Subscribe

Sign up for timely perspectives delivered to your inbox.

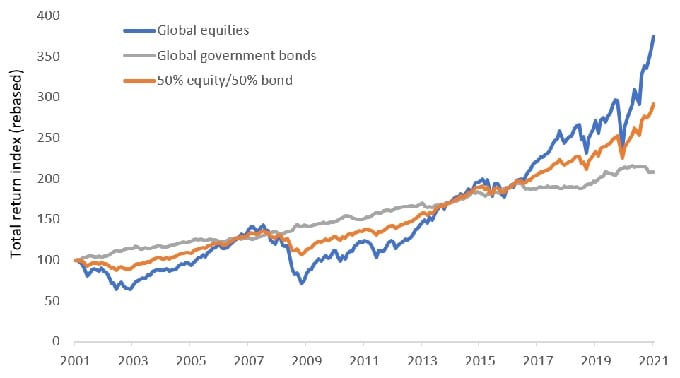

Traditional asset allocation strategies, splitting a portfolio between equities and bonds, have been a great tool for investors over the past decade – and even more so over the past year (Exhibit 1). Equity markets rallied hard in response to stimulus from central banks and governments worldwide, helping to dispel the visceral fear that gripped markets in late February 2020, in the early stages of the pandemic. At the same time, allocations to bonds helped to mitigate the worst of the market falls we saw during that intense and emotional few weeks.

Source: Refinitiv Datastream, 1 April 2001 to 30 April 2021. Rebased to 100 at start date. Past performance is not a guide to future performance.

Source: Refinitiv Datastream, 1 April 2001 to 30 April 2021. Rebased to 100 at start date. Past performance is not a guide to future performance.While the intervention of government and central banks provided some surety that those businesses and sectors worst affected by lockdowns would survive, we saw another significant turning point in November 2020. Markets responded positively to news of Pfizer’s vaccine breakthrough, the US election and an eleventh-hour agreement between the UK and EU over the shape of their post-Brexit trade relationship. Throughout this period, strategies built around a simple allocation between equities and bonds were able to deliver a positive, risk-adjusted return for investors. But will these strategies be fit for purpose over the next decade?

The demand for perceptually secure ‘safe haven’ investments during the pandemic era has been as strong as it has for more economically sensitive (riskier) assets, leaving prices looking expensive for both major asset classes.

For bonds, the amount of negative-yielding debt globally has been in record territory, passing US$18 trillion for the first time in early December 20201. While recent inflationary drivers may turn out to be transient, given current 5y5y inflation swap rates, it seems likely that we will see at least a slightly higher inflationary environment than we have become used to in recent years. If this proves to be the case, the end of this era of negative bond yields may be on the horizon.

Similarly, equities are priced at heightened levels, with the Shiller price-earnings (P/E) ratio for the S&P 500 at 31x earnings at the end of April 2021. If we consider these P/E levels from an historical perspective, this would suggest an implied return on capital of approximately 4% per annum2 – a relatively low level.

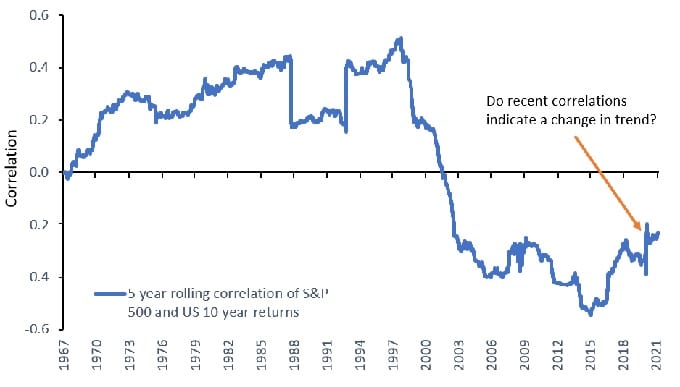

The inverse correlation between equities and bonds has been a central tenet of asset allocation since the start of the 21st Century. However, history shows us that this seemingly reliable source of diversification is not something that should be taken for granted (Exhibit 2). The scale of government and central bank intervention, among other factors, has pushed the relationship between bonds and equities into uncertain territory.

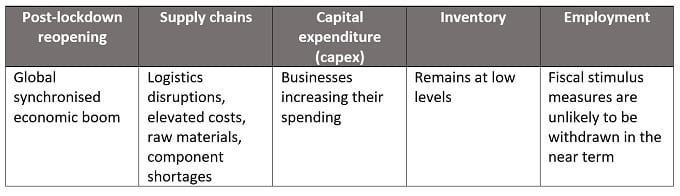

At the heart of the inflation argument is the availability of vaccines with high levels of efficacy. Inflationary datapoints are expected as economic restrictions ease, supply chains for goods and services normalise, businesses start spending once more, and as consumer spending picks up, although inflation data is likely to vary between countries, as we have seen. It is also unclear what the long-term price response in a number of industries will be to exceptional fiscal and monetary stimulus (Exhibit 3).

The inflation debate is not over, but the impact of unsynchronised bouts of inflation invites questions as to what alternative strategies investors can leverage in order to manage risk across their portfolios at this stage in the cycle. Aside from the direct consequences of monetary tightening (higher interest rates) on demand and prices for bonds, the volatility of an equity and fixed income portfolio increases significantly when prices are positively correlated.

A well-diversified, liquid absolute return strategy can offer improved diversification benefits for a balanced portfolio, opening up differentiated drivers of performance (uncorrelated returns), and the ability to position advantageously for perceived uncertainties. The experience of the past year shows us that stock fundamentals can be rewarded on both the long and short side, despite the macro uncertainty. We have also seen a rise in stock dispersion over the past few months across sectors. Many businesses have been trading together in the same sector, often erroneously, and their varying capacity to negotiate prices, or pass on higher raw materials costs, for example, is opening up some interesting pair opportunities.

In our view, there is some real relative and absolute value to be found in markets at a geographical, sector and industry level, but also areas that have perhaps been too loved, for too long. Dominant technology businesses have been driving markets for much of the past decade, but many other areas have been left behind. Should we see a change in focus towards more social outcomes, there is a chance that the winners and losers over the next ten years could be very different.

1https://www.bloomberg.com/news/articles/2020-12-11/world-s-negative-yield-debt-pile-at-18-trillion-for-first-time

2Bloomberg, JP Morgan, as at 30 April 2021. Past performance is not a guide to future performance.