Subscribe

Sign up for timely perspectives delivered to your inbox.

Greg Wilensky discusses the benefits of holding core bond allocations and the importance of actively managing them.

U.S. bond yields have risen quickly in recent months and, given current expectations for an economic recovery, we expect they will rise further over time. Yields were simply too low given the improving economic outlook, and a normalization of interest rates should be expected. While many factors will impact how quickly and to what level bond yields ultimately rise, we believe U.S. Treasury bonds will continue to act as an important hedge to an investor’s overall portfolio – especially their equity allocation.

Every investor has different goals, different time horizons, and different risk tolerances. For investors who want a balanced portfolio that will perform (that is, generate a reasonable risk-adjusted return) through different market environments, “core” allocations to bonds have generally delivered. Even as interest rates declined toward – and in some cases through – zero, core bond benchmarks like the Bloomberg Barclays U.S. Aggregate Bond Index proved they could still rally when equities sold off.

We don’t believe the current environment is so fundamentally different that this history should be ignored. Equity markets are (as of this writing) near all-time highs, and the risks of unknown or unexpected events are as prevalent as ever. The question, in our view, for bond investors today is not whether to have or avoid bond exposure, but rather how to find the right balance of bond exposures. While there is no guarantee that bonds will provide insurance against falling equity markets, we think the expected outcomes of a balanced portfolio are more likely to meet the goals of most investors.

Rising yields do detract from performance, but it’s important to remember that investors are also earning some income during the time they hold a bond, providing a cushion against losses from rising rates. The bigger the yield spread a bond has over cash, the more “carry” (i.e., incremental yield benefit gained from holding, or carrying, the bond instead of cash) an investor gets. And, everything else being equal, when the yield curve is steep – as it is now – bonds should benefit from seeing yields “rolling down” the curve. Meaning that, as the security’s time to maturity shortens, its yield tends to fall in order to match the lower yields of the shorter-dated bonds. The steeper the yield curve, the lower the yield must fall to reach the appropriate level for a shorter-maturity security. Thus both the “carry” and the “roll down” can provide some cushion, allowing bonds to outperform cash even if yields rise modestly.

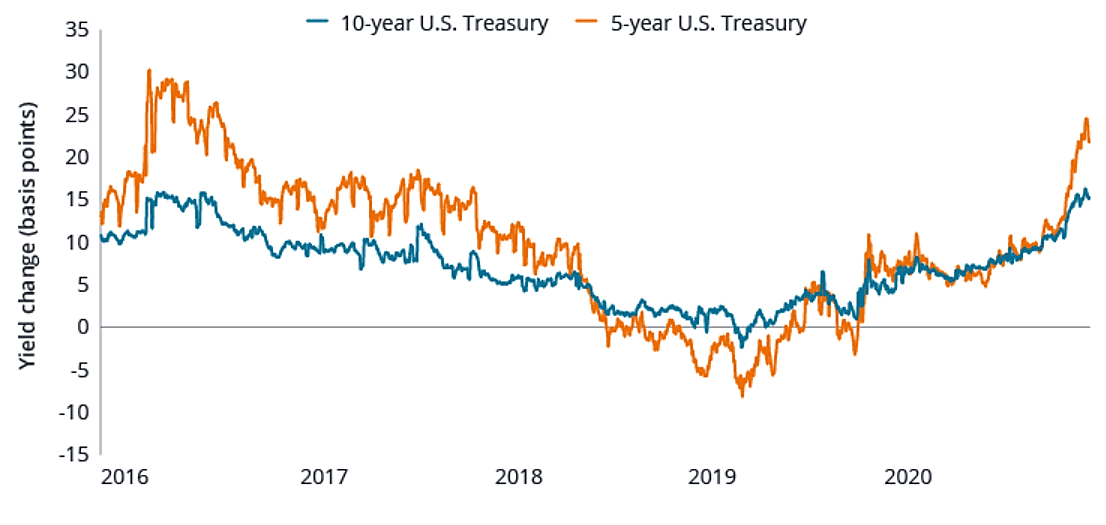

The chart below shows how much 5- and 10-year Treasury yields could have risen (in basis points) over the subsequent six months while still outperforming cash. In both maturities, the levels have increased substantially in the last year, reaching levels not seen in four years. Thanks to low cash rates and a steep yield curve, the cushion provided for sitting on U.S. Treasuries has recently gotten bigger.

[caption id=”attachment_366634″ align=”alignnone” width=”1106″] Source: JPMorgan, Janus Henderson, as of 25 March 2021.[/caption]

Source: JPMorgan, Janus Henderson, as of 25 March 2021.[/caption]

When Treasury rates are expected to rise, it makes intuitive sense to have less exposure to them. But however strongly this view may be held, some Treasury exposure can be a key diversifier when equity markets are weak. Fixed-rate corporate bonds and securitized assets, which typically provide higher yields/returns but a little less insurance against weak equity markets, can also help add diversification. Additionally, Treasury Inflation-Protected Securities (TIPS) and floating rate investments like many commercial mortgage-backed securities (CMBS) and collateralized loan obligations (CLOs) can provide even more diverse profiles of interest rate risk, income and defense against weakness in equities or other riskier assets.

All of the instruments referenced above provide some spread over Treasuries and thus create an additional yield cushion that can help shield capital against the cost of rising interest rates. And, an active manager can use all of these instruments to dynamically adjust exposures as conditions evolve while maintaining a core focus on finding the appropriate balance of risk and reward to meet investors’ goals.

However inevitable it may seem that bond yields will rise, we believe bond portfolios have a core role to play in investors’ diversified portfolios. The challenge rests with the manager to navigate the wave of rising rates – not fight or walk away from it.

Connecting you to the latest thinking from our fixed income teams.

Explore Now