Subscribe

Sign up for timely perspectives delivered to your inbox.

Diversified alternatives portfolio managers Andrew Kaleel, Mathew Kaleel and Maya Perone discuss the impact of rising rates on traditional asset classes and trend-following strategies.

Since the COVID-related sell-off in the first quarter of 2020, global governments have deployed record stimulus packages to underpin both Wall Street and Main Street, using a combination of direct subsidies to corporations and cash injections to consumers. Central banks have also collectively moved away from a policy of inflation targeting toward one seeking higher levels of sustained inflation.

In its release to the market on 17 March, the US Federal Reserve clearly articulated this objective:

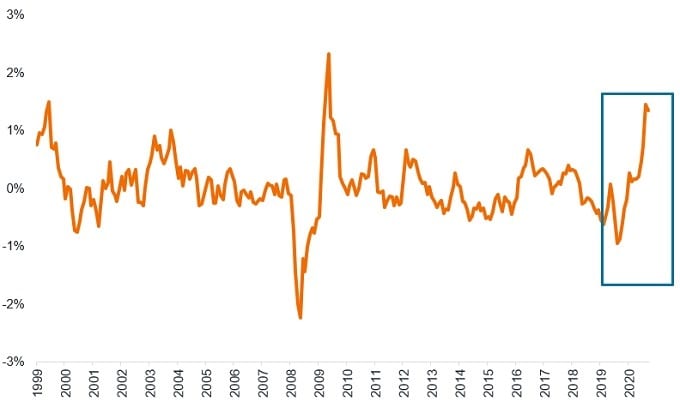

This policy, echoed by other major central banks, can be understood as a desire for global central banks to achieve higher sustained levels of price inflation. While short rates have remained near-zero bound and may for some time, the change in central bank policy has led to increases in long-term rates and inflationary expectations. The US 10-year breakeven rate (year-on-year) has surged to levels not seen for well over a decade (Exhibit 1).

Only time will tell as to whether this targeting of higher levels of inflation is both achievable and manageable; however, this has broad-based implications for asset classes. A repricing of longer-term interest rates will affect portfolios sensitive to equity and bond market beta, particularly if this leads to a sustained period of higher inflationary outcomes, as was the case in the 1970s. This also raises the question of the performance of various asset classes in response to changes in long-term interest rates.

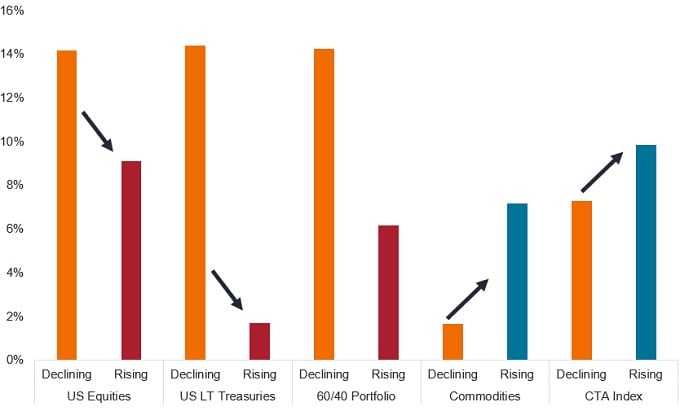

For the purpose of this analysis, we will consider the performance implications of falling and rising interest rates on four distinct asset classes; US equities (S&P500), US bonds (Bloomberg Barclays US Treasury Long Index), commodities (Bloomberg Commodity Total Return Index) and trend following strategies (Barclays CTA Index) from January 1981 to April 2021. This period is relevant as the Barclays CTA Index, launched in January 1980, incorporates the longest public track record for broad-based CTA returns. Results are shown in Exhibit 2.

Unsurprisingly, the impact of changes in interest rates for both stocks and bonds is inversely correlated to changes in interest rates, with equities pricing factoring in lower or higher discount rates. Bonds and equities exhibited similar outcomes, with higher relative returns in declining rate environments and lower returns in periods of rising rates. This is reflected in the long-term performance of a 60/40 portfolio of US stocks and bonds, which generated higher (lower) returns in periods of falling (rising) rates (14% per annum vs 6% per annum respectively).

The impact on returns for commodities and CTAs varied from that of stocks and bonds, with both exhibiting a higher positive sensitivity to rising interest rates. This is intuitive for broad-based commodities, which are sensitive to global growth and are one of the drivers of inflation – and hence have an impact upon monetary policy.

An analysis of CTA returns highlights the diversification benefits of this asset class during the same period, providing interesting considerations from a portfolio construction perspective. This differentiated pattern of returns is reflected in a low correlation of the CTA Index to equities (0.00), bonds (0.12) and the 60/40 portfolio (0.05). Whilst CTA returns have benefited from long positions in bond markets over the last three decades (that was the trend and the trade to be in), other sectors have contributed more strongly to performance in periods of rising interest rates. Intuitively, during rising interest rate periods, we would expect to see commodities rallying and bond prices falling. This has, notably, been the case over the past six months (to 31 May 2021), with short bond positions making a large contribution to positive returns.

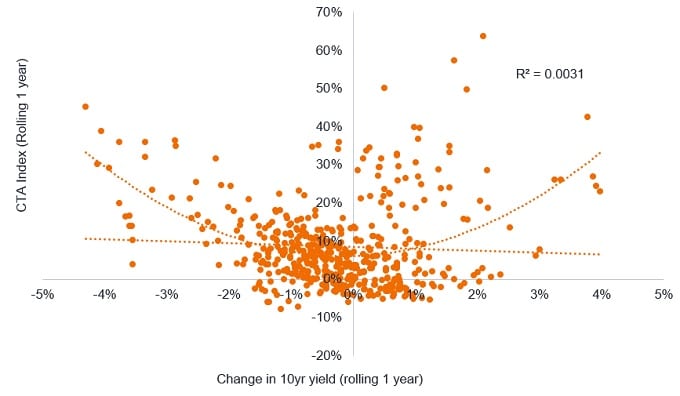

A deeper dive into the return profile of CTAs compared to bonds highlights some interesting characteristics, particularly under differing interest rate regimes. Regressing the returns against changes in 10-year yields, the CTA Index provides a convex as opposed to linear relationship (R2 of 0.003) to the direction of interest rates (Exhibit 3). This contrasts with both equity and bond markets, which showed higher sensitivity to shifts in interest rates.

The lack of a linear relationship between CTA returns and the direction of interest rates can be explained by a few key characteristics of trend-following, including:

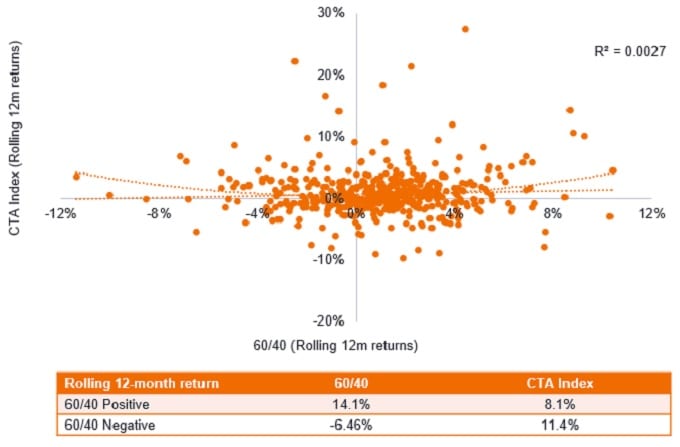

Exhibit 4 shows the monthly returns of a 60/40 portfolio plotted against the returns in the same month for the trend index. The upper-left quadrant shows the returns of trend following in months when 60/40 returns are negative. This graph is famously known as the ‘CTA Smile’ reflecting the shape of the line of best fit through the data points. It highlights that trend following has historically performed well in periods where stocks, bonds and 60/40 are negative.

The spectre of rising interest rates and increasing inflation, supported by central banks globally, is forcing investors to consider the impact on traditional asset class returns. Rising rate regimes have historically resulted in lower return outcomes for bonds and equities, thus highlighting the importance of more dynamic and effective portfolio diversification. The historical return pattern of trend following, with its potential to add value in rising rate environments and low correlation to equity and bond markets, suggest consideration for a traditional portfolio. While this article considers the potential benefits of including an allocation to trend following, the question of how much to allocate is a topic that will be covered in a future article.

—–