Subscribe

Sign up for timely perspectives delivered to your inbox.

The process for selecting U.S. equity options for defined contribution menus is fairly standardized across the industry, but there is far less agreement around which asset classes should be represented in the international equity category. Senior Portfolio Strategist Lara Reinhard and Head of Defined Contribution and Wealth Advisor Services Matt Sommer discuss how plan advisors may want to approach this decision with their investment committees.

One of the core services plan advisors provide to their clients is selecting which asset classes should be represented in a defined contribution plan menu. According to an analysis by BrightScope and the Investment Company Institute, the average number of investments available in a typical core menu is 21, including a target-date series as a single option.1 This number reflects the delicate balancing act of providing participants who wish to make their own selections adequate choice to build a diversified portfolio, but at the same time not overwhelming the very same participants with too many options, or the investment committee with unnecessary due diligence.

When it comes to U.S. equity, there are two primary conventions adopted by most advisors. One approach is to simply fill the Morningstar style boxes to create a growth, blend and value option for large-, mid- and small-cap categories. A more parsimonious approach is the so-called “T” convention of offering a growth, blend and value option for large cap but only a blend option for mid and small cap (these five options visually represent the letter “T” in the Morningstar style box). Both approaches are sound and offer a logical starting point for developing a core menu.

There is far less industry agreement, however, regarding which asset classes should be represented in the international equity category. Modern portfolio theory suggests that international investing offers diversification benefits, allowing participants to earn greater risk-adjusted returns. Research in behavioral finance, however, suggests that investors are not rational and tend to fall into traps such as performance chasing and loss aversion. Despite these challenges, there is little disagreement that international options should be offered; the dilemma for plan advisors and sponsors is which options and how many asset classes.

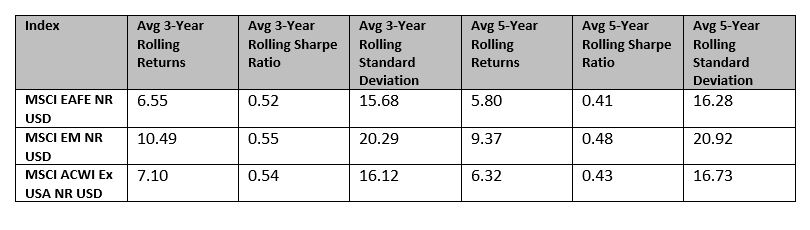

Expanding on the excellent work done by Chun and Gautam, we compared the rolling three- and five-year performance numbers for the MSCI EAFE (developed), MSCI EM (emerging market) and MSCI All Country World Index (developed and emerging market). The results, illustrated below, led us to a similar conclusion as Fidelity’s: The benefits of emerging markets are clear but may be best suited as part of a broader international option.

Source: Morningstar, as of 30 June 2021.

For advisors interested in exploring this methodology, the next question surrounds implementation. In our view, a foreign large-cap blend strategy that includes a meaningful, but measured, emerging market exposure is ideal. As an added benefit, by eliminating the emerging market standalone option, plan advisors could use that “slot” to recommend other strategies that are likely on the minds of investment committees, such as inflation-protection and ESG alternatives. Some plans might even consider consolidating their foreign large-cap growth and value options into foreign large-cap blend, although there is a similar rationale for offering all three foreign options as there is for offering all three U.S. large-cap equity options: As discussed earlier, there is a delicate balancing act between providing too few and too many options.

There is no right or wrong answer when it comes to 401(k) menu construction; the role of the plan advisor, however, is to educate committee members so they can make thoughtful and deliberate decisions about the plan’s investment options. The total international equity approach is clearly worthy of discussion. At a minimum, plan advisors might wish to add this topic to their clients’ next investment committee meeting.

1“The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans.” BrightScope, Investment Company Institute, August 2020.

The MSCI EAFE Index is an equity index which captures large- and mid-cap representation across 21 Developed Markets countries* around the world, excluding the U.S. and Canada.

The MSCI Emerging Markets Index is a selection of stocks that is designed to track the financial performance of key companies in fast-growing nations.

The MSCI All Country World Index (ACWI) is a stock index designed to track broad global equity-market performance.

This information is not intended to be legal or fiduciary advice or a full representation of all responsibilities of plan sponsors and financial professionals.