Subscribe

Sign up for timely perspectives delivered to your inbox.

Head of U.S. Fixed Income Greg Wilensky comments on the release of first quarter gross domestic product (GDP) data, the April Federal Reserve (Fed) meeting and President Biden’s first address to Congress.

The first quarter 2021 gross domestic product (GDP) figure announced this morning was slightly below expectations (the U.S. economy grew at an annual rate of 6.4% versus expectations of 6.7%). However, given the magnitude of the move and all the quirks that result from various states working through various stages of reopening, we see today’s headline as confirmation that growth is coming, and coming fast – and we expect the markets will agree.

Consumer spending (which is about 68% of the U.S. economy) drove the rebound seen in today’s number. Overall consumption was up 10.7% but spending on durable goods (e.g., refrigerators and other things that last a long time) surged 41.4%, likely reflecting the latest – and largest – round of stimulus checks paid directly to consumers.

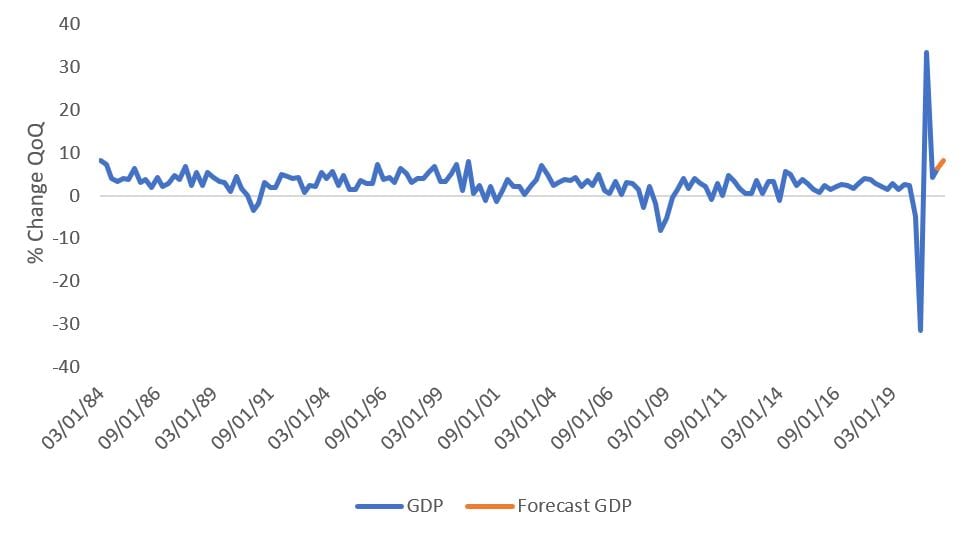

Growth in the service side of the economy was also positive, at 4.6%, and we expect this will pick up significantly in the next quarter as more people are vaccinated and the population feels increasingly comfortable getting out and about. Indeed, today’s figures showed that the savings rate jumped yet again, from 13% to 21%, suggesting that pent-up demand could be easily funded as households have only spent part of the latest round of stimulus. Currently, the consensus forecast for next quarter’s GDP is already higher than the first quarter, at just over 8%, which (excluding the rebound last fall) would be the highest quarterly GDP since 1984.

[caption id=”attachment_370276″ align=”alignnone” width=”962″] Source: Bloomberg, as of 29 April 2021.[/caption]

Source: Bloomberg, as of 29 April 2021.[/caption]

The Federal Reserve (Fed) shared its updated outlook on April 28, and the message was both largely unchanged from the last meeting and mostly in line with what the market expected. They reiterated their expectations for strong economic growth and indicated that they will look past the near-term inflation data because the year-on-year changes will be relative to some of the worst months of the 2020 pandemic. The Fed also noted that initial bottlenecks will cause some “one time” price pressures, but they do not expect inflation to be running above their 2.0% target while a significant amount of slack remans in the labor markets. Thus the Fed “expects to maintain an accommodative stance of monetary policy” until both employment and inflation targets are achieved (that is, not anytime soon).

Also on April 28, President Biden recapped his first 100 days in office and presented his vision for policy going forward. The economic message was clear: More stimulus and more taxes. The numbers are, again, large, and we expect that – after the inevitable negotiations – what is ultimately implemented will likely not be as substantial as what was presented in Biden’s address. However, we (and the market) held that same view regarding the last stimulus package and the final number wasn’t all that far below the initial headline.

Since the market closed on April 28, 10-year U.S. Treasury yields rose a few basis points (a basis point is 1/100th of a percent) before the GDP figure was released as it reacted to the Fed and the State of the Union and a few more basis points after its release. In our view, the market is right to price somewhat higher rates on longer-dated bonds given an accommodative Fed, high GDP and the likelihood of more fiscal stimulus.