Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Aneet Chachra ponders the question of who is putting money into long-duration bonds at today’s ultra-low rates.

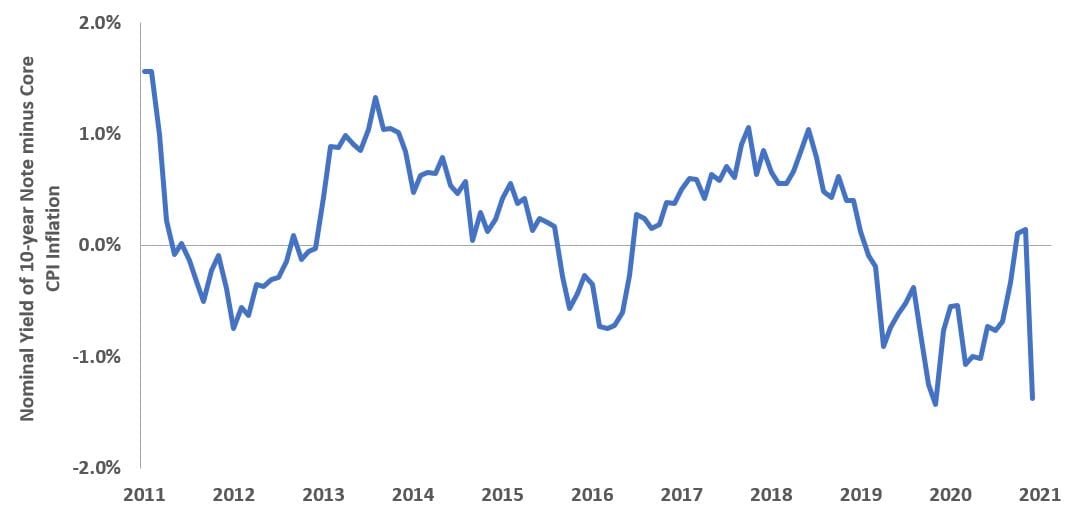

The pandemic is now receding, equity markets are near record highs, and inflation has spiked. The biggest market mystery is why long-dated bond yields are still low. It’s extraordinary. The chart below shows U.S. real rates (10-year nominal minus core Consumer Price Index). Real rates averaged +0.1% over the last decade. It makes sense that 10-year bond yields have roughly tracked inflation. But the real 10-year yield is now -1.3%, far below inflation.

[caption id=”attachment_380749″ align=”alignnone” width=”1074″] Source: Bloomberg, as of 30 April 2021.[/caption]

Source: Bloomberg, as of 30 April 2021.[/caption]

Even assuming the recent core inflation surge to +3.0% year over year is transient, annual inflation forecasts for the next decade range from 2.3% (consensus) to 2.5% (market implied breakeven). Buying a 10-year Treasury at current 1.6% nominal yield implies a base case -0.8%/year loss in purchasing power for each of the next 10 years. And the U.S. is a positive outlier as 10-year rates in Japan/Europe are even lower at around zero. No wonder nearly everyone hates long-dated bonds at these low yields.

The obvious answer to this mystery is “It’s the Fed, stupid”. But that can’t be the entire explanation. U.S. Treasury gross issuance is $6.68 trillion year-to-date (January to April 2021). Bills (<1 year to maturity) account for $4.95 trillion, with $1.73 trillion coming from notes/bonds (2 to 30 years to maturity). The Federal Reserve has bought about $320 billion in notes/bonds year-to-date, leaving about $1.4 trillion to be absorbed by other holders. So, there are plenty of buyers willing to reinvest and/or allocate further into Treasuries at below-inflation yields. Who are they?

Several years ago, my wife and I started contributing to a 529 educational savings plan for our two kids. Given the long time horizon and high tuition inflation, I selected the aggressive allocation option. But when I recently checked the quarterly statement, I noticed the account was in a mix of equity and bond funds. As our kids got older (they are now 9 and 11), the provider automatically moved them into a 70% equity/30% bond allocation. And as equities rallied over the past year, the plan periodically sold stocks and bought bonds to maintain the target ratio.

It turns out that I’m among the investors buying low-yield bonds. Also, about 5% of the account is allocated to a diversified international bond fund. Roughly 60% of its holdings are in Japan/Europe, so we’ve been inadvertently investing 3% of our kids’ educational savings in no-yield bonds.

In this 529 plan, I can override the pre-set allocation rules and choose a different weighting to stocks and bonds. But I still have two uncomfortable choices. With stocks I take the risk that they decline sharply in value immediately before our kids start college. With bonds I’m accepting a likely below-inflation return.

Usually stocks and bonds are the only options available in systematic plans – alternatives are rare. Everyone in a target-date, balanced or similar fund will likely end up with meaningful bond holdings regardless of yield, especially when liabilities approach.

I was wondering who puts money into long-duration bonds at ultra-low rates.

Unexpectedly, the answer was me.