Subscribe

Sign up for timely perspectives delivered to your inbox.

With valuations high and the global economy reopening, Dan Siluk and Jason England argue that investors should take an orderly and methodical approach in assessing what’s next for the bond market.

The trajectory of interest rates in 2021 has been notable for how rapidly they priced in economic recovery and then, beginning in mid-June, the degree to which that view was tempered. Both instances, in our view, are examples of the market getting ahead of itself. We, too, expected rising rates in the wake vaccination approvals, economic reopening and the expansion of fiscal stimulus, but by March, U.S. Treasuries yields had already climbed to levels we expected to see only at year-end. While this summer’s rally in rates likely reflected inflation being transitory, the unwinding of bearish positions put in place as the global economy reopened also likely played a part as traders sought to stem losses. In both cases, we believe the lesson for investors is – in the parlance of the Federal Reserve (Fed) – to act in a “methodical” and “orderly” manner, and not get too far ahead of the data.

Looking forward, the path of neither the economy nor monetary policy is set in stone. Policy makers have a needle to thread. On one hand, forward-looking indicators such as U.S. purchasing manager indices and capital goods orders denote a strengthening economy. On the other, nearly seven million U.S. jobs lost during the pandemic have yet to return. Given the Fed’s prioritization of achieving full employment, and its willingness to allow inflation to run above its 2.0% target to do so, we believe the central bank will continue to err on the side of dovishness.

[caption id=”attachment_394159″ align=”alignnone” width=”495″] Source: Bloomberg, as of 28 July 2021.[/caption]

Source: Bloomberg, as of 28 July 2021.[/caption]

By taking this path, the Fed would prove that it learned from past missteps, such as what led to 2013’s “taper tantrum.” But unlike the Global Financial Crisis, where markets had to sop up an ocean of bad debt, the recovery from the pandemic finds the global economy on relatively solid footing. As such, we believe – again borrowing from Fed vernacular – a “transparent” plan on tapering assets will soon be put forth, perhaps by the end of the year. Regardless of when an announcement is made, our expectation is that no changes to the Fed’s asset purchase program will occur before the first quarter of 2022.

Transparency does not mean that policy won’t potentially present surprises. Nine years ago, the median estimate of the long-term policy rate by Fed officials was 4.25%. By 2016 it had fallen to 3.0%. It presently sits at 2.5%.1 We believe it could go even lower. Driving our view are demographic headwinds and the disinflationary effects of technology. Also likely to exert downward pressure is the expansion of government debt. While this inches toward the Rubicon separating monetary and fiscal policy, Fed officials are keenly aware of the harm that would be caused to government finances should the Treasury have to service current debt loads at borrowing costs closer to their historical average.

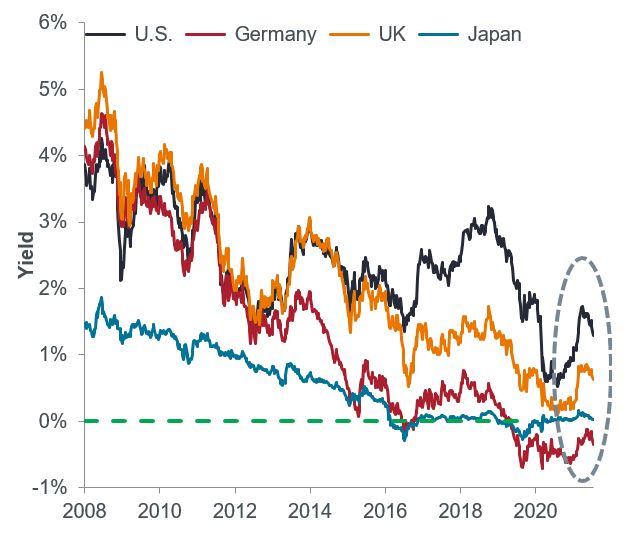

As is often the case, future U.S. monetary policy will have knock-on effects far from American shores. The management of COVID-19 and its variants have been uneven across geographies. Certain economies are experiencing robust recoveries and others are dealing with rising inflation from surging commodities prices. Even if the rationale for tightening builds, other countries’ central banks would be loath to raise rates before the Fed out of concern over currency appreciation weighing on exports. Despite the sway held by U.S. monetary policy, we believe the dispersion in economic recoveries and policy responses creates opportunities for bond investors willing to cast a wide net. In fact, a geographically diversified bond portfolio may be one of the few tools left for investors attempting to generate income and preserve capital in an otherwise challenging fixed income environment.

[caption id=”attachment_394170″ align=”alignnone” width=”530″] Source: Bloomberg, as of 16 July 2021.[/caption]

Source: Bloomberg, as of 16 July 2021.[/caption]

With yields at current levels, only the slightest dip in bond prices can overwhelm coupons, resulting in negative annual returns. Consequently, we believe duration management will be paramount in the months ahead. Shorter-dated bonds in countries that may feel compelled to raise rates should be treated with caution while higher-yielding, longer-dated securities could remain stable and possibly enjoy a degree of capital appreciation if inflation indeed proves transitory.

1Source: Bloomberg, U.S. Federal Reserve, as of 28 July 2021