Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Managers John Kerschner and Seth Meyer describe where they see opportunities to harvest higher yields with lower sensitivity to rising interest rates in the current environment.

Rising interest rates raise justifiable concerns about the future returns of bond portfolios. But it is important to not let the fear of higher rates weighing on returns keep investors from capitalizing on the potential opportunities in the current environment.

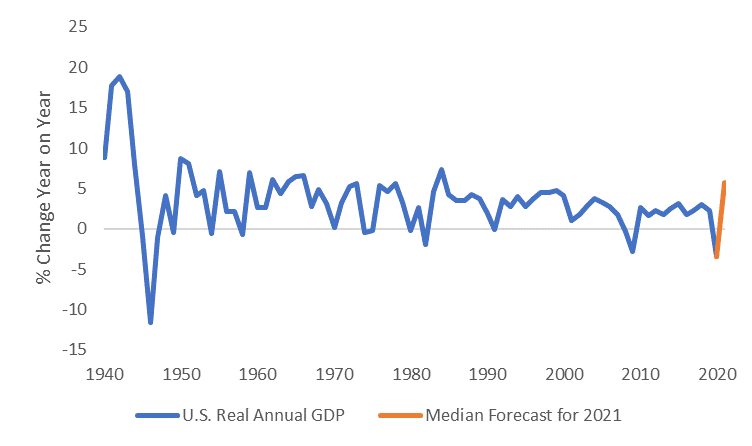

Bond yields are rising because the market thinks economic growth will be strong and expects the Federal Reserve (Fed) will ultimately have to raise interest rates to cool the economy. But the degree of growth in the meantime could be substantial. The to-date fiscal stimulus in response to the COVID-19 pandemic is around 25% of U.S. gross domestic product (GDP)1. We haven’t seen fiscal support like that since World War II. The median projection for 2021 economic growth in the U.S. is currently 5.7% – higher than any year since 1984, when annual growth was 7.3%.

Source: Bloomberg, as of 25 March 2021.

Despite the historic recession, consumer bankruptcies and auto delinquencies in the U.S. are both near record lows while home price appreciation and used car sale values are near all-time highs. Aggregate consumer savings have surged, with over $2 trillion in excess savings accumulated since the pandemic hit. We believe this environment creates attractive risk-adjusted return opportunities in consumer-related sectors such as asset-backed securities (ABS), which are “backed” with assets such as car loans or credit card debt.

Meanwhile, the asset class known as Market-Placed Lending (MPL) – which consist primarily of direct-to-consumer loans – has grown, taking share from the credit card market. In our view, the trend toward MPL is likely to accelerate and may well be the future of unsecured consumer lending. Like many newer markets, this provides opportunities for experienced investors to identify attractive pools of loans offering higher yields and/or lower credit risk than similarly rated counterparts in the ABS market.

Credit-Risk Transfers (CRTs) are another opportunity in the mortgage market where performance is more directly tied to the outlook for the consumer. When the U.S. housing agencies (such as Fannie Mae or Freddie Mac) issue mortgages, they issue mortgage-backed securities (MBS), which are guaranteed by the issuing agency, and CRTs, which transfer the credit risk of the mortgage to the buyer. Having a positive outlook on CRTs is thus predicated on having a positive view on the creditworthiness of homeowners. In addition to the already mentioned strengths of the aggregate consumer, there is more demand for homes as a result of COVID-19 and a shortage of supply, supporting prices. While mortgage rates have risen in recent months, they are still relatively low, and home price appreciation was strong in 2020 at near 10% 2.

COVID-19 accelerated many transitions in the U.S. economy, including the shift to a more digital economy, which has sparked some surprisingly niche opportunities. The rise of e-commerce enabled a fast-tracking of remote work capabilities, cloud services and on-demand grocery and goods delivery. As online ordering has gained popularity, the call for speedy delivery has grown. This is driving increasing demand for industrial space – particularly warehousing – close to large urban areas. As a result, builders are scrambling to add these spaces and the commercial mortgage-backed securities (CMBS) market is funding it.

Similarly, we are seeing a rise in demand for biomedical office space. Occupancy rates for these spaces are likely to stay high because it is a niche industry that – unlike many other sectors of the economy – does not lend itself to working from home. (It is rather difficult to do cutting-edge biomedical research from your spare bedroom.) Likewise, it is not easy to retrofit existing industrial spaces to suit medical research – the requirements are too specific, with highly regulated health and safety requirements. Current occupancy rates of biomedical facilities are near 100%, rents are high per square foot and CMBS is funding new facilities.

Monetary stimulus has been as historic as the fiscal stimulus provided since the pandemic began. Not only did the Fed lower policy rates to zero, it also bought bonds directly in the open market, including – for the first time ever – high-yield bonds. The aim was clear and twofold: to ensure companies could access funding and to lower companies’ funding costs to buttress their profitability. Such was the signaling strength of the Fed that the corporate bond-buying programs were only lightly tapped, with market participants eagerly supporting new issues, allowing the Fed to cease further purchases at the end of 2020.

While broader monetary accommodation must end at some point, it is difficult to argue against the mathematics of low default rates in short-maturity securities given the current support. Unsurprisingly, the forecast default rate has fallen. During the height of the COVID-19 induced uncertainty, defaults were predicted to be as high as 15% this year. In reality, the default rate over the past 12 months – both in the U.S. and globally – was in the single digits, and declining 3. We do not believe the Fed engaged in the most massive balance sheet expansion since World War II only to pull the plug too soon, thus we expect their generous accommodation to last until it is no longer needed.

While high-yield bonds are rated below investment grade and thus carry more risk, we think we are in the part of the recovery cycle where lower-credit quality security returns are probably more skewed to positive than at other times. And with current yields in the Bloomberg Barclays U.S. High Yield Index near 4.4%, the absolute income is nearly two times the yield of the Bloomberg Barclays U.S. Corporate Bond Index (currently near 2.3%) and nearing three times the yield of the Bloomberg Barclays U.S. Aggregate Bond Index (currently around 1.6%) 4.

It is important to note that relatively low yields across the government and corporate bond markets require a more nuanced approach. Broad corporate credit benchmarks have rallied significantly in recent quarters, and the Bloomberg Barclays U.S. Corporate Bond Index now yields 2.3% with a duration (a measure of sensitivity to changes in interest rates) of 8.4 years 5. With 8.4 years of duration, the index would – assuming spreads stay unchanged – fall 8.4% if the comparable-maturity Treasury bond yield were to rise a further 1.0% in the next year. Taking into account the yield of 2.3% earned over the period, investors would lose a net 6.1% 6. The benchmark’s duration risk should not be underestimated.

But not all bond portfolios need to be constructed the same as the benchmark. First, an individual investor’s goals and risk tolerance are key factors in finding the right balance of duration and income. Second, we do not believe that rising rates mean “bonds” (generally) are inappropriate in a diversified portfolio. On the contrary, we believe there are numerous opportunities to harvest higher yields with lower durations across both the corporate bond and securitized products markets. And, because the path to higher rates is unclear and surprises happen, owning some duration is prudent. Nuance, balance and diversity are likely to be the keys to effective bond management in 2021.

Don’t give up on bonds. Instead, find a manager that understands your goals and will mine the market for the opportunities that help you realize them.

1 International Monetary Fund, as of 11 March 2021

2 Bloomberg, as of 29 March 2021

3 Source: Moody’s, U.S. speculative-grade trailing 12-month default rate, global speculative-grade trailing 12 month default rate, at 28 February 2021.

4 Source: Bloomberg, as of 22 March 2021.

5Bloomberg, as of 22 March 2021.

6 Janus Henderson, as of 22 March 2021. High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. Bloomberg Barclays U.S. High Yield Index: The Bloomberg Barclays U.S. Corporate High Yield Bond Index measures the US dollar-denominated, high yield, fixed-rate corporate bond market.

Bloomberg Barclays U.S. Aggregate Bond Index: The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.