Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager and Lead Emerging Markets Analyst Jennifer James and Corporate Credit Portfolio Manager Tom Ross consider how efforts to rebalance the economy in China are having far-reaching implications.

Trying to describe China’s economy in recent decades has always been a lesson in economic gymnastics. From a more traditional communist command economy through to a capitalist hybrid model, China is now undergoing another reinvention as it seeks to share prosperity more equitably. It has even coined a name for it: “common prosperity.”

For China, inequality comes with additional consequences. Its political system relies on stability so there is a desire to ensure the majority of people feel they have a stake in the system. China is intent on undergoing social engineering through policy tools. Few countries can do this effectively and even fewer have such firm ambition.

Exhibit 1a highlights the speed at which the wealthiest cohort have begun to move away from the middle- and lower-income cohorts. Common prosperity seeks to enlarge the middle class at the expense of the ultra-wealthy. The aim is social harmony. A second derivative of this would be to increase China’s birth rate (happier and economically stable people are more likely to have children). A major concern for authorities is the growing dependency ratio as the proportion of people age 65 and over steadily increases while the population of working age shrinks as a share of the overall population (Exhibit 1b).

Source: Morgan Stanley, CEIC, Wind, mean quintile urban disposable income, USD, 1995 to 2020. A quintile represents one-fifth of the population.

Source: United Nations Population Division, World Population Prospects 2019, percentage of total population by broad age group, both sexes (per 100% of total population).

The policy tools to achieve these social goals have so far targeted specific sectors that the government views as being either monopolistic (e.g., technology) or those creating barriers for social upward mobility (e.g., private educational tutoring, expensive health care and expensive property).

Methods have been blunt, often with little warning. As such, markets have not reacted well. To be fair, China has a habit of permitting rapid growth in industries, only to introduce tight regulation once an industry is firmly embedded. Examples include the imposition of safety standards on dairy products in the late 2000s and a crackdown on luxury entertainment and gifts in recent years to tackle corruption. The regulatory reset currently taking place covers a much broader range of industries, from gaming to semiconductors, education to property.

Pressure to cool prices has come from central government, which sees high property prices as an impediment to social progress and an expense that is discouraging households from having more children.

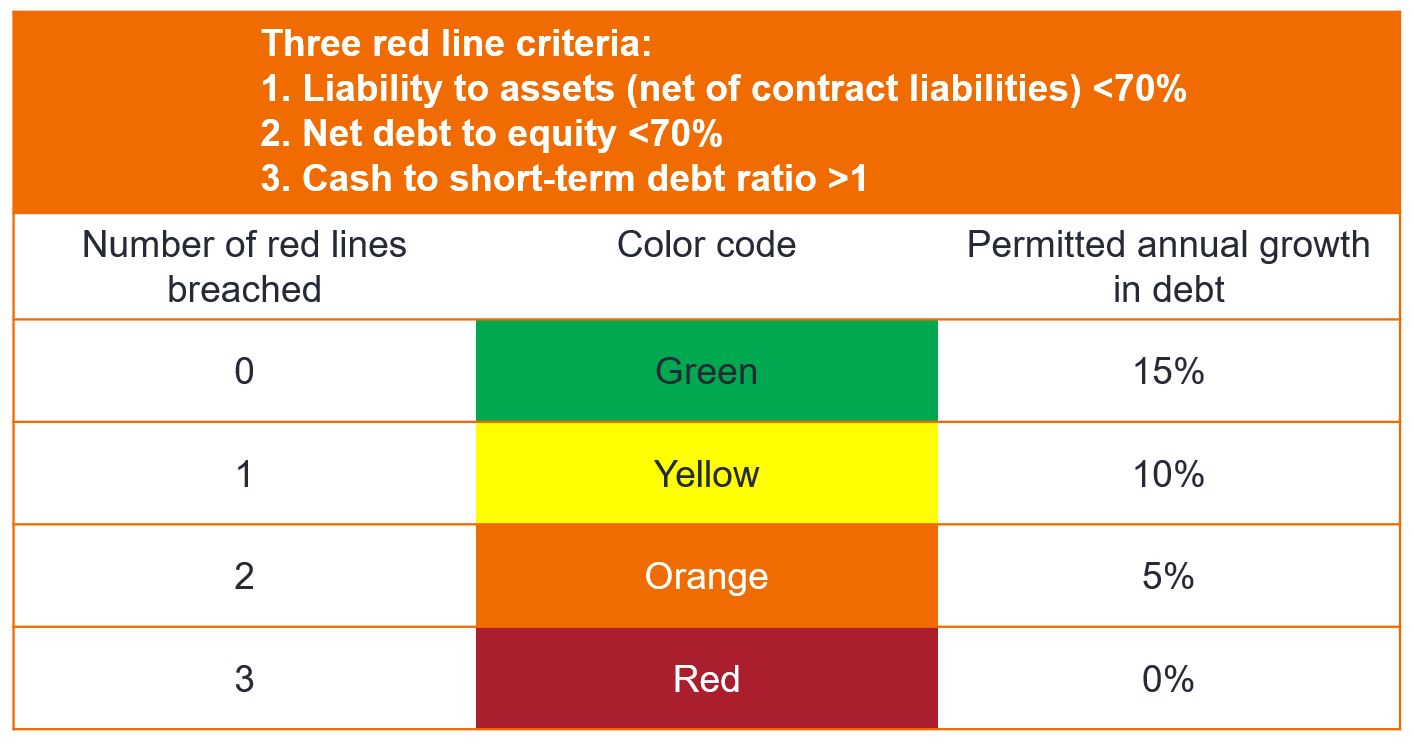

Recent efforts to cool prices began last year with the trial of the “three red lines” test. This concept demanded developers submit detailed reports of their finances to be assessed against three criteria. If one or more of these three lines is breached, then the regulator can limit the extent to which a developer can grow their debt.

[caption id=”attachment_410979″ align=”alignnone” width=”1414″]

Source Bloomberg, press reports, September 2021.

[/caption]This policy is not expected to be formally implemented until June 2023, but the market has been quick to single out those companies most at risk of failing the three-threshold criteria.

Concerns that Evergrande may default on its debt has seen its bonds drop to around 25 cents on the dollar in mid-September 2021, essentially a quarter of their par value.4 The property sector relies partly on offshore funding to operate, which is why the response in the credit markets has been particularly severe.

A messy restructuring would be bad for China and come at an inopportune time given that the country is already showing evidence of an economic slowdown (Exhibit 3).

Source: Refinitiv Datastream, National Bureau of Statistics of China, Purchasing Managers Index, Manufacturing Sector, Services, seasonally adjusted, August 2011 to August 2021. A reading below 50 indicates contraction.

For now, investors are having to gauge how much market pain the authorities in China are prepared to tolerate to achieve their goals. With China such a key player in the global economy, the risk is that fallout in its property sector spreads globally through markets.

When China coined the phrase “common prosperity,” most investors assumed this meant the domestic economy; the law of unintended consequences could see it come to refer to China exporting its growth slowdown to all.

1CEIC, National Bureau of Statistics, September 2021

2China Banking News, 15 June 2021

3Refinitiv Datastream

4Bloomberg, 20 September 2021

5Xinhua, 22 September 2021

Socio-economic engineering: policies designed to deliver specific social and economic goals.