Subscribe

Sign up for timely perspectives delivered to your inbox.

Adam Hetts from the Portfolio Construction and Strategy Team examines whether unintended risks are introduced by a shift to “sustainable” investing and the scarcity of allocation options.

Sustainable investment considerations are currently a major catalyst shifting the investment landscape. They carry myriad intended influences on one’s asset allocation, including the application of a forward-looking view accounting for the varied impact of climate change across global asset classes and sectors. However, what if this relatively new investment landscape is also creating the potential for other, unintended, asset allocation risks? What if many of the new sustainable model portfolios financial professionals are building as a service to their clients are sometimes unrecognizable compared to their traditional models when it comes to regional biases, style drifts and sector concentrations?

At Janus Henderson, our global Portfolio Construction and Strategy (PCS) Team provides portfolio consultations to financial professionals throughout the world. With Europe well ahead of most countries on the sustainable investing front, our team has the luxury of a “sneak peek” of the European sustainable investing themes and risks that will likely be top of mind for our U.S. clients very soon.

Our European portfolio assessments are currently showing risks and inconsistencies in sustainable model portfolios that may have been masked by recent strong equity performance in certain sectors and regions. We believe the case study outlined below from a recent UK client might help U.S. financial professionals get a head start on addressing the challenges that sustainable model portfolios might soon create.

If our main concern is the inconsistency of risk profiles between traditional and sustainable model portfolios, we should begin by focusing on the root cause of this inconsistency. This root cause, in our view, is the “scarcity of sustainability” driven by the fact that the asset management industry’s product offerings are still catching up to the demand for sustainable portfolios.

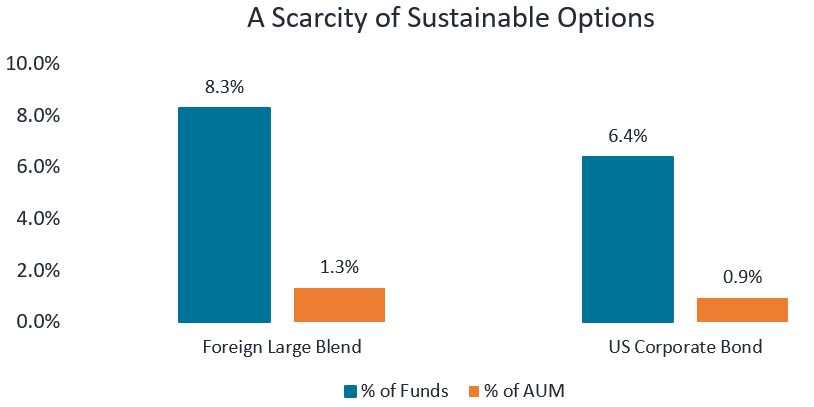

For example, a financial professional investing in Foreign Large Blend equity for a traditional model portfolio has a plethora of solutions available. That same financial professional looking to mirror this selection in sustainable model portfolios is limited to a much smaller selection. Compared to traditional Foreign Large Blend equity, the sustainable options are severely limited as only 8% of the number of funds in the category – representing 1% of the assets under management (AUM) – meet the criteria, as shown in Figure 1. There is a similar discrepancy within fixed income, with U.S. Corporate Bond as an example.

Figure 1: Availability of sustainable funds and AUM

Source: Janus Henderson PCS Team, Morningstar. Percentage of all funds and AUM categorized by Morningstar as explicitly indicating any kind of sustainability, impact or ESG strategy in their prospectus or offering documents, as of July 14 2021.

This availability challenge makes it easy to understand why many sustainable model portfolios take a different approach to traditional model portfolios. If, for example, a financial professional owns a Foreign Large Blend equity fund in a traditional model portfolio and wants to select a sustainable Foreign Large Blend fund but finds there are few available for the sustainable model – perhaps none of which are available on their specific platform – the likelihood might be they transition to a global sustainable fund. Global sustainable funds are important portfolio tools, but if they are not completely interchangeable with Foreign Large Blend funds, the result is often that the different approach presents a different set of (often unintended) risks.

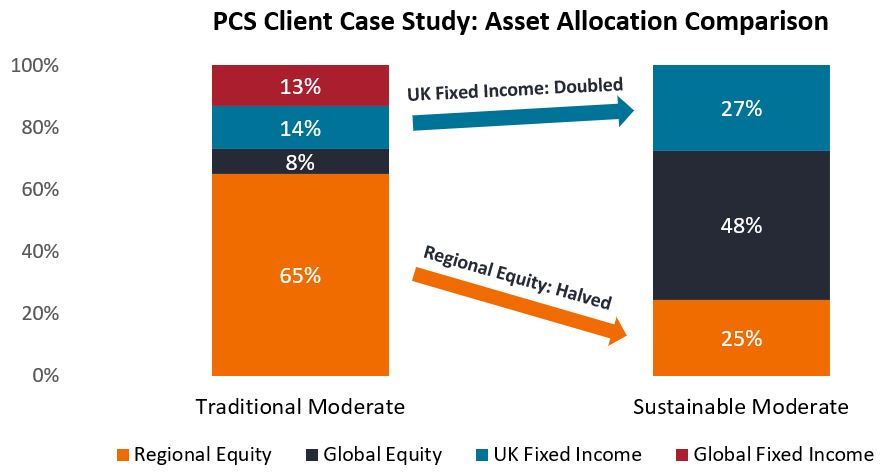

The example portfolios in Figure 2 show exactly this phenomenon in our recent UK client consultation case study. Within equities, the traditional model portfolio includes fewer global strategies, with more granular regional equity allocations, while the sustainable model portfolio relies more on global equity. Within fixed income, the phenomenon is the opposite with the traditional model portfolio fixed income allocation split between UK and global fixed income and the sustainable model with all its fixed income allocated to the UK. We believe these asset allocation shifts – and therefore risk shifts – are attributable to the relative paucity of sustainable strategies in certain categories, which forces financial professionals to find alternative categories.

Figure 2: Portfolio Holdings – Significant Differences

Source: Janus Henderson PCS Team, as of July 14, 2021. For illustrative purposes only. The above scenario is based on a consultation with a single advisor; the portfolios are presented as hypothetical. Janus Henderson does not actively manage this product or strategy.

The sustainable asset allocation is inconsistent with the traditional asset allocation and creates a meaningful return divergence. We do not feel that either model’s returns in this example are necessarily “good” or “bad,” but our concern is that they are very different – and this difference can create major headaches when managing client expectations.

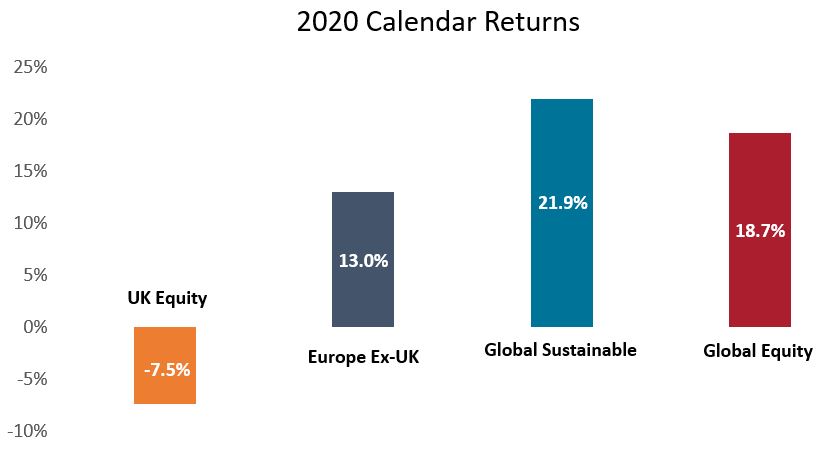

The scarcity of sustainable regional equity strategies is likely the key reason for the sustainable model being underweight regional equity strategies and overweight global equity strategies. This introduces meaningful return differentials, as shown in Figure 3.

Figure 3: Regional vs. Global Equity – 2020 Returns

Source: Janus Henderson PCS Team, Morningstar. Aggregated calendar returns in 2020 (GBP) of global sustainable equity, Europe ex-UK, UK equity and global equity Morningstar categories, reported as of July 2021. Past performance is not a guide to future performance.

The unfortunate reality today is that selection is still limited for many portions of financial professionals’ sustainability asset allocation, both in the U.S and globally. There is a ubiquitous need for more sustainable portfolios and professional model portfolio solutions.

For financial professionals building sustainable model portfolios, appropriate risk management tools and asset allocation perspective are indispensable in limiting unintended asset allocation tilts, biases, drifts and other risks. These, in our view, are important considerations in maintaining asset allocation risk consistency across model portfolios and finding a sustainable method to accomplish clients’ sustainable investing goals.

The Janus Henderson PCS Team is available to financial professionals for customized model portfolio consultations. The team and its proprietary portfolio analysis capabilities provide support based on a whole-of-market view, focused on your needs and goals. We would be delighted to discuss in more detail the services the PCS Team can offer. Please visit the PCS section of our website or speak to your usual Janus Henderson representative.