Subscribe

Sign up for timely perspectives delivered to your inbox.

Higher prices are putting a damper on all Americans’ post-pandemic plans, but retirees on a fixed income are particularly hard hit by inflation. Head of Defined Contribution and Wealth Advisor Services Matt Sommer discusses how financial professionals can help clients cope while still keeping them on track to their long-term goals.

The recent spike in prices for everyday goods and services is being felt nationwide. The most recent 12-month Consumer Price Index inflation number of 4.2% was considerably higher than expected and was the largest increase in 13 years.1 The biggest contributor to this inflation number was energy, with prices rising 25%. As the country exits the COVID-19 pandemic and people plan vacations, they must contend with more expensive gasoline prices and airline tickets.

The impact on rising prices hits retirees the hardest, particularly those on a fixed income. Higher prices result in a drop in real income. Without making any adjustments, retirees will enjoy fewer goods or services despite their nominal income remaining the same.

Fortunately, the majority of economists predict this bout with inflation is transitory, which means prices could stabilize by 2022. In the meantime, retirees may be wondering how today’s more expensive world impacts their short- and long-term retirement budget.

Financial professionals and individual investors are keenly aware that one of the worst possible outcomes is to run out of money later in life. Another negative outcome, but one that receives less attention, is not spending enough money in retirement. Consumption of goods and services has been found to positively impact satisfaction (up to a point). Many retirees may be presently experiencing lower levels of satisfaction as higher prices have effectively hampered their ability – or willingness – to purchase what they may want and need.

The good news is the financial planning process accounts for the impact of inflation. Most financial professionals adjust retirement income by 2% to 3% annually to account for higher prices over time. But in reality, clients almost never ask for their annual cost-of-living adjustment, nor are systematic withdrawal plans automatically increased. Instead, retirees typically withdraw a constant amount each year, with upward or downward adjustments for unexpected occurrences or as needed.

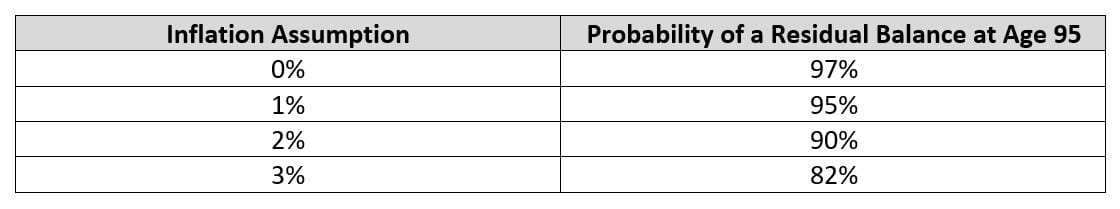

Consider an example: A 65-year-old has $1,000,000 of investable assets and an annual income need of $60,000. Let’s assume the portfolio is allocated as follows: 50% equities, 30% fixed income and 20% cash. The return assumptions are 7%, 3%, and 2%, respectively. Using a Monte Carlo simulation with 5,000 trials, the probability of a residual balance at age 95 is calculated in the chart below. For simplicity purposes, income taxes are ignored.

[caption id=”attachment_376228″ align=”alignnone” width=”1120″] Source: retirementsimulation.com[/caption]

Source: retirementsimulation.com[/caption]

Assuming a 3% inflation rate, the client has about a four-in-five chance of not running out of money before age 95. These results reflect a reasonable approach as most financial professionals target a success rate between 80% and 90%. This plan, however, is based on increasing the initial $60,000 income need by 3% annually. As discussed earlier, that rarely happens. The inflation assumption adds a degree of conservativism into the analysis, allowing for additional withdrawals when circumstances warrant, such as today.

Similar to how financial professionals check in with clients following a substantial stock market downturn, we encourage the same approach regarding how retired clients are coping with inflation. Simply start the conversation by asking, “How have higher gas and food prices impacted you?” For clients who have engaged in the financial planning process, you can explain that “we planned for times like this,” and if needed, they can withdraw more than planned to meet their upcoming expenses.

Of course, if higher inflation becomes the new normal, the entire financial plan may need to be revisited. In the meantime, you can let clients know you are thinking about their day-to-day needs and offer some welcome news – a recommendation to increase their withdrawals for the time being so they can enjoy a more comfortable lifestyle.