Subscribe

Sign up for timely perspectives delivered to your inbox.

The consensus has swung from pessimism about prospects for corporate profits in 2020 to likely excessive optimism now. Analysts, in particular, may underappreciate the contribution to recent profits resilience of government subsidies, withdrawal of which may offset much of the benefit of economic normalisation.

Posts here last year suggested that global profits would mirror V-shaped rebounds in retail sales and industrial output. S&P 500 aggregate operating earnings are likely to have risen above their pre-pandemic peak in Q1 2021, based on results to date and analyst estimates, according to S&P. Analyst forecasts imply growth of 29% between Q1 and Q4 2022 – see first chart.

S&P 500 operating earnings are equivalent to about 60% of corporate post-tax economic* profits in the national accounts and the two series follow a similar path. An attribution analysis, however, is available for the national accounts measure, allowing the recent contribution of higher subsidies and reduced taxes on production to be separated out.

As of Q4 2020, national accounts profits were 2.4% below their pre-pandemic peak in Q4 2019. If subsidies / production taxes had remained unchanged, the shortfall would have been 19.8%. Put differently, the rise in subsidies accounted for 17.8% of the level of profits in Q4 2020.

This direct contribution of government to profits will normalise as the economy reopens and emergency programmes are withdrawn. Assuming that the rise in subsidies since Q4 2019 is reversed, “underlying” profits – excluding the recent additional support – would need to grow by 21.7% from their Q4 2020 level to maintain overall stability. The consensus forecast of a 29% increase in S&P 500 operating earnings between Q1 2021 and Q4 2022, therefore, could require underlying growth of more than 50%.

Data later this week will show that GDP almost regained its pre-pandemic level in Q1 2021 and the FOMC’s median projection implies a further increase of more than 8% by Q4 2022. Adding in inflation at 2-3% pa suggests nominal GDP growth of about 13% – unlikely to support profits expansion of 50%.

Profit margins, indeed, could be squeezed by rising labour costs. The view here has been that the labour market would return to pre-pandemic levels of tightness by late 2021, resulting in upward pressure on wage growth. Labour market responses in the April Conference Board consumer survey support the view that conditions are normalising rapidly – second chart.

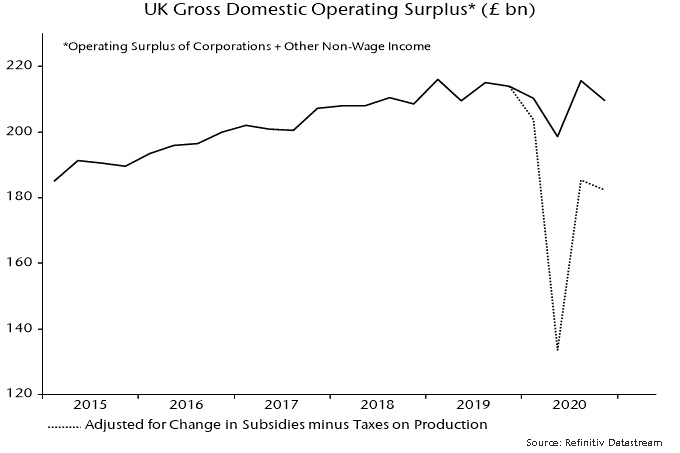

National accounts data for other G7 countries are less detailed / timely than for the US but government subsidies are likely to have provided similar or larger-scale support for profits. In the UK, the economy-wide gross operating surplus** would have been 13.0% lower in Q4 2020 without additional government subsidies / lower production taxes – third chart. The extra support amounted to 5.0% of GDP in Q4, double the equivalent in the US, reflecting the “generosity” of the UK’s furlough scheme.