Subscribe

Sign up for timely perspectives delivered to your inbox.

As the year has progressed, financial markets have shifted away from being dominated by the simple “reopening reflation” theme that set the tone in early 2021, to instead reflecting the impact of a more complex tangle of macro influences. As the dominant themes have changed so has market performance. While the “everything” rally of the first half of the year saw most asset classes delivering healthy returns, the third quarter was a different story, with investors making nothing from owning US Treasuries, corporate bonds and developed market equities, and generally losing money in emerging market assets.

The recent turbulence in financial markets reflects the difficult in responding to fast-changing developments on the global economic and policy fronts. The economic recovery from the pandemic has been highly idiosyncratic, reflecting unprecedented policy interventions, big changes in consumer spending patterns and unusual labour market dynamics. While bottlenecks and economic frictions had been widely expected when economies began to reopen, some central banks and many investors have begun to question in the past few months whether such shortages of labour, commodities and goods will be more persistent than originally expected. Earlier confidence that the upswing in wage and inflation would be transitory has faded, as concerns have grown of stagflationary scenarios, involving sustained high wage increases and inflation alongside weak economic growth.

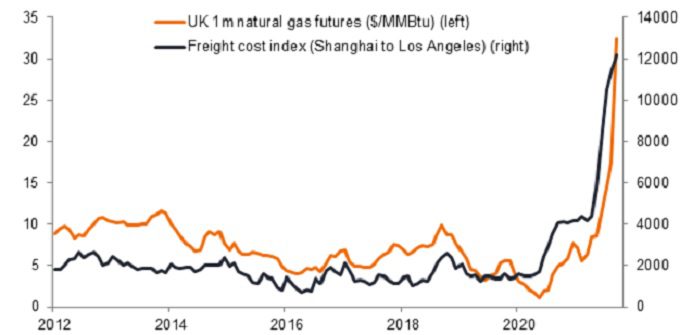

Such concerns are understandable, given the breadth and intensity of supply problems now evident in many global sectors. While the first stage of the recovery from the pandemic saw notable shortages and price surges in specific areas like lumber, shipping and semiconductors, these sorts of supply problems have recently become a much broader global phenomenon. There are now many striking global examples of important industrial sectors where supply is clearly struggling to keep up with demand. Notable examples include electricity shortages in China, fuel shortages in the UK and labour shortages in the US and elsewhere. These bottlenecks are not just squeezing up prices and wages, but they are also now beginning to restrain growth, through enforced production shutdowns, labour shortages and demand destruction.

For financial markets, these widespread supply shortages have not just forced a reappraisal of growth and inflation expectations but have also raised some awkward questions for central banks. Diminishing confidence in the “transitory inflation” scenario has nudged many monetary policy makers to move more decisively towards ending asset purchase programmes and raising interest rates. Although actions on both fronts are still expected to be cautious relative to past monetary cycles, the dovish messages from central banks earlier in the year have now been overwhelmed by the sense that the great post-pandemic tide of central bank funding is beginning to turn. Central bank asset purchase programmes injected about $8.5tn into financial markets in 2020, but that number is expected to fall to about $2.3tn this year and $0.3tn in 2022.

It seems reasonable to conclude that the easy part of the coronavirus recovery is behind us and the global economy is now transitioning from a strong recovery phase into a more complicated economic environment. Many of the prevailing economic strains look set to persist for months to come, particularly in the UK where Brexit-related economic frictions have accentuated global supply disruptions. Still, while we have little visibility on how global supply shortages will be resolved, we would be wary of extrapolating the recent recalibration of wages, prices, and policy settings too far. Seasonal factors might well see supply shortages get worse before they get better in the final quarter, but we would expect a meaningful easing of tensions to begin to materialise in the first half of 2022, as demand and supply adjust to higher wages and prices in goods and labour markets.

So, it is quite conceivable that supply shortages will impede growth in some sectors in the fourth quarter of 2021, as they have done in recent months. Still, despite all the headlines, the net impact of these frictions on growth has been fairly modest, and the big picture is still one of a strong economic recovery carrying well into next year. The resilience of growth, despite price squeezes in many sectors, partly reflects the unusual strength of personal sector finances in most major countries. Households in the advanced economies have accumulated excess savings amounting to nearly 10% of GDP over the pandemic. Corporates too should be a decent source of growth in the months ahead, as they look to rebuild inventories that have been run down in many sectors.

| Region | 2020 | 2021F | 2022F |

|---|---|---|---|

| World | -3.8 | 5.9 | 4.5 |

| Developed | -4.9 | 5.3 | 4.0 |

| Emerging | -0.6 | 6.5 | 5.2 |

| US | -3.5 | 5.8 | 4.1 |

| UK | -10.1 | 7.0 | 5.3 |

| Eurozone | -6.8 | 5.0 | 4.3 |

| Japan | -5.1 | 2.4 | 2.5 |

| China | 2.3 | 8.2 | 5.5 |

The fact that investor attention in recent months has shifted significantly away from the coronavirus to more orthodox cyclical issues reflects the market consensus view that the influence of the pandemic on economic activity is continuing to wane. Impressive progress on vaccinations and on the development of COVID-19 treatments have kept most of the major developed countries on the path to a continued reopening of their economies, with scope to unleash significant pent-up demand for services. The outlook however remains more complicated in Asia and Australasia, where lower vaccination rates suggest that economic restrictions will remain in place well into next year.

While deliberations on fiscal matters in the US have been another source of market disquiet in recent months, China has delivered the most significant market-moving news. A rapid sequence of unexpected regulatory interventions across a wide range of industries has shaken confidence in Chinese stocks, raising big questions about the possibility of further intrusions and their potential impact on corporate profitability. Aside from this, the rapidly deteriorating health of many Chinese property developers looks sure to be a source of episodic stress for Chinese credit and equity markets well into 2022. While the Chinese authorities seem capable of containing financial spill-overs from the Evergrande debt crisis, the economic consequences look set to cast a long shadow over the outlook for Chinese growth.

As we enter the final few months of 2021, it is hard to avoid the conclusion that the near-term outlook for financial markets is unusually opaque, obscured by uncertainties associated with some fast-moving economic and policy crosscurrents. While continued progress against the coronavirus promises a sustained upswing in demand in the major economies, the benefit to risk sentiment from this theme is being restrained by doubts about supply-side dynamics, the impact on monetary policy and various China-specific concerns.

To us, the balance of risks from a multi-asset perspective still looks most favourable in developed equity markets, although we expect more volatility and setbacks in markets before the year is out. We are unconvinced that recent adverse developments in China are yet fully priced into Chinese stocks. While fixed income assets always have a role to play in multi-asset portfolios, it is hard to be enthusiastic right now about government bonds or credit given low yields, low spreads and fading central bank support. With risk-return prospects from fixed income looking unappealing, we strategically prefer listed alternatives. These offer plenty of scope for diversification, potentially attractive income streams and exposure to many potential secular growth themes, such as renewables, infrastructure, and logistics.

Reopening reflation: Government policies intended to stimulate the economy as pandemic lockdown measures are eased/come to an end.

Idiosyncratic risk: factors that are specific to a particular company and have little or no correlation with market risk.

Listed alternatives: Investment vehicles or companies that own and manage real assets. While holding the underlying assets directly may be slow or expensive to trade (illiquid), by investing in a listed vehicle, investors can gain exposure to a particular asset or investment theme, at a relatively low cost, and with the flexibility to buy or sell more easily.