Subscribe

Sign up for timely perspectives delivered to your inbox.

Research shows that plan sponsors are committed to their employees’ financial well-being, but the options available in plan menus often fall short – particularly when participants leave assets in the plan when they retire. Retirement Director Ben Rizzuto discusses the importance of providing adequate diversification and drawdown strategies through the decumulation phase.

A recent survey by Cerulli Associates found that 84% of plan sponsors with more than $500 million in plan assets would prefer that former employees who have retired keep their savings in the plan, rather than rolling money into an IRA.”1 This is not necessarily surprising, considering the fact that, with more assets in the plan, plan sponsors can negotiate lower fees, which of course is advantageous for participants as well.

That financial well-being includes accumulation, but now also decumulation. So, if plan sponsors truly feel committed to helping employees succeed in retirement, they need to consider how their plan menu can help participants achieve their goals. And that starts with making the option of staying in the plan attractive.

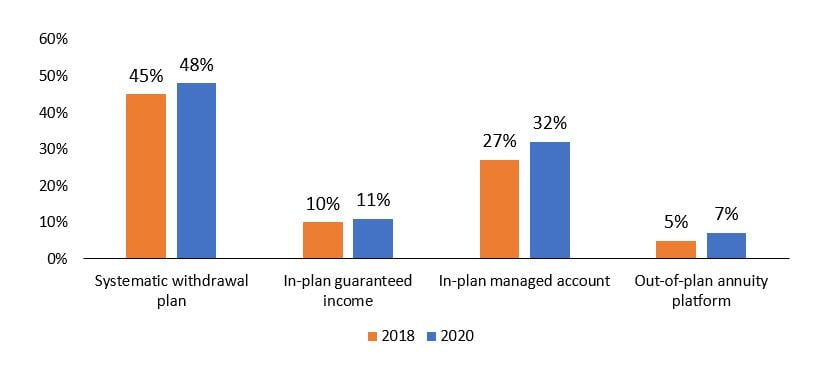

One critical step in that direction is to make decumulation and drawdown solutions available. Indeed, we are seeing more plans utilizing managed accounts for this purpose, as well as the guaranteed income product safe harbor provided by the SECURE Act. But as you can see below, those options may not yet be available to a good portion of participants.

Plans Offering an Income Creation Product/Strategy

Source: PLANSPONSOR 2020 DC Survey, Janus Henderson Investors, as of October 2020.

Based on the figures above, which we highlighted in our first-quarter Top DC Trends and Developments report, it seems that the easiest way to make staying in the plan attractive is to provide a systematic withdrawal plan or managed account. Both options effectively make the retirement plan a one-stop shop for participants in which they can accumulate assets during their careers and then draw down on those assets as they age and leave the workforce.

But what plan sponsors need to remember is that these options utilize the investments currently available within the plan menu. Participants can schedule ongoing withdrawals for a percentage of plan assets, but those amounts – and, most importantly, how long they last – are a function of a participant’s account balance. That balance is going to be invested in the options available within the plan, and as the Cerulli report notes, it’s important for a plan to provide “an investment opportunity set that allows for the appropriate investment and drawdown strategy in retirement.”

If plan sponsors are committed to supporting their participants’ financial well-being and would like them to stay in the plan after they retire, they have a responsibility to create a plan and plan menu that meets those needs.

The first step is to review the plan menu with the assumption that participants may leave assets in the plan. If they do, how will they allocate their assets as they age? If their allocation becomes more conservative as they age, either through their own discretion or via a managed account, what funds will they be allocated to? And finally, will those funds provide the ability to withstand future risks such as inflation, market downturns, etc.?

The first step is to review the plan menu with the assumption that participants may leave assets in the plan. If they do, how will they allocate their assets as they age? If their allocation becomes more conservative as they age, either through their own discretion or via a managed account, what funds will they be allocated to? And finally, will those funds provide the ability to withstand future risks such as inflation, market downturns, etc.?

These are the issues many plan sponsors may at least be aware of, but through our research with the American Retirement Association, we identified additional risks that are often overlooked. These include overlap (not offering plan participants investment options with distinct and complementary exposures) and the failure of traditional measures in assessing risk for fixed income categories. While these potential risks may not be evident to plan sponsors, we feel they are critical considerations when thinking about how to create a better plan menu.

1“Personalized Retirement Income Solutions to Play Central Role in Retiree-Friendly DC Plans.” Cerulli Associates, June 22, 2021.

This information is not intended to be legal or fiduciary advice or a full representation of all responsibilities of plan sponsors and financial professionals.

Janus Henderson is not affiliated with American Retirement Association.