Subscribe

Sign up for timely perspectives delivered to your inbox.

Tom Ross and Seth Meyer, corporate credit portfolio managers, explain why the rise in the size of the high yield bond market is to be welcomed.

A common refrain of recent years was that the growth in the size of the BBB rated corporate bond market (the lowest rated area of investment grade) would lead to a tidal wave of fallen angels (investment grade bonds downgraded into high yield). This would likely overwhelm and destabilize the high yield market. All it would take would be an economic crisis.

Cue COVID-19.

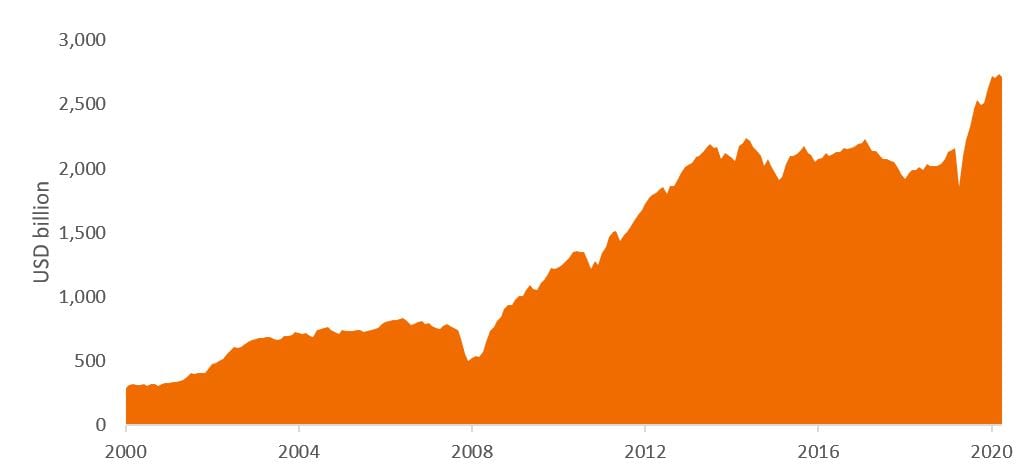

Why such a muted response? The chart below is instructive. For the better part of six years from 2014, the high yield bond market had been broadly static in size. Far from being a market where there was an excess supply of bonds, this was one that could happily afford an influx.

[caption id=”attachment_366695″ align=”alignnone” width=”1026″] Source: Bloomberg, Full market value in USD billion of ICE BofA Global High Yield Index, 31 December 2000 to 31 March 2021.[/caption]

Source: Bloomberg, Full market value in USD billion of ICE BofA Global High Yield Index, 31 December 2000 to 31 March 2021.[/caption]

The high yield market is in a constant state of flux. At one end, there are bonds journeying back and forth between investment grade and high yield. At the other end, bonds that are on the brink of default. All the while, there are hundreds of different issuers jostling for position along the credit spectrum.

There are several reasons why the market remained broadly the same size in recent years. Moderate economic growth meant some companies had been able to finance growth from cash flows without recourse to capital markets. Improving cash flows and credit fundamentals had also allowed bonds to make the journey from high yield to investment grade. Some bonds had simply matured and not been rolled over. On a less positive note, some bonds had defaulted, thus exiting the market in a less favorable way.

Alternative forms of capital financing were also a factor. Some companies had opted to go down the leveraged loan route of financing since this could offer more flexible terms for the issuer (such as earlier redemption with fewer penalties). The growth of collateralized loan obligations (structured vehicles that purchase several loans, repackage them and sell them on to investors) had also created a ready buyer for loans, again increasing the attractiveness of this form of debt capital for the borrowing company.

The pandemic broke the stalemate. The need for fresh funds to tide companies through economic lockdowns meant there was a broad variety of existing high yield companies seeking to tap the bond market. This was met by eager investors, whose appetite for bonds had swelled in the face of interest rate cuts and evidence of central bank and government support for the corporate sector. In Europe, purchasing programs for investment grade bonds had a cascade effect, with investors moving down the credit spectrum to capture higher yields.

In the U.S., the Federal Reserve even went so far as to announce it would directly buy high yield bonds. This generated a high degree of confidence among investors that the central bank would help support markets. In the end, such was the level of demand that US corporate bond purchases by the Federal Reserve were fairly limited, with robust market demand easily absorbing bond issues.

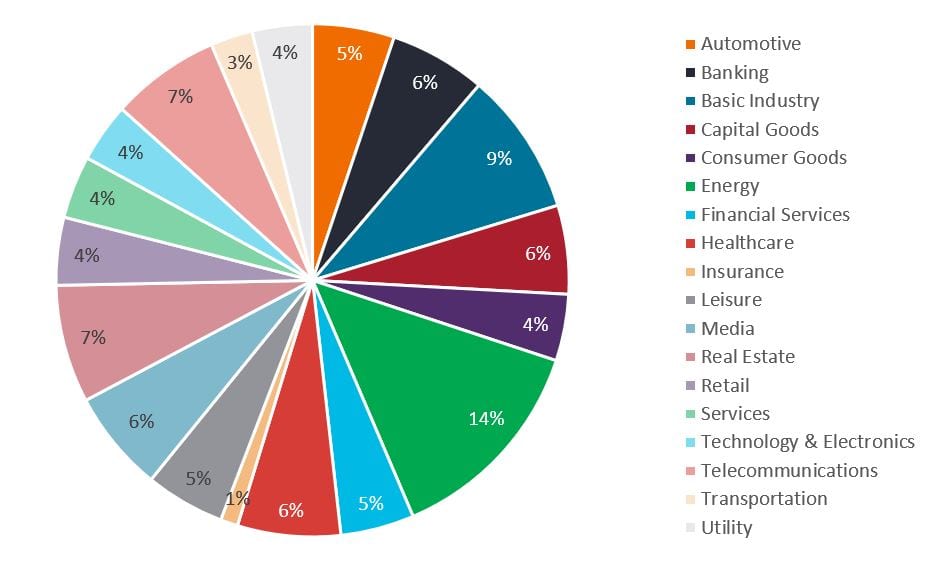

There has also been a pick-up in more sustainable bond issuance. For example, high yield green bond issuance in the U.S. in the first quarter of 2021 alone was $4 billion, double the level of the whole of 2020.4 Together, this has brought fresh issuance across many sectors, allowing for a high yield bond universe that is well diversified (Figure 2). This includes more defensive sectors such as health care, utilities and telecoms, alongside sectors that are more economically sensitive such as banking, basic industry, capital goods and energy.

[caption id=”attachment_366706″ align=”alignnone” width=”932″] Source: Bloomberg, ICE BofA Global High Yield Bond Index, sector breakdown at 31 March 2021.[/caption]

Source: Bloomberg, ICE BofA Global High Yield Bond Index, sector breakdown at 31 March 2021.[/caption]

We believe this is an important consideration. In our view. the improvement in credit quality means there is some justification to argue that credit spreads could move below their historical lows of the last 10 years, reflecting the changed composition of the index to companies rated with better credit quality.

All this comes at a time when the picture for credit fundamentals looks set to improve as economies reopen and revenues recover. Leverage ratios (net debt/EBITDA) should begin to look more favorable (i.e., move lower) as a pick-up in surplus cash generation allows companies to pay down some of the debt they have accumulated (shrinking the numerator in this ratio) while the rise in earnings swells the denominator. We are of course mindful that economic re-openings are at the mercy of successful vaccine programs and unpredictable variants of COVID.

Similarly, there is also the concern that economic strength causes corporate management to engage in behavior that is less friendly to bondholders such as debt-fueled merger and acquisition activity, or that it ignites more permanent inflation. High yield bonds have historically been able to tolerate periods of higher inflation, given it can assist revenues while the higher yields and low maturities prevalent among high yield bonds offer some cushioning against higher interest rates.

Nevertheless, we would not want a disorderly rise in yields. We believe that central banks will try to forestall excess market volatility and maintain support for economic recovery by keeping interest rates low and engaging in asset purchases as appropriate. This ought to provide a reasonably favorable environment for both the supply and demand for high yield bonds, creating opportunities for good credit selection.

Connecting you to the latest thinking from our fixed income teams.

Explore Now 1Source: Deutsche Bank, Bloomberg Finance, ICE Indices, 11 March 2021.