Subscribe

Sign up for timely perspectives delivered to your inbox.

What is in store for secured credit markets in 2022? Colin Fleury, Head of Secured Credit, shares his views on what to look for over the next year.

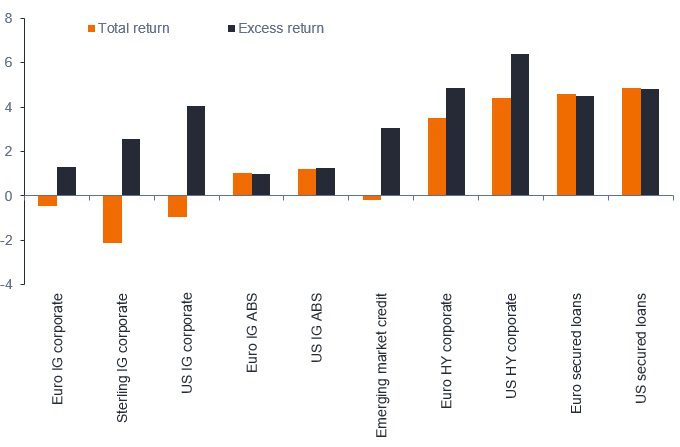

When thinking about 2021 this time last year, I felt there were two key themes. An overall constructive environment for credit markets and an interest rate outlook where the distribution of risk was skewed towards higher rates. When we look at the returns delivered across credit markets year‑to‑date, these themes become apparent (see figure 1).

Simply put, fixed income returns are driven by two things; the excess returns achieved for the credit risk taken and the impact of market interest rates (both their level and, how they have moved over the period), to produce the overall total return. It can be seen from the chart in figure 1 that the excess return for taking credit risk has been strong across most markets, while total returns from asset classes with more interest rate sensitivity or duration, such as investment grade corporate bonds, have been impacted negatively by the overall rising levels of interest rates.

Broadly speaking, we can think of the asset classes in the chart as falling into three interest rate buckets; longer duration (say 5 to 9 years maturity) for investment grade corporate bonds and emerging markets, mid-level duration in high yield (say 3 to 4 years), and very short duration or variable rates linked to cash markets in asset‑backed securities (ABS) and secured loans.

In the context of the above, where do I feel things stand now as we look ahead to 2022?

I am not going to add to the debate around inflation and its transitory or permanent nature. What is clear though, is that some very high inflation data prints can be expected across the global economy over the coming months while economies are still working through the impacts of COVID‑19. It is going to be a very tricky period for both central bankers and politicians to manage- expect interest rate market volatility to remain elevated.

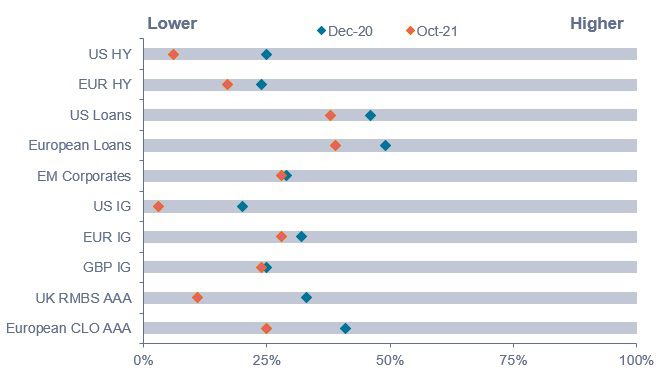

From an excess return perspective, after the compression in credit spreads generally during 2021, it feels as though 2022 maybe more about returning carry (coupon or income) than capital gains. The chart in figure 2 shows long–term credit spread distributions across a range of asset classes and how spreads have tended to move lower over the course of the year.

It can be seen from the chart that loan markets continue to screen as relatively attractive at around the 40th percentile versus their long run history (loan spreads have been tighter than current levels roughly 40% of the time over the last 20 years). To put some numbers to this, a typical European loan new issue is coming to market with an overall credit spread above cash rates of around 4%. Loans also sit in the short duration bucket referenced above; hence, they can offer both a decent spread carry (coupon), and protection against a volatile interest rate environment.

What are the risks to this view?

From a fundamental perspective, while loans are sub-investment grade instruments, we expect general default levels to remain low. We are seeing some companies dealing with supply chain and/or input cost issues, but generally abundant market liquidity has enabled healthy extension of debt maturity profiles and global growth should be above trend. Further, COVID related restrictions pose some risks, but overall companies are well prepared to operate in such environments. From a market technical point of view, loan markets are clearly not directly at risk to interest volatility. This is not to say that extreme fixed income market volatility is not at risk of spilling into the market, but we would view this as a second order risk and one that should still result in a decent relative performance for the asset class.

For those investors with a lower risk tolerance and preferring to stay within investment grade, collateralised loan obligations (CLOs) that own diverse portfolios of loans could look interesting, whether as a standalone investment strategy or as part of a meaningful allocation within a broad portfolio of securitised investments. As an example, a credit spread of around 1.3% can be earned today on a diversified portfolio of securitised bonds with an AA average rating and very short overall interest rate duration.

Next year looks like a year of building portfolios for ‘income’ and utilising the opportunities that are present in secured credit markets within diverse portfolios. The appetite for credit remains strong in this, still, low yielding environment.