Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Jeremiah Buckley and Assistant Portfolio Manager David Chung discuss the strong recovery potential for travel and leisure industries as COVID restrictions ease.

Travel and leisure have perhaps been the two industries most severely impacted by social restrictions brought on by the COVID pandemic. However, there are powerful factors coalescing that point to a strong economic rebound in the U.S. in 2021: the broader rollout of vaccines, significant pent-up demand, strong consumer balance sheets and extensive monetary and fiscal stimulus. These forces are beginning to foster green shoots of activity ‒ particularly in these beleaguered areas ‒ and could lead to a considerable rebound once the economy can fully reopen.

Vaccination rollouts have led to a marked drop in the number of COVID-19 cases and hospitalizations, fueling optimism for a full reopening of the economy. At the time of writing, nearly 100 million vaccine shots had been administered in the U.S. and nearly 20% of the population had received at least one dose.1 Some states have begun to lift social restrictions and mask mandates (e.g., Texas, South Dakota, Montana, Mississippi and Iowa), citing the drop in infections and increased vaccinations. In other states, restrictions are being eased, such as allowing increased capacity for social gatherings in restaurants, theaters, casinos and sports and entertainment venues, foreshadowing a full reopening of the economy. However, significant concerns remain around highly contagious variants of the virus and past instances where the easing of restrictions has led to spikes in cases.

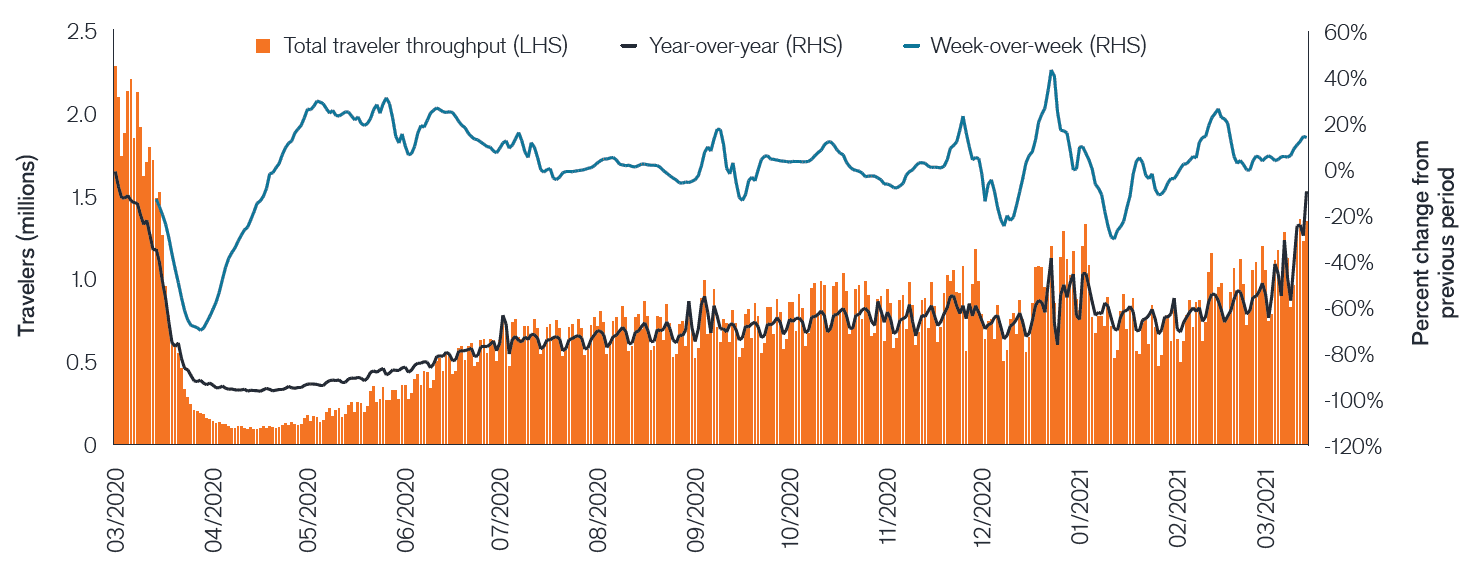

Although still significantly below pre-pandemic levels, total traveler throughput at U.S. airports has increased to the highest levels since the pandemic began, as shown in Figure 1.

[caption id=”attachment_363652″ align=”alignnone” width=”1468″] Source: TSA.gov, as of 14 March 2021.[/caption]

Source: TSA.gov, as of 14 March 2021.[/caption]

While leisure travel and bookings within driving distance continue to significantly outpace business and longer-distance travel, there are expectations that business and group demand (trade conferences, for example) will recover in the second half of 2021 and into 2022 as some companies view this travel and these events as essential to their businesses. That said, the majority of hotel reservations are still being made within a week of travel and international trips remain heavily restricted. This lack of visibility limits trend forecasts going forward but does suggest that companies more exposed to regional travel could benefit initially and potentially grow market share during this period.

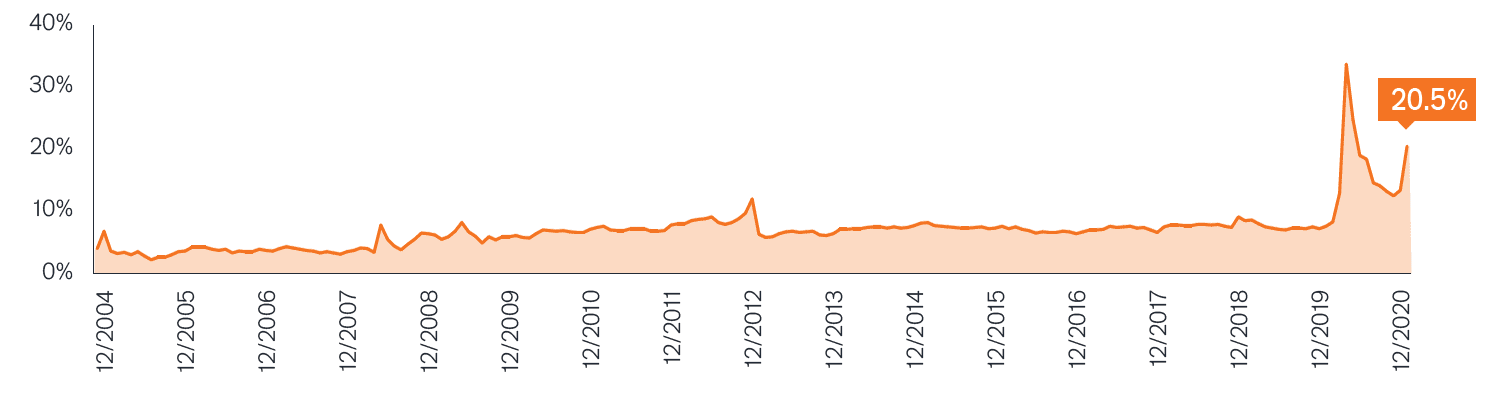

[caption id=”attachment_363663″ align=”alignnone” width=”1490″] Source: U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis, as of 3 March 2021.[/caption]

Source: U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis, as of 3 March 2021.[/caption]

Of course, consumers may decide to spend their savings on goods and services or use them to pay down debt or make investments rather than for travel or leisure pursuits. Ultimately, these decisions will play a significant role in the trajectory of the economic recovery. However, early indications show that consumers’ propensity to save is already beginning to ease.

Throughout the pandemic, we have seen investment themes related to widespread digitization galvanized. We think a broad economic recovery can only serve to bolster these long-term trends. These include the shift to e-commerce, increased adoption of digital payments and a transition to the cloud and Software as a Service for remote work, schooling and entertainment. Health care innovation across pharmaceuticals, medical devices, patient personalization and diagnostics capabilities also looks poised to endure.

While we have seen a recent uptick in inflation expectations and interest rates, we believe that the backdrop for equities in general remains positive, helped by ongoing fiscal stimulus and accommodative monetary policy. Combined with an improving health situation, significant pent-up demand and a strong consumer, this backdrop creates growth potential in the leisure and travel industries.

That said, it remains extremely important to be selective when analyzing these industries, as some stocks’ valuations are higher than pre-pandemic levels despite materially worse balance sheets. In some cases, companies have also diluted shareholders by issuing additional equity. Businesses, particularly in the travel and leisure industries, that can benefit from a recovery and have strong balance sheets could be well placed for a rebound as the economy reopens and returns to health.

Quarterly insight from our Equity team to help clients navigate the markets and opportunities ahead.

Read Now 1 Centers for Disease Control and Prevention, 10 March 2021.