Subscribe

Sign up for timely perspectives delivered to your inbox.

Investment trusts – often referred to as investment companies or closed-ended funds – are similar in nature to other types of ‘pooled’ investment, such as unit trusts and OEICs (open-ended investment companies), in that they allow you to combine your money with that of other investors in order to gain exposure to a wide range of assets through a single vehicle. However, they are much less widely understood, despite having been in existence for over 150 years.

In that respect, many believe them to be the investment industry’s best kept secret. For example, at the end of 2019, the total assets under management in UK investment trusts was in the region of £200 billion, whereas the assets within the UK investment industry as a whole was about £9.1 trillion. Although still dwarfed by unit trusts in terms of their popularity, investment trusts are attracting wider attention and at an ever-increasing rate: in the last 10 years, their total assets have increased by over £120 billion, more than doubling the size of the sector.

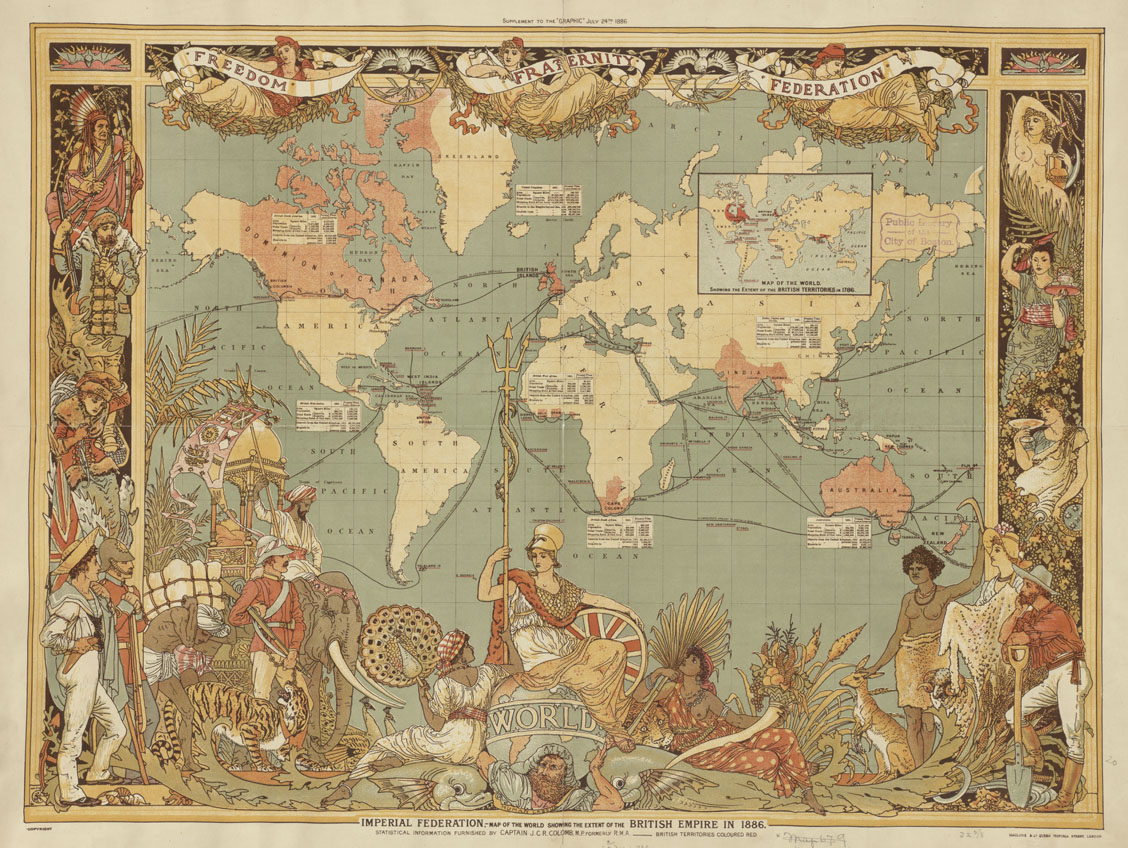

Investment trusts are most commonly found in the UK and Japan. Oddly, the name is somewhat inaccurate in that they are not actually constituted as ‘trusts’ in the legal sense of the word, but as companies, with their shares listed and traded on a recognised stock exchange like other public companies. From an investor’s perspective, they were established to enable those of modest means to access the stock market in much the same way as wealthier individuals and institutions, lowering the risk to the individual by spreading their investment over a wide range of holdings. From the trust’s perspective, however, they were created largely in order to fund the vast sums required by ambitious new investment initiatives across the globe, as the burgeoning British Empire spread its tentacles ever wider.

The Foreign & Colonial Government Trust (now known as the Foreign & Colonial Investment Trust) – was set up by Philip Rose in London in 1868, the same year as the discovery of Helium and the last public execution in Britain. It focused on investing in government bonds and, as the name suggests, the initial portfolio comprised ‘foreign and colonial’ government bonds from 18 countries, specifically those in the more advanced markets of Europe, the US, South America, the Middle East and New Zealand.

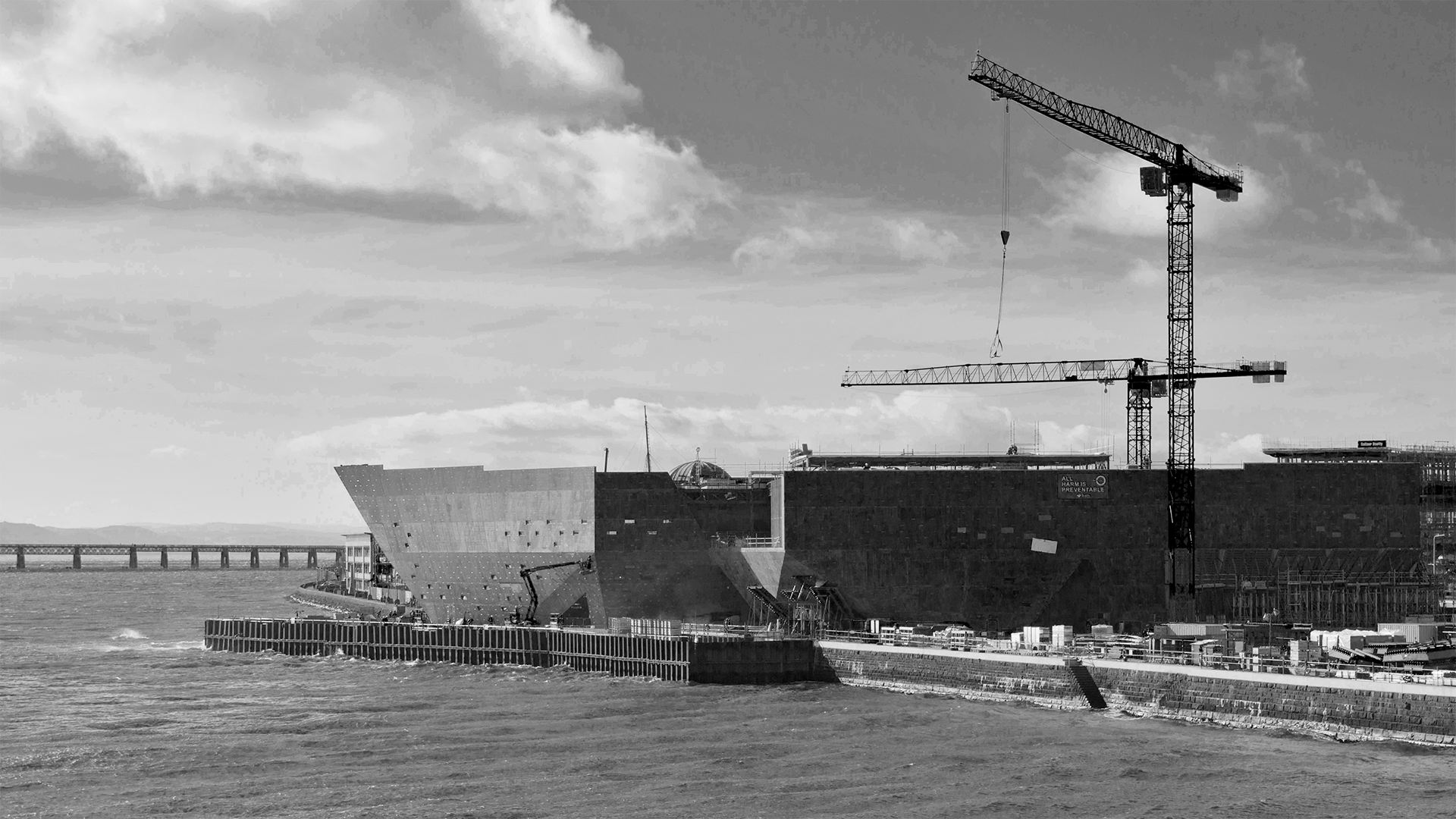

In the years since, Scotland – and in particular docks – became a breeding ground for new investment trusts on the back of the ‘jute boom’. Tons of jute – a long, soft, shiny vegetable fibre that can be woven into coarse, strong threads or fabrics – were being imported from India, and the whale oil needed to lubricate the weaving machines was similarly landed by the ton on the banks of the Dee.

In 1873, Robert Fleming launched the Scottish American Investment Trust (now called Dunedin Income Growth) to finance the building of the railway network which would ultimately link the United States of America. In the same year, he founded Flemings, one of London’s most famous merchant banks, which is now JPMorgan Asset Management. Alliance Trust, launched in 1888, was originally founded as a mortgage bank, raising capital from British investors and lending it to pioneer farmers in the north western United States. A year later, the Edinburgh Investment Trust was formed, investing over half of its assets in company shares. It would seem that the investment managers at the time were heavily reliant on personal recommendations, given the large number of breweries, tobacco companies and even diamond mines within the initial portfolio!

The late 1800s saw the launch of two investment trusts now managed by Janus Henderson: The Bankers Investment Trust in 1888 and City Of London Investment Trust in 1891. Both trusts have formidable long-term records but are particularly noteworthy for having successfully increased their dividend payouts for over 50 consecutive years – two of only four investment trusts to have done so.

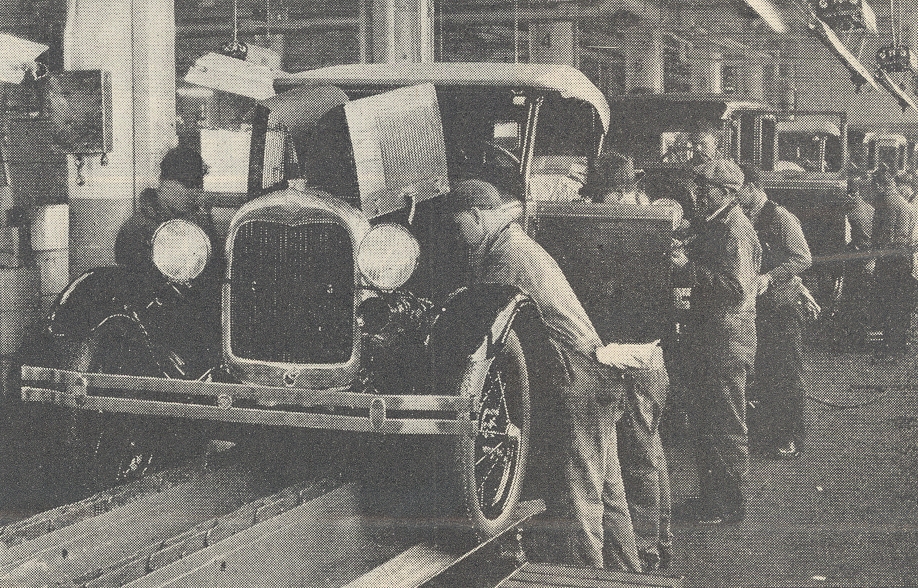

1909 saw two investment trust launches: the founders of Baillie Gifford launched the Scottish Mortgage Investment Trust, the original investment focus being to offer mortgages to Malaysian rubber plantation owners eager to capitalise on the accelerating demand for rubber from the Ford Motor Company and its Model T car, and Witan was established to cater for the investment needs of the families which had funded the construction of the London & North Eastern Railway and the Manchester Ship Canal.

By the outbreak of the First World War in 1914, 90 investment trusts had been established. Of those, 26 are still in existence today, having survived everything that the ups and downs of world markets could throw at them for over a century – testament indeed to their extraordinary resilience.

Shares – A security representing ownership, typically listed on a stock exchange. ‘Equities’ as an asset class means investments in shares, as opposed to, for instance, bonds. To have ‘equity’ in a company means to hold shares in that company and therefore have part ownership.

Portfolio – A grouping of financial assets such as equities, bonds and cash. Also often called a ‘fund’.

Source:

1 Money Observer, Demand for existing investment trusts hits record high in 2019, January 2020

2 Business Telegraph, UK asset management sector passes £9tn milestone, September 2018

3 AIC, Investment companies reach record £200 billion, August 2019

4 The AIC, Investment Company Dividend Heroes, March 2019

5 The Telegraph, How investment funds survived the First World War, August 2014