ‘linear thinking’, a simple extrapolation of existing trends or a reflection of long-held industry biases forecasting higher rates of growth and inflation that pays no attention to the rate of change in the variables, which we believe are more reliable indicators of where we are heading.

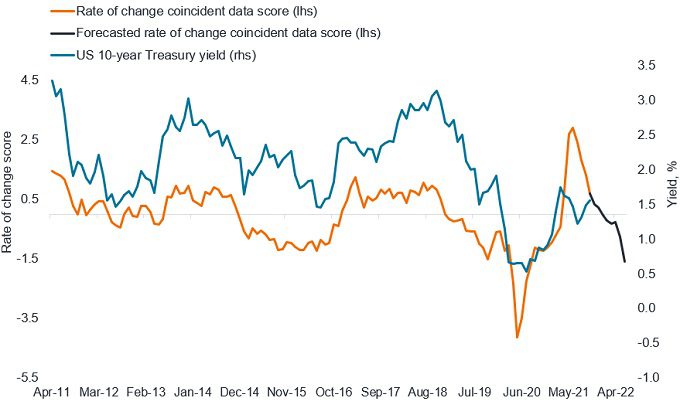

Bond yields, in our view, primarily react to the rate of change in the economic data rather than being driven by the actual ‘level’ of growth, inflation or unemployment. In other words, the direction of the moves in yields (up or down) is driven by accelerations or decelerations in the economy. Alongside the traditional host of indicators that bond investors use to build the picture of regime shifts in the bond markets, looking at the rate of change (accelerations or decelerations) in the economic data could also be beneficial.

It is not unusual to see inflation rise following a recession – and COVID‑19 was a particularly harsh episode, as it came with unprecedented fiscal spending and supply constraints. These are cyclical effects and do not necessarily imply a breakout in the longer‑term structural trends. Indeed, it will take a few years before the trend rate of inflation emerging from COVID‑19 is resolved. Thinking ahead to 2022, from a year‑on‑year rate of change of economic data perspective, inflation should come down sharply and will likely look transitory next year. This is due to the starting point; for example, given a 6.2% headline inflation in the US (October 2021) – ‘base effects’ would mathematically result in a lower year-on-year figure. This, however, could be deceptive and mask a higher underlying trend rate of inflation. All told, the inflation debate will continue to rumble on.

In many aspects, COVID‑19 has simply accelerated the disinflationary structural forces we are all grappling with as well as the pace of digital and structural change. It has certainly brought more debt burden for all of us, reduced fertility rates and migration rates and increased inequality. All of these factors are negative for a sustainable growth in the future.

Against this, we are surprised by how low unemployment is at this point in the recovery. Some of this is attributable to the size of the workforce, which has shrunk post-COVID, for both cyclical and structural reasons. It may suggest tighter labour markets than many expected, implying central banks may be forced into a precautionary tightening cycle (rising rates) – but only for a while. This will present both opportunities and threats to bond investors.

Figure 1 shows the results of our model’s output versus US 10‑year Treasury bond yields. Coming into 2021, we could clearly see a rapid acceleration in the rate of change in economic data, which was based on a mixture of base effects, additional fiscal stimulus in the US and the reopening of economies driven by rapid vaccinations – three elements that drove the peak in growth and we thought, also inflation by March/April. That data then predictably collapsed from a rate of change perspective into the summer and bond yields followed. From there we felt this approach would not work particularly well until early 2022 when the next big deceleration in the data would be expected given base effects. Instead, central bank hawkishness provided a window for higher yields into early 2022.

![]()

This is in line with historical trends in the bond markets, where yields have shown a tendency to go down a year or two after a recession (normally due to a lack of structural inflation drivers). Further supporting evidence to this thesis comes from the work of our Economic Adviser, Simon Ward, which has shown a collapse in real monetary aggregates across the world (not boding well for the health of economies in 2022).

In summary, the cyclical signals we follow are pointing to lower government bond yields in 2022. Looking at the two engines of economic growth, US and China, the fiscal impulse seen in the pandemic is unlikely to be repeated in the former next year, and the Chinese economy is already slowing rapidly. Yet, we could be faced with an environment where central bankers might put the brakes on a little too hard and increase rates. This would be a recipe for lower long‑term bond yields.

As for credit markets, they are rather dull at present, but we believe they are reasonably priced given that volatility and defaults have been extraordinarily low in the market in 2021 (defaults have only occurred in the lower rated, triple-C part of the high yield market and mainly in the energy sector). However, flatter government bond yield curves do not bode well for the credit markets and we shall keep a watchful eye.

Overall, we believe there are going to be opportunities to exploit in government bonds going into early next year and will wait patiently for them in credit markets. In our mind, 2022 is setting out to be a much more fertile environment for bonds.

Base effects: the impact of comparing current data/price levels in a given month against the price levels in the same month a year ago.

Bond yield: the level of income on a security, typically expressed as a percentage rate. Note, lower bond yields mean higher prices and vice versa.

Credit: refers to bonds within fixed income markets where the borrower is not a sovereign or government entity. Typically, the borrower will be a company or an individual, and the borrowings will be in the form of bonds, loans or other fixed interest asset classes.

Credit market: a marketplace for investment in corporate bonds and associated derivatives.

Default: the failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Fiscal policy: connected with government taxes, debts and spending.

Hawkish: (hawkish central bank language) refers to policymakers being more in favour of raising interest rates.

Inflation: the rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Monetary aggregates: measures of the stock of money circulating in an economy.

Structural change: a dramatic shift in the way an industry or market functions, usually brought on by major economic developments, eg, advances in technology.