Inflation Worries: Overwrought, or Not?

At the start of the year, we on the Portfolio Construction and Strategy team expressed cautious optimism in our expectations for the reemergence of strong economic growth in 2021. Over the last six months we have seen significant progress in the long-awaited economic reopening. While the reopening should allow the economic recovery to gain momentum through the end of this year, it is not without its own risks – chief among them, concerns about inflation.

In our view, the biggest risk as it relates to inflation could be investors’ tendency to overreact to it. In our client portfolio consultations, we’re seeing this unprecedented environment generate too much tendency and desire to change entire asset allocations based on a single fear or view, such as inflation. By making drastic changes to their portfolios that fail to consider the underlying causes of inflation, investors could prove to be their own worst enemy.

Our priority is not predicting whether or not recent inflation changes are transitory, but it is on designing robust asset allocations that can withstand, and perhaps thrive, in either outcome. In an environment where the outlook for inflation is so uncertain, our preference is to focus on the following four strategies, all of which we feel are underrepresented in financial professionals’ portfolios. These portfolio tools are well-rounded solutions that offer the potential to not only help combat inflation, but also address an environment with low rates, tight credit spreads and pockets of historically high equity valuations. The following four examples offer portfolio strategies that can be appropriate for this environment, regardless of whether inflation worries prove overwrought, or not.

U.S. Equity: Transcend the Growth/Value Conundrum

Back in January, we noted that concentrated market leadership, while not a new phenomenon, had reached a tipping point during the pandemic, when the historic run of outperformance for growth relative to value widened even further.

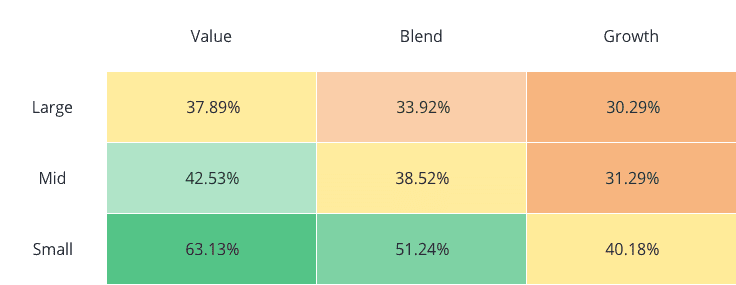

At that time the COVID vaccine rollout was just getting started in the U.S., pointing to a broadening of the economy – and, in turn, of equity market leadership – in the months ahead. Indeed, as consumers have started to reengage with the physical economy, this broadening has already translated into a rotation toward those market segments that were battered during COVID lockdowns, such as dining, entertainment and travel. As illustrated in the chart below, small-cap value stocks have delivered more than double the returns of large-cap growth since the initial vaccine announcements in November, however the transition is not as simple as Large Cap Growth versus Small Cap Value.

Economy – and Market Leadership – Broadens Post-Vaccine

The current economic rebound cannot be expected to follow the same pattern as recovery cycles of the past. It transcends traditional style boxes, making it short-sighted to think only in terms of growth/value. The pandemic dramatically impacted consumer behaviors and disrupted virtually every industry, resulting in a clear delineation between COVID “winners” and “losers.”

Performance since vaccine announcements(11/1/2020 – 6/30/2021)

Source: Morningstar as of 30 June 2021

Rather than getting stuck in a growth/value mentality, consider which of these trends and market themes have the potential to endure over the long-term. Investors should consider broadening their sights, understanding different risks may be involved, by looking down in cap size for opportunities and across sectors to access differentiated cash flows, while also considering strategies that complement incumbent managers by adding alpha opportunities through stock selection in misunderstood and underappreciated areas.

International Equity: Home Bias Hurts in a New Way

Through our team’s examination of allocations in our portfolio database, we’ve long noted that international stocks are underrepresented in U.S.-based portfolios relative to those regions’ share of global GDP and market capitalization. Consequently, U.S. investors are typically underexposed to what we would consider the different risks associated with international/emerging markets investing. Given this home-country bias, the staggered reopening of the global economy post-pandemic, and recent performance differentials, we believe U.S. investors are at risk of not fully participating in the next stage of the global economic reopening.

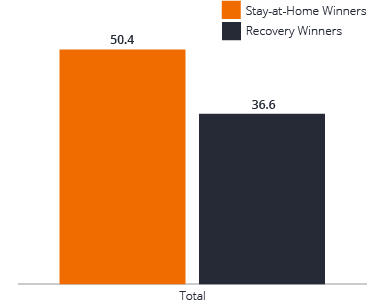

The recent transition of market leadership toward “recovery” stocks exacerbated this. Many of the pre-vaccine “stay-at-home winners” were Internet and cloud computing companies based in the U.S., which explains much of last year’s outperformance by U.S. equities. “Recovery winners,” on the other hand, are generally outperforming since the vaccine announcements and are more prevalent outside the U.S.

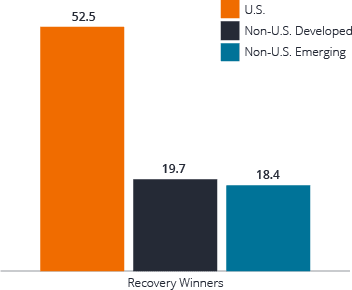

In aggregate, “recovery” stocks tend to have lower valuations given their greater sensitivity to the economic cycle. It’s worth noting, however, that both international developed and emerging market recovery stocks carry cheaper valuations than their U.S. peers at the time of this writing. As these countries achieve certain vaccination and reopening milestones – many of which currently lag those of the U.S. – we expect this divergence to decrease.

Total and U.S., Non-U.S. Developed and Non-U.S. Emerging Markets

Given the aforementioned home country bias in our database of client portfolios, the typical U.S.-based investor is under-allocated to “recovery winners”. Compared to the MSCI ACWI benchmark, these investor portfolios are potentially under-allocated by more than 50% to where we see some of the potential global equity opportunities in the months ahead . As investors revisit their global equity allocations, they may benefit from rebalancing in a way that can alleviate these drastic underweights.

REITs: A Diversification Trilogy

In our experience, incorporating real estate investment trusts (REITs) in a diversified portfolio can help counterbalance some of the biggest concerns surrounding today’s portfolios:

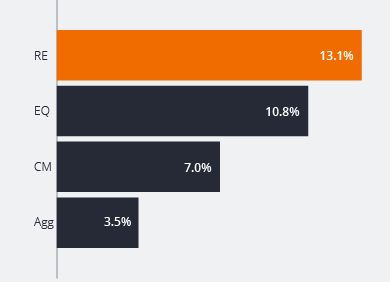

1. Survive and Thrive During Inflation

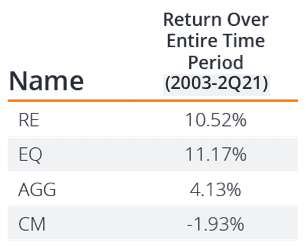

In our analysis of macro environments since the end of the Tech bubble (2003), 48% of the months have been characterized by above-average growth and above-average inflation. In these environments, REITs have averaged 13% while equities have averaged only 11%. Investors currently expecting a regime of high growth and high inflation should consider the potential for REITs to outperform.

Past performance is no guarantee of future results.

2. An Income Source in a Low-Rate World

Part of this outperformance is because annual growth for REIT dividends have outpaced inflation by an average of 7.3%1 over the last 20 years, and more than half of REITs’ total returns during that period have been driven by dividends. Furthermore, REITs overall yield is 2.99%, which is competitive with US High Yield at 3.75%* and far outpaces U.S. 10-year Treasuries at 1.45%.

3. Diversification from Tech and U.S. Growth

For advisors not only concerned with combating U.S. home bias but also its heavy allocation to technology, an allocation to REITs can offer a differentiated return source compared to the broader U.S. growth equity market while also offering a potential “smoother ride” accompanied by lower risk and volatility. During the ten years surrounding the March 2000 dot-com peak, U.S. REITs returned more than the S&P 500 (13.8% vs 11% annualized, respectively) and did so with a lot less drama along the way: REITs’ nearly 3% increase in 10 year annualized return was accompanied by a standard deviation over 2% lower. While history is not expected to repeat itself, the dot-com era serves to illustrate the potential benefits of REITs diversification.

Fixed Income: Keep Risks in Check while Searching for Yield

The specter of rising inflation has placed an even greater focus on fixed income duration in this low-rate environment. But the warning we issued at the start of the year holds true today: Abandoning core fixed income because of low U.S. Treasury yields – or being overly cautious about duration due to concerns about inflation – is throwing the baby out with the bathwater.

With the global economic recovery still in its early stages, there are bound to be setbacks along the way. Investors need to be cognizant of where we are in the cycle and avoid layering on more risk as they stretch for yield.

Despite pervasive low rates, core fixed income’s role is as essential as ever: core bond allocations are strategic allocations intended for capital preservation during a crisis. However, with inflation potentially coming in many forms – both transitory and structural – there are positive and negative implications for fixed income. As such, we believe investors will need to exploit the entire yield spectrum, from global sovereigns to securitized and investment-grade corporates. And with both rates and spreads hovering near historic lows, investors will need to seek exposures that offer income streams with multiple risk factors in mind.

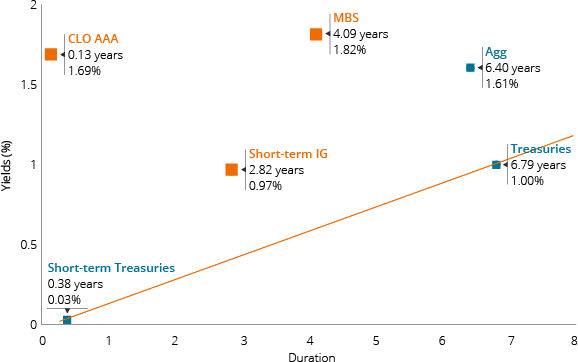

Exploiting Fixed Income’s Inefficiencies

We often refer to the “inefficient frontier” of fixed income markets. As the chart illustrates, investments such as short-term corporate credit, mortgage-backed securities (MBS) and high-quality collateralized loan obligations (CLOs) may result in a higher yield without adding additional interest rate risk while still providing risk-management to the broader portfolio. We believe these inefficiencies are paramount for investors endeavoring to find balance between the needs of risk management and portfolio income.

Note: Yield cushion defined as Yield to Worst (YTW) divided by duration. As of 03/31/21. Indices shown represent: J.P. Morgan CLO AAA Index, Bloomberg Barclays Short Treasury, Bloomberg. Barclays U.S. MBS Index, Bloomberg Barclays U.S. Treasury, Bloomberg Barclays U.S. Aggregate Bond, Bloomberg Barclays U.S. Corporate Bond 1-5 Year

Yield cushion, defined as a security’s yield divided by its duration, is a common approach that views bond yields as a cushion that can help bond investors navigate the potential negative effects of duration risk. The yield cushion potentially helps mitigate losses from falling bond prices if yields were to rise. In the chart above, the highest yield cushions would be found in securities plotting closest to the top-left corner of the chart.

Custom Consultation

As we continue to face uncertainty in today’s global environment, we understand the importance of helping to navigate the path ahead. Our proprietary portfolio risk analytics are designed to help determine the solutions for specific circumstances . For help, consider engaging with our PCS team so that we can extend these tools.

Read morePortfolio Construction and Strategy Group

A select team team of highly specialized strategists with deep experienceand expertise gained from thousands of custom analyses of advisor models.

Adam Hetts, CFA

Adam Hetts, CFAGlobal Head of Portfolio Construction and Strategy

Damien Comeaux, CIMA®

Damien Comeaux, CIMA®Senior Portfolio Strategist

Lara Reinhard, CFA

Lara Reinhard, CFASenior Portfolio Strategist Contact your Janus Henderson sales director at 800.668.0434

and ask about our Portfolio Construction consultations. Footnotes:

1. Nareit, S&P Global Market Intelligence as of 5/17/21, 2001-2020 dividend per share compound annual growth rate, or CAGR. Inflation measured for all items, all urban consumers, not seasonally adjusted.

2. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. The principal on mortgage- or asset-backed securities may normally be prepaid at any time, which will reduce the yield and market value of these securities. Investing in derivatives entails specific risks relating to liquidity, leverage and credit and may reduce returns and/or increase volatility.