Subscribe

Sign up for timely perspectives delivered to your inbox.

The Global Property Equities Team look back on 2021 and discuss the key trends impacting the global real estate sector.

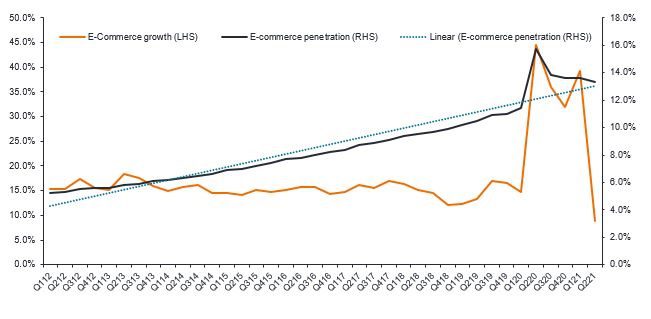

Looking ahead, while the pandemic leads us all to question what the “new normal” may look like, when it comes to underlying real estate markets our core view is that nothing has really changed. This may seem a little odd given what we’ve gone through, but the chart below neatly encapsulates the round trip we’ve been on as it pertains to the winners and losers within real estate, using e-commerce as an example:

With most of the benefit from the current environment accruing to future earnings and dividends [typically REITS are mandated to pay out at least 90% of taxable income to shareholders], as rental contracts are marked-to-market [valued at current market prices] over time, we can have a high degree of confidence and visibility in the growth potential of these businesses, even amid a more uncertain macro backdrop.

Aside from this, other long-term trends remain undisturbed and central to our thinking within the real estate sector:

Demographics – continue to be an important tailwind, especially for various forms of housing targeted at the older age cohorts looking to downsize and enjoy more active lifestyles.

Digitisation – remains a major tailwind to technology focused real estate sectors, with 5G deployments just beginning to benefit cell tower companies.

Sustainability – is an increasingly important driver of tenant decisions. Greener buildings (most notably in office to-date) are more likely to command a rent premium and are seeing a stronger take-up.

A lingering question throughout 2021 has been around inflation. We will leave macro considerations to the experts, however, it’s worth mentioning that as a real asset, real estate stands up to inflation pretty well. Indeed, a consistent theme this year has been that yields for real estate assets have continued to compress [fall] as values have risen across most property types and often ahead of market expectations.

While inflation can provide a healthy backdrop for the asset class, we believe the property companies that are the best positioned to benefit often possess the following characteristics:

Pricing power – landlords need to own buildings that can be kept near full occupancy, where they can demand leases rising with inflation or greater rental escalation and where market rents are growing at least as fast as overall inflation. This is true in some markets/sectors, but not all. US residential landlords, global logistics firms and storage operators, for example, are currently signing leases significantly above current inflation rates.

Inflation-resistant rental and business structure – all else being equal, those landlords with shorter lease terms, less labour-intensive businesses (either via adoption of technology or property type) can pass on price increases to tenants and sustain or grow operational margins. Therefore, it makes sense to avoid those landlords in oversupplied property types whose business involves a heavy labour component and whose tenants will struggle to pass along labour cost increases to end customers.

Strong balance sheets – the likelihood of interest rates and potentially longer-term financing rates increasing in 2022 means we also need to focus on the debt profile of companies. Generally, we have few concerns, with proactive management teams having extended debt maturities, diversified funding sources and still seeing refinancing as an accretive activity. Indeed, in the US, current REIT balance sheets have never been stronger, fostering the ability to raise dividend distributions while ‘playing offense’ through acquisitions and development. Beware the outliers though!

Looking beyond a single-year outlook, the listed real estate market is experiencing a dramatic evolution. In the last decade, both the composition and quality of the investment universe has been changing for the better, making it a relevant investment today and in the future (REITs 3.0). Many REITs have become businesses with formidable scale, operational excellence and relatively easy access to capital, with some of the best operators using the ‘flywheel’ concept, aiming to provide investors with a new level of compounding growth. The flywheel model is based around the idea that a series of small steps, rather than a sudden breakthrough, can accumulate to create growing momentum and a virtuous cycle of sustainable growth. Seeking out those companies that create true value will continue to serve investors well beyond 2022.

2021 has been a year of relief as the world has returned to some semblance of its old self. No doubt there will be more speedbumps along the way, but from a real estate perspective it is our view that the longer-term fundamentals remain largely unchanged. Put simply, we have seen evidence that those companies that could grow income streams before COVID emerged can still grow them today; those that struggled before COVID may continue to struggle.

Accommodative policies from governments and central banks have given the global economy the support needed to get back on its feet, and as landlords of that economy, those real estate companies with the right assets, in the right location, with the right business model are most likely to continue to outperform.

Own. Innovate. Diversify