Subscribe

Sign up for timely perspectives delivered to your inbox.

Recent fiduciary breach lawsuits have centered around investment options in retirement plan menus being either too conservative or too aggressive. Retirement Director Ben Rizzuto discusses potential ways to find a middle ground that is better suited to participants’ needs and goals.

In a recent blog post, I covered what I expect will be two growing areas of focus in fiduciary breach lawsuits. One of those areas was core investment menus and their makeup, and I recommended that investment committees get more comfortable wading into the minutia when it comes to the investments being offered to plan participants.

Now I’d like to delve a little deeper on the subject by looking at two specific court cases. In terms of plan menu options being too aggressive or too conservative, these cases sit at both ends of the spectrum. And while the middle ground is quite wide, there are lessons to be learned that investment committees can use to improve their processes and create plan menus that are “just right” – or at least better suited to participants’ needs and goals.

The first case is Toomey v DeMoulas Super Markets.1 This is a supermarket chain in New England that has a profit-sharing money purchase plan that is trustee-directed, which means the plan’s trustees makes investment decisions on behalf of the employees in a pooled account.

The main issue that arose in this case was that the allocation put together by the trustees was said to be too conservative, in that 70% of plan assets were allocated to domestic fixed income options. While the plan’s investment policy statement (IPS) did call for 70% of the plan’s assets to be allocated into domestic fixed income options and 30% into equities, the complaint noted that this “one-size-fits-all” investment strategy was inappropriate. Further, it was not only deemed inappropriate for younger participants who were decades away from retirement, but also for those participants who were closer to retirement, who would need plan assets to last for decades in retirement and would thus require greater capital appreciation.

This case was settled in late 2020. Terms included a monetary component of $17.5 million as well as non-monetary components to address the opportunity for growth allegation. Those components included limiting the amount of plan assets that could be held in cash or cash equivalents to 10% or less and modifying the plan’s IPS to increase the annual return target by 100 basis points.

On the other end of the spectrum we find the Fleming v Rollins case.

One of the main and most novel allegations in this case is that the defendants, which included both the plan sponsor and advisor, “failed to diversify the investments of the plan to minimize the risk of large losses.” This allegation focused on the plan’s core menu, which included a total of 12 mutual funds.

There were two main issues at play with this case: First, of those 12 options, there was only one fixed income option – an intermediate core bond fund – available to plan participants. The complaint noted that because there was just this one option, “participants had no other low correlation bonds to choose from (short term, long term or international bonds) or other low-correlation investment choices (REITs, emerging market, etc.).”

Based on these two issues, participants were said to have been exposed to harm and continued future losses.

In their dismissal motion responding to these allegations, the defendants put forward five main arguments why the suit should be rejected. And while this case was dismissed in late 2020, the dismissal ruling only spoke to the first argument – that plaintiffs did not exhaust their potential administrative remedies before filing the case. It did not speak to the investment-related issues, which means they could come up again in the future.

Again, these two cases sit at opposite ends of the overly conservative/overly aggressive spectrum And while it may never be possible to create the “perfect” plan menu – especially when each participant may be allocating differently to each investment option offered -is there some way we can at least do better? I believe there is. Let’s take a look at potential ways to improve both the equity and fixed income lineups in plan menus.

Most line items in plan lineups are filled with equity funds. This makes sense for a long-term investment vehicle, but where might we improve things? One way is by looking at what options are currently offered to plan participants. A 2019 study by Brightscope and Erisapedia.com showed the number of plans that offered different asset classes within plans.3 Looking at domestic equity, as you might expect, most of the style boxes (growth, blend, value, small, medium and large) are generally well represented. However, two cases where we don’t see as much usage is in small- and mid-value funds, which were offered by 56% and 59% of plans, respectively.

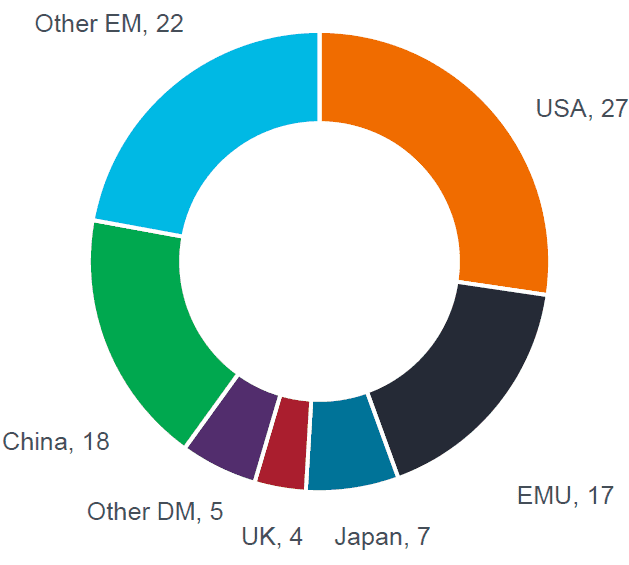

On the international side of the ledger, home bias seems to be at play in many plans, as fewer line items are devoted to international equities overall. According to the study, foreign large growth (64%) and foreign large blend (63%) are offered most often, followed by diversified emerging markets (52%), world large stock (34%) and foreign large value (14%). This leaves a relatively wide swath of the world that may not be offered, which means participants could be missing out on potential diversification and return opportunities.

[caption id=”attachment_377493″ align=”alignnone” width=”450″] Source: JP Morgan, Janus Henderson Investors, as at 21 October 2020.[/caption]

Source: JP Morgan, Janus Henderson Investors, as at 21 October 2020.[/caption]

While each participant base is different and each investment committee needs to decide how to allocate line items to a fund, it seems that these are a couple of areas that may be worthy of review.

In my view, more can and should be done here to provide participants the ability to diversify during their mid- and late-career phases. Plus, in an environment where low interest rates will likely continue to be the norm and inflation is a growing concern, having fixed income options that span the spectrum seems prudent. This is especially true when looking at weekly return distributions for the Bloomberg Barclays U.S. Bond Aggregate and High Yield indices. Most people aren’t surprised that high yield has a higher percentage of negative weeks (22%) based on its inherent risk, but what some may find surprising is that the U.S. Bond Aggregate index has a similar ratio, with 19% of weeks being negative.

The question plan sponsors need to consider based on this information is, does this type of return pattern meet the expectations of participants when they think of “fixed income”? This question is especially pertinent when reviewing what might be a small number of fixed income options.

One way to potentially improve fixed income offerings in plan menus is adding a multi-sector bond fund. We can also revisit the complaint from the Rollins case, which cited short-term, long-term or international bonds and REITs and emerging markets as low-correlation investment choices that were lacking from the investment menu.

One way we have thought about this is through a framework that uses five fixed income options, as shown below.

By utilizing this framework, plan sponsors can find options that meet their specific participant populations’ demographics and provide better long-term diversification opportunities.

While the two lawsuits highlighted here may be outliers, they could potentially open new avenues for lawyers looking to sue plan sponsors for alleged fiduciary breaches. This means plan sponsors must now consider how to guard against these lawsuits by reviewing and possibly rationalizing their plan menus. That could mean more international equity exposure expanding the opportunity set in fixed income, or both. Either way, this exercise should push plan sponsors to more deeply consider their plan menus to better ensure they offer participants the ability to diversify over the course of their careers.

1Toomey v. DeMoulas Super Markets, Inc., D. Mass., No. 1:19-cv-11633.