Subscribe

Sign up for timely perspectives delivered to your inbox.

No one talks about enhanced index strategies anymore. At the turn of the century, enhanced index strategies were wildly popular and formed the foundation of global equity structures for U.S. institutional investors. A typical core-satellite structure would combine enhanced index strategies with actively managed growth and value satellite strategies. Fast-forward two decades – passive equity strategies have basically replaced enhanced index strategies as an anchor in equity structures. Some have gone one step further and have replaced their entire global large- and mid-cap equity allocations with passive equities because, in their opinion, active management does not pay in the long-only large and mid-cap equity space.

If one could not reliably count on enhanced index management to deliver consistent excess returns over beta returns, then it absolutely made sense to go the passive route. Why pay active management fees for unreliable and, sometimes, meaningfully negative excess returns? The fact that one paid lower active management fees for enhanced index strategies was no consolation when excess returns turned meaningfully negative. Notwithstanding, while going passive aligned the fees paid (very low) with the type of returns received (beta returns), it did nothing to address a higher order question that institutional investors have been asking:

Where can we get high enough returns to meet the required rate of return necessary to fulfill future benefit obligations or spending needs?

Their group behavior speaks volumes about their current beliefs around future equity returns. The fact that institutional investors have been reallocating capital away from public equities to private equities indicates they do not believe they can meet the required rate of return solely from listed equity beta returns.

But, what if one can improve the odds of closing the return gap of roughly 100 basis points between the plan level assumed rate of return (7.26%1) and the beta return of U.S. equities (6.0% to 6.5%2) by making passive equity portfolios more structurally efficient? Past enhanced index strategies relied on common stock selection models based on value, earnings growth and revision, price momentum and quality (for quantitative equity-based strategies) or credit spreads and volatility selling (for fixed income-based strategies) to eke out small excess returns. And they failed because these sources of excess returns individually or, in aggregate, became crowded, ineffective and exhibited negative skew during periods of market stress. Some plan sponsors viewed them as “picking up pennies in front of a steamroller.”

In what follows, we posit a novel enhanced index approach that relies on financial disintermediation alphas to make existing passive equity portfolios more structurally efficient. It materially differs from yesteryear’s enhanced index strategies in two crucial aspects: it does not rely on uncertain and crowded sources of alpha with material drawdown risk during periods of market stress, and it builds on the existing passive equity portfolios that many institutional investors already hold.

In the late ’90s, the likes of BGI (now part of BlackRock) and SSgA’s Advanced Research Center popularized quantitative equity enhanced index strategies, while PIMCO popularized fixed income-based enhanced index strategies.

Quantitative equity enhanced index strategies would not hold the entire basket of stocks in an index, rather, they would hold a diversified subset portfolio of stocks that scored highly in their respective stock selection models. They were often comprised of the following common factors: value, earnings growth and revision, price momentum and quality. Fixed income-based enhanced index strategies would gain synthetic exposure to the underlying index via futures or forwards and invest the unencumbered cash in short-duration, high-quality, investment-grade fixed income portfolios.

The 2008 Global Financial Crisis (GFC) turned the enhanced index world upside down and laid bare their hidden risks. For quantitative equity enhanced index strategies, the value factor stopped working because value companies were deemed most likely to go bankrupt; the earnings growth factor suffered losses when companies with positive earnings growth and revisions sharply revised their earnings downward; the quality factor – that favored companies with positive free cash flows to pay down debt and to buy back shares – was penalized because only those companies that could issue debt or equity at the depth of market despair were deemed quality companies.

To make matters worse, some equity-based quantitative enhanced index strategies invested the proceeds from securities lending in short-term money market funds that invested in high-quality (i.e., purported) asset-backed commercial paper or triple-A structured credit instruments that suffered permanent loss of capital during the GFC. In a similar vein, fixed income-based enhanced index strategies that invested unencumbered cash in shorter-duration, high-quality credit assets suffered material losses due to significant credit downgrades and defaults, lack of liquidity, and seizing up of the fixed income markets. Those that tried to amplify their excess returns by selling volatility experienced even bigger losses.

When many institutional investors requested redemptions at the same time, both equity and fixed income-based enhanced index managers discovered they all held and were forced to sell the same securities precisely at the wrong time. Exhibit 1 illustrates the common experience of U.S. investors in enhanced index strategies surrounding the GFC.

Source: eVestment, Jan 2007 – June 2020.

There is a general agreement among past quantitative equity enhanced index portfolio managers that their stock selection models began going haywire sometime in July 2007 – about a year before the dawn of the GFC. From January 1986 to June 2007, the average excess return of the three largest quantitative equity enhanced index strategies3 shown in Exhibit 1 averaged 6 basis points per month. Contrast that to 2007 and the ensuing four year performances: in 2007, the average lagged the S&P 500® Index by 367 basis points for the year and by 497 basis points from July 2007 to February 2011 (the deepest point of underperformance). The former is equivalent to about 61 months and the latter to about 83 months of average monthly excess returns. And as shown in Exhibit 1, the underperformance did not fully abate until February 2011 – about 3.7 years after the quantitative stock selection models went haywire.

The depth of underperformance was far worse for some fixed income-based enhanced index strategies. From August 1986 to June 2007, the average excess return of the two largest fixed income-based enhanced index strategies4 shown in Exhibit 2 approximated 10 basis points per month. In 2007, the average excess return lagged the S&P 500 Index by about 3.0% and from July 2007 to December 2008, by 21.5% (the deepest point of underperformance).

Source: eVestment, Jan 2007 – June 2020.

It’s no wonder why some investors have equated enhanced indexing to picking up pennies in front of a steamroller.

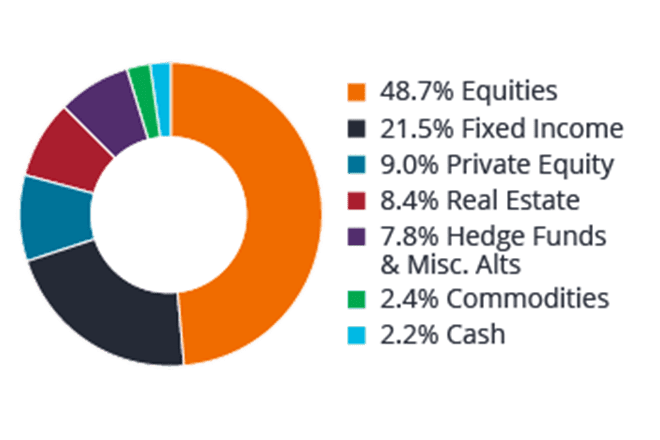

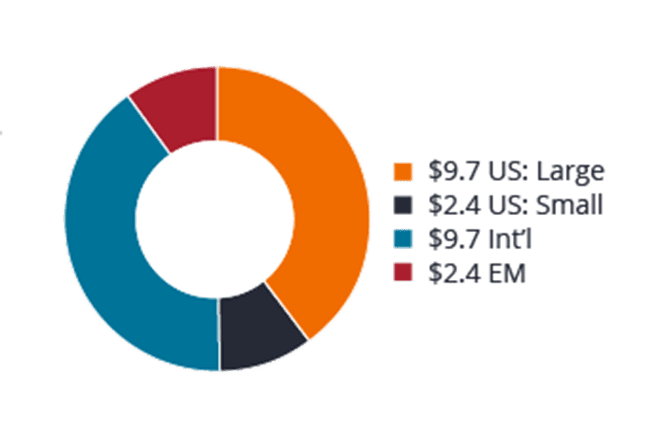

The prevailing advice among U.S. pension consultants is to “go big or go home” when it comes to active long-only equity management. The way this advice has played out is that most U.S. plan sponsors hold passive portfolios in U.S. large-cap equities, a mix of active and passive portfolios in international equities and mostly active portfolios in small-cap and emerging markets. Exhibit 3 illustrates a stylized global equity structure of an average U.S. public plan with $50 billion in plan assets, a 50/40/10 split among U.S., international and emerging market equities, and an 80/20 split between large- and small- to mid-cap stocks.

Source: National Association of State Retirement Administrators (NASRA) Public Fund Survey. Fiscal year end 2018.

As a rule of thumb, in the U.S., enhanced index strategies have historically targeted a tracking error equal to or less than 2.0% – hardly going big in terms of tracking error vis-à-vis a benchmark. What some fail to realize (i.e., purely from an active risk impact at the overall plan level) is that a stylized U.S. public plan with an 80% large-cap equity allocation and an expected tracking error of 2.0% is equivalent to a 20% small-cap equity allocation with an expected tracking error of 8.0%. Likewise, the same large-cap equity allocation with an expected tracking error of 2.0% is no different from the emerging markets equity allocation with an expected tracking error of 8.0% in terms of the tracking error impact at the overall plan level.

However, just because the resultant expected active risk impacts are the same between large-cap, small-cap and emerging market equities allocations, it does not mean their expected excess return targets will be the same. In fact, their excess returns will be different because, empirically, their information ratios (IRs) have been different.

As demonstrated in Exhibit 4, historically, the median IR has been the highest for enhanced index managers even when the results of the COVID-19 crisis and the GFC are factored in. Therefore, even though the tracking error level is meaningfully lower for enhanced index strategies than for active small-cap or emerging market equity strategies, the dollar impact at the overall plan level may be the highest for the former due to higher average IR and much higher dollar allocations in institutional portfolios. Exhibit 5 illustrates this point.

Source: eVestment, for the 15 Years Ended 30 June 2020.| Plan AUM (in $B): $50 | US | US: Large | US: Small | Int’l | EM |

|---|---|---|---|---|---|

| Regional Allocation | 50% | 40% | 10% | 40% | 10% |

| US Allocation | 80% | 20% | |||

| $ Allocation | $12.2 | $9.7 | $2.4 | $9.7 | $2.4 |

| Expected: | |||||

| Tracking Error | 2.0% | 8.0% | 8.0% | ||

| Information Ratio | 0.35 | 0.23 | 0.26 | ||

| Excess Return | 0.69% | 1.81% | 2.11% | ||

| Excess Return in $M | $67 | $44 | $51 |

Note, historical IRs for 15 years ended 30 June 2020.

Source: eVestment and Janus Henderson Investors.

The foregoing makes one question the prevailing advice to “go big or go home.”

History has shown that enhanced index strategies built on stock selection models, traditional style risk premia such as value, momentum and size, fixed income credit risk premium and volatility selling have exposed investors to acute underperformance during periods of market stress. For that reason, particularly in the U.S., institutional investors have shown no interest in going back to the old enhanced index strategies and repeating the same mistakes all over again.

Therefore, to succeed as a return-generating strategy, enhanced index strategies must part ways with the past and rely on persistent but different sources of returns. And, since passive equity portfolios play a prominent role in most institutional portfolios, enhanced index approaches must begin with passive equity portfolios. As their name indicates, they must enhance returns by making the underlying index holdings more structurally efficient via what we refer to as ‘disintermediation alphas.’

There are myriad disintermediation alphas, which we broadly classify into:

Disintermediation alphas represent excess returns from providing risk transfer or financial intermediary services typically provided by investment banks. Alpha opportunities arise from disintermediating some of the services provided by investment banks or market makers. They are inherently different from uncertain excess returns derived from stock selection models, style and credit risk premia that failed the past enhanced index strategies.

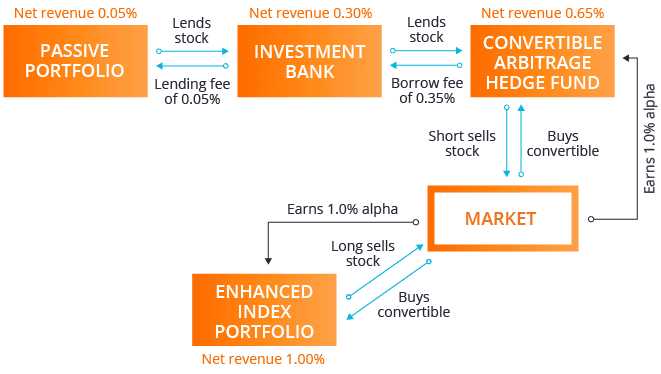

Convertible arbitrage is a well-known relative value strategy among hedge fund investors. A hedge fund may invest in a convertible bond and neutralize the equity risk by shorting an equal amount of equities. Now, consider mandatory convertible bonds. Because of the mandatory conversion feature, these bonds represent equity surrogates, whose conversion has been deferred to a future date. Holders of passive portfolios can enhance returns by replacing the underlying passive equity holdings with mandatory convertible bonds and collecting the coupon on the bond in addition to the pass-through value of the dividend on the underlying equities. Differing from hedge funds that must incur borrowing costs to sell the underlying equity securities to hedge the position, holders of passive portfolios incur no such borrowing costs to hedge because they sell shares they already own in their passive equity portfolios, structuring a natural underweight versus the index weight. In addition, because investment banks have been disintermediated, holders of passive portfolios also capture the bid-ask spread that typically accrue to the market makers. Exhibit 6 illustrates components of the convertible arbitrage strategy alpha chain.

Exhibit 6: Components of the Convertible Arbitrage Alpha Chain

The combination of a passive portfolio (0.05% lending revenue*) and convertible arbitrage hedge fund (0.65% net alpha) earns 0.70% but cannot access the intermediation profits earned by the investment bank.

The enhanced index fund captures “disintermediation alpha” and earns a full 1.00% arbitrage opportunity, at an opportunity cost of 0.05% of not lending stock out, uplifting total alpha by more than 40%.

In the early days of the development of modern portfolio theory, academics such as Sharpe, Jensen and Treynor conceptualized the separation of beta and alpha, which eventually led to the creation of portable alpha strategies by practitioners. In fact, fixed income‑based enhanced index strategies represent a form of portable alpha strategies where alphas from high-quality fixed income portfolios are ported unto equity indices such as the S&P 500 or the MSCI World. In theory, with the advent of financial engineering, it is now possible to form any combination of alphas and betas.

In practice, however, one diminishes or completely negates disintermediation alphas by combining disparate beta and alpha sources. The relative value disintermediation alpha example illustrated in Exhibit 6 would only capture convertible arbitrage alpha of 65 basis points if one were to port alpha from a convertible hedge fund onto, say, the Nikkei 225 Index.

Structurally, there are certain complementary betas and alphas that maximize disintermediation alphas. Refer back to the illustration in Exhibit 6. Suppose the company issuing mandatory convertible bonds is a small capitalization stock with limited free-float. Because the cost of borrowing such a stock would be prohibitively high for convertible arbitrage hedge funds, the related disintermediation alphas harvested by an enhanced index manager would also be commensurably high. An enhanced index manager who already owns this small-cap stock would capture a high disintermediation alpha, as well as alpha from the convertible arbitrage opportunity. Since one does not know before the fact which stocks will benefit from disintermediation alphas, it necessarily follows that having the broadest possible portfolio of stocks improves the odds of enhancing returns. And that is one of the reasons why enhanced index strategies should begin with a broad passive equity portfolio that many institutional investors already hold.

Yogi Berra was way ahead of finance academics and practitioners alike when he quipped: “In theory there is no difference between theory and practice. In practice there is.” Indeed, in practice there is a difference as evidenced by the existence of disintermediation alphas.

Relate the illustration in Exhibit 6 to an institutional investor who attempts to harvest alpha from convertible arbitrage via a portable alpha structure where she combines a passive equity portfolio with a convertible arbitrage hedge fund. This portable alpha approach is structurally inferior to the more holistic enhanced index approach as described in the callout box, where beta and alpha management are combined (i.e., they complement each other). Structurally, the former approach cannot earn the intermediation profit of 30 basis points because the convertible arbitrage hedge fund must borrow stocks to short from investment banks. In contrast, an enhanced index strategy can earn a full 100 basis points of arbitrage opportunity by disintermediating the investment bank. Therefore, enhanced index strategies can capture structural alphas from disintermediation in additions to alphas associated with relative value opportunities.

Preference shares, different voting share classes, dual listed shares and holding company shares represent other forms of return enhancement opportunities due to differences in value among different share classes or between the holding company and the underlying operating company shares. In each case, one can enhance passive portfolio returns by buying cheaper shares and selling more expensive shares.

Merger arbitrage is a classic example of an event driven strategy. Once a deal has been announced, a merger arb manager typically shorts the acquiror and buys the target to capture the merger spread. It is not a risk-free arbitrage because mergers can and do fall apart for a number of reasons. Holders of passive portfolios can capture a part of the merger spread by buying the target company if they believe the likelihood of the deal closing is high. During the intervening period (between the deal announcement and deal completion dates), the target’s stock price will behave less like equities and more like a discounted bond that converges to par value (i.e., acquisition price) at the deal completion date. This decoupling of the target’s stock price from the general equity markets represents a tracking error risk that must be addressed by the enhanced index managers. In a rising market, the broad market gain may exceed the alpha from the merger spread; therefore, to isolate the merger spread, in addition to investing in the target company, the enhanced index manager must also invest in index futures of equal notional amount to capture the underlying index return.

Spin-offs, hostile takeovers, pre-announced deals, and back-end deals represent some of the other event-driven return enhancement opportunities available to holders of passive portfolios.

Although one of the most prominent allocations in institutional portfolios, plan sponsors have set their passive equity portfolios on autopilot, generally satisfied to collect beta returns for a nominal fee. For most, securities lending has been the extent of deviation allowed in these passive portfolios. In our opinion, there is no reason to stop at securities lending, especially if there are other compelling disintermediation alphas readily available to holders of passive equities. As remarked earlier, taking small active risk at a high information ratio via disintermediation alphas on large passive equity portfolios can result in a large value add in terms of dollars. In this low expected return environment, plan sponsors can accept low beta returns on their passive equity portfolios as given by the market or attempt to enhance returns by sweating their passive equity holdings harder.

The enhanced index approach proposed herein is inherently different from past enhanced index strategies.

The approach, however, requires a fully integrated portfolio, where the disintermediation alpha and beta coexist in one portfolio. This necessarily imposes an operational burden on the portfolio manager team; as a result, only a few have the ability and the willingness to run both passive and hedge fund alpha strategies on a fully integrated basis – erecting one of the barriers to entry to disintermediation alpha proposed herein.

Currently, most institutional investors focus their attention on private investments and less-efficient asset classes such as international small-cap or emerging market equities to generate higher returns; however, there is merit in looking for excess returns in pockets of financial markets that, by and large, have been neglected by most institutional investors. Albeit a minority, it appears that some large European and Middle Eastern institutional investors are coming around to appreciate the merits of risk-controlled enhanced index strategies that seek to harvest consistent excess returns via disintermediation alphas or complex risk premia.

In our opinion, it pays to be counter-cultural, to be different from the rest, and to go low active risk when the prevailing advice is to “go big or go home.” To generate higher returns, plan sponsors must continue to do the former without neglecting the latter.

1 National Association of State Retirement Administrators (NASRA) Public Fund Survey fiscal year end 2018.

2 2019 Horizon Survey of Capital Market Assumptions.

3 That is, three largest based on strategy AUM as reported in eVestment. The three largest strategies accounted for about 85% of all currently active (as opposed to inactive) quantitative equity enhanced index strategies AUM as of the first quarter 2007 – the year preceding the 2008 Global Financial Crisis. Although not a full representation, in our opinion, the experience of the largest three quantitative equity enhanced index strategies is a reasonable proxy for the average institutional investor’s experience leading up to and during the 2008 Global Financial Crisis.

4 Different from quantitative equity enhanced index strategies, there were only two surviving fixed income-based enhanced index strategies that continued to report AUM and performance data in eVestment. As of the first quarter 2007, their aggregate AUM approximated $46.4B, representing about 25% of AUM of all currently active enhanced index strategies in eVestment.