Subscribe

Sign up for timely perspectives delivered to your inbox.

Janus Henderson’s Portfolio Construction and Strategy (PCS) conducted an assessment of the key challenges of fixed income in retirement plan lineups. Here, Senior Portfolio Strategist Damien Comeaux discusses how to help ensure adequate diversification among the fixed income options included in plan menus.

Janus Henderson’s Portfolio Construction and Strategy (PCS) team developed a diagnostic report specific to retirement plans that provides a comprehensive analysis on the risk and reward of fixed income investments in plan lineups. In our conversations reviewing this diagnostic report with DC-focused financial professionals, we identified four areas we believe are the most crucial to consider in order to avoid the complications of implicit and unintended risk.

We cover each of those challenges in detail in our four-part blog series. Here, we explore the potential for overlap and discuss how to address the issue through specific due diligence measures.

In a previous post, we discussed the issue of overlap that can occur when both Core and Core-Plus options are included in plan menus, given the fact that the risk and return profiles of these categories are so similar. Based on what we’ve seen in the plan lineups we’ve reviewed, not only is the overlap of Core and Core-Plus not beneficial to participants, but there is a heavy focus within these two categories on government-related securities, which are highly susceptible to rising rates.

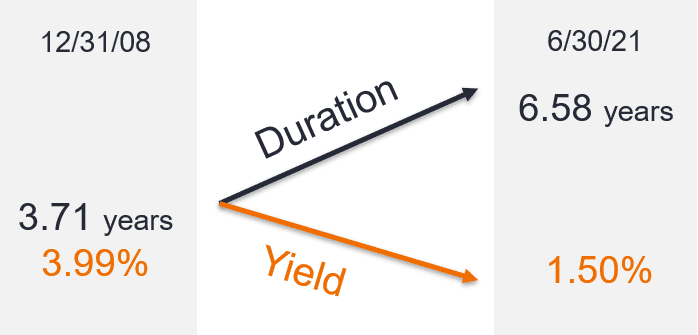

Government securities make up a considerable portion of the investable universe in the fixed income asset class. The trade-off between yield and duration in these types of securities is currently at its weakest and potentially exposes plan participants to too much rate risk (duration) without proper compensation (yield, compared to historical norms).

To illustrate this problem, the chart below shows the change between yield and duration of the U.S. Aggregate Bond Index – the primary benchmark for intermediate term U.S. fixed income assets – from the end of 2008 to June 30, 2021:

[caption id=”attachment_401246″ align=”alignnone” width=”698″] Source: Bloomberg U.S. Aggregate Bond Index, Duration and Yield as of 12/31/08 and 6/30/21.[/caption]

Source: Bloomberg U.S. Aggregate Bond Index, Duration and Yield as of 12/31/08 and 6/30/21.[/caption]

While the Core and Core-Plus categories face the challenge of decreasing value in the trade-off between duration and yield, we feel it is still absolutely necessary to include one, but not necessarily both, of these categories in plan lineups. And while their necessity cannot be denied, they may no longer be adequate as the only fixed income options in a plan; in our view, they should be complemented with strategies that may have a greater yield or return potential for participants.

Furthermore, based on the correlation assessment, selecting one of either the Core or Core-Plus categories (noting that a Core-Plus fund typically provides greater flexibility) addresses two challenges: First, it reduces the possibility of highly correlated assets in the protection-focused portion of the lineup. Second, it allows plans to diversify the poor trade-off in more traditional, government-focused fixed income by opening a slot for an additional category such as multi-sector or world bond, either of which would provide a combination of asset classes outside of primarily government-focused securities.

It’s important to note, however, that vigilance is required here: While categories such as multi-sector or world bond may provide diversification relative to more traditional fixed income, they are not “off the shelf” options for many. As a result, the task of evaluating and deciding whether to include these options in a plan lineup may be challenging for DC-focused financial professionals.

Our goal in presenting these insights is to ignite conversations that help construct the best lineup possible for participants. We think such due diligence measures can help effectively diversify fixed income lineups while maintaining a risk/reward profile that plans – and their participants – have come to expect from fixed income.

In our next post in this series, we look at how to gain a better understanding of specific risks when evaluating fixed income options in plan lineups.